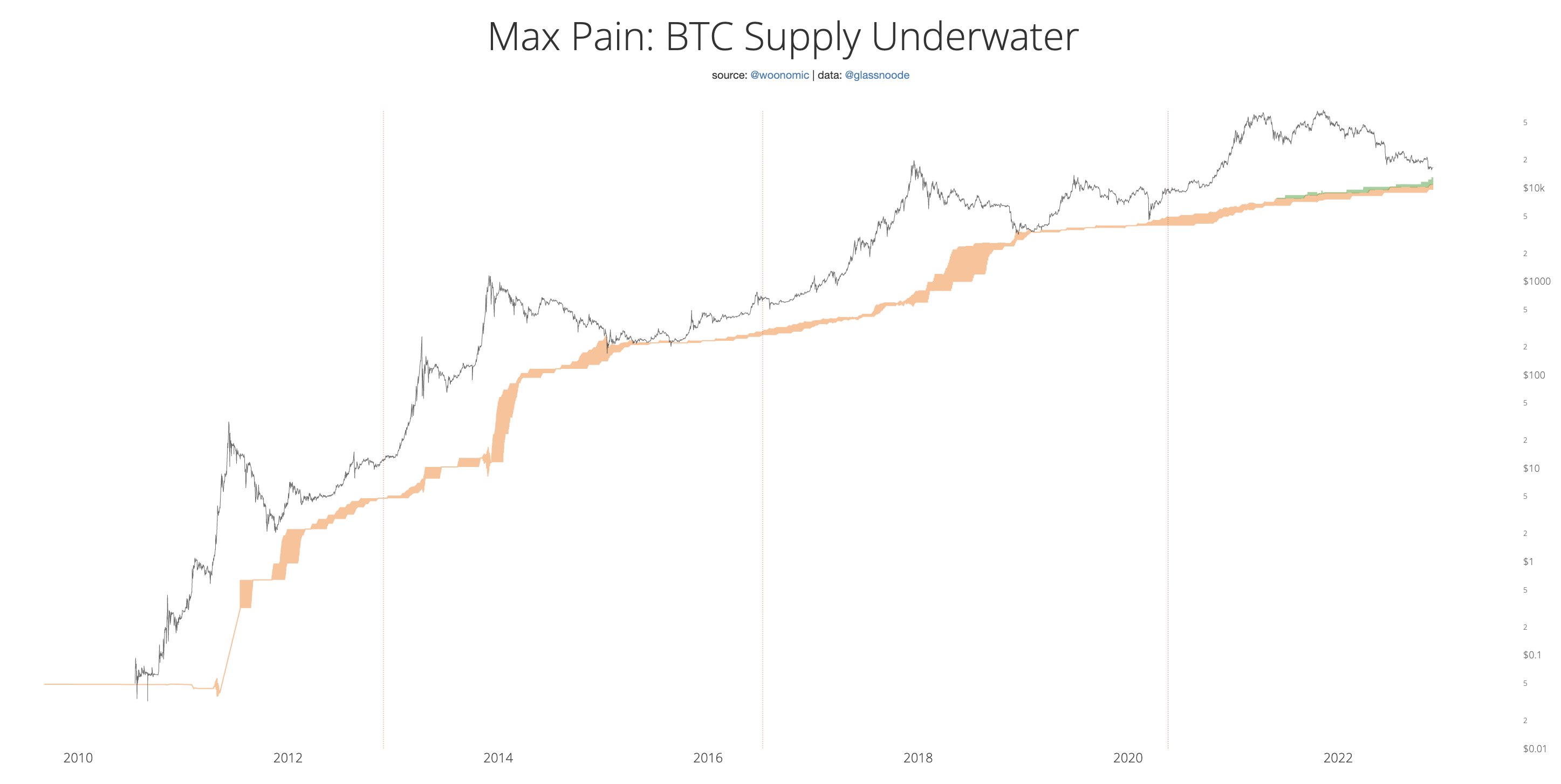

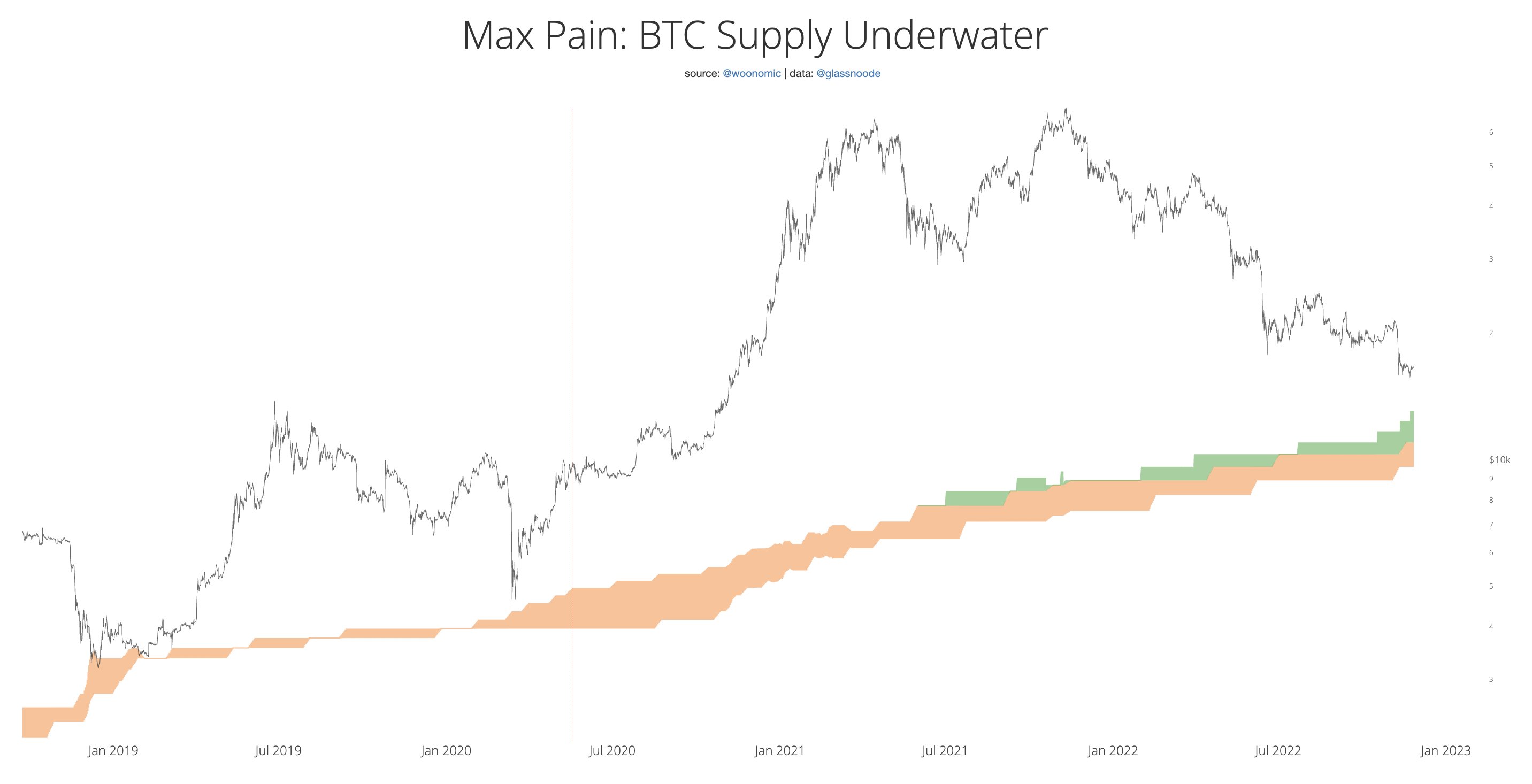

Popular on-chain analyst Willy Woo has a “max pain” model for Bitcoin that suggests a floor price for BTC at the bottom of its bear market.

Woo tells his one million Twitter followers that he’s estimating a Bitcoin bottom by looking at where BTC’s price would be if 58% to 61% of all coins would be below the price of purchase, or at a loss.

“Bitcoin bottom is getting close under the Max Pain model.

Historically BTC price reaches macro cycle bottoms when 58%-61% of coins are underwater (orange).

Green shading adjusts for the coins locked up inside GBTC Trust.”

Looking at the zoomed in view of the chart, the model appears to be suggesting that Bitcoin can still drop to around the $12,000 price range.

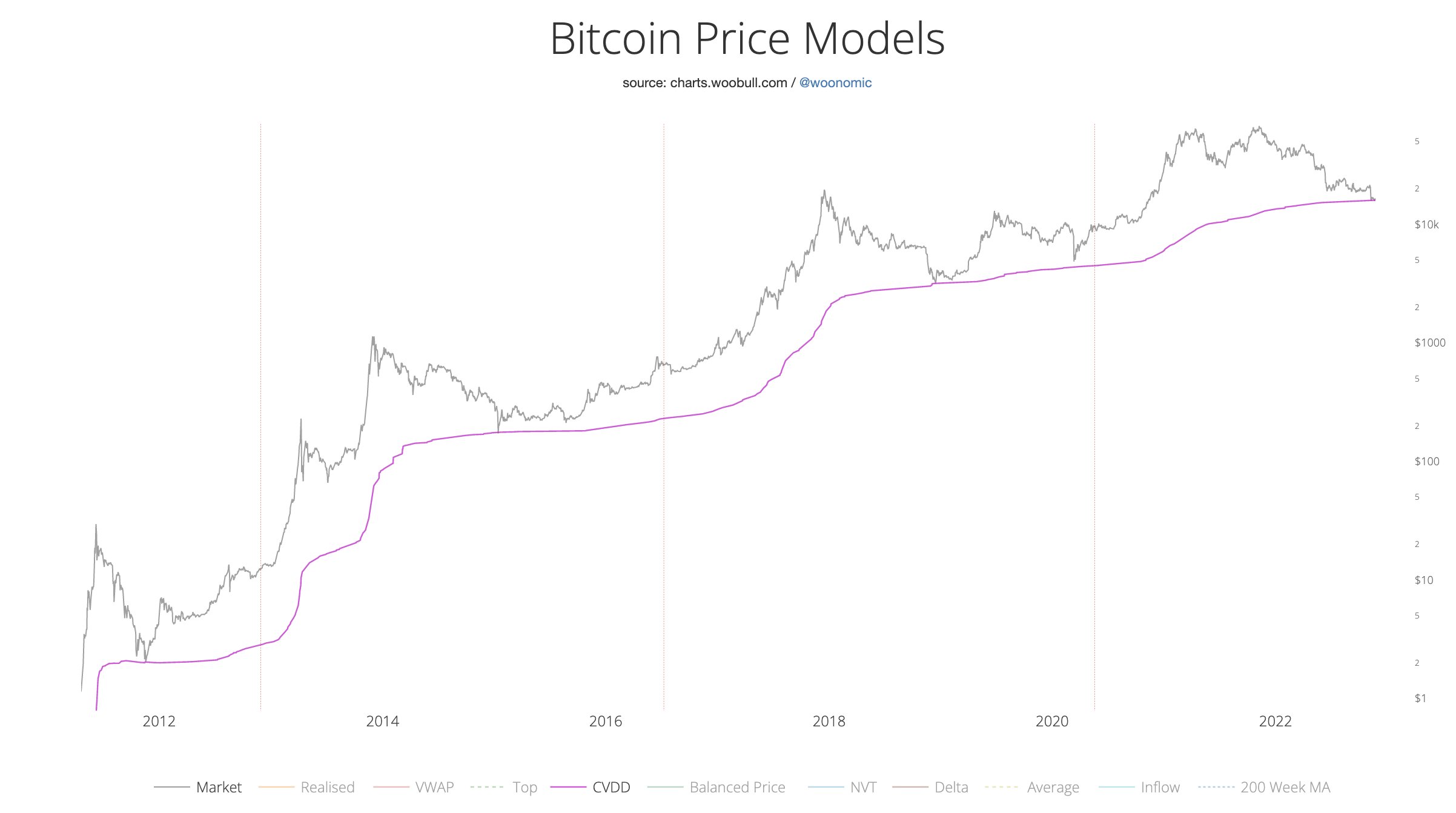

In a separate, less severe model, Woo says BTC is testing a bottom based on CVDD (Cumulative Value Coin Days Destroyed).

Explains Woo,

“When coins pass from old investor to new investor, the transaction carries a USD value and also destroys an amount of HODL time by the previous holder. CVDD is the cumulative sum of this value-time destruction as a ratio to the age of the market and divided by six million as a calibration factor.”

Woo says that the CVDD model is based on the idea that BTC tends to establish a new price floor as a fresh generation of investors enters the market.

“CVDD floor price being tested.

Uses age and value of BTC moving to new investors to create a floor.

Theory: when significantly old coins (say bought at $100) pass to new investors (say at $16,000), the market perceives a higher floor.”

At time of writing, Bitcoin is trading at $16,235, a 76.50% decrease from its all-time high.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Mr.Alex M/Chuenmanuse