Leading analytics firm Glassnode reveals that crypto exchanges are witnessing a massive exodus of Bitcoin as BTC holders take the initiative to self-custody their coins.

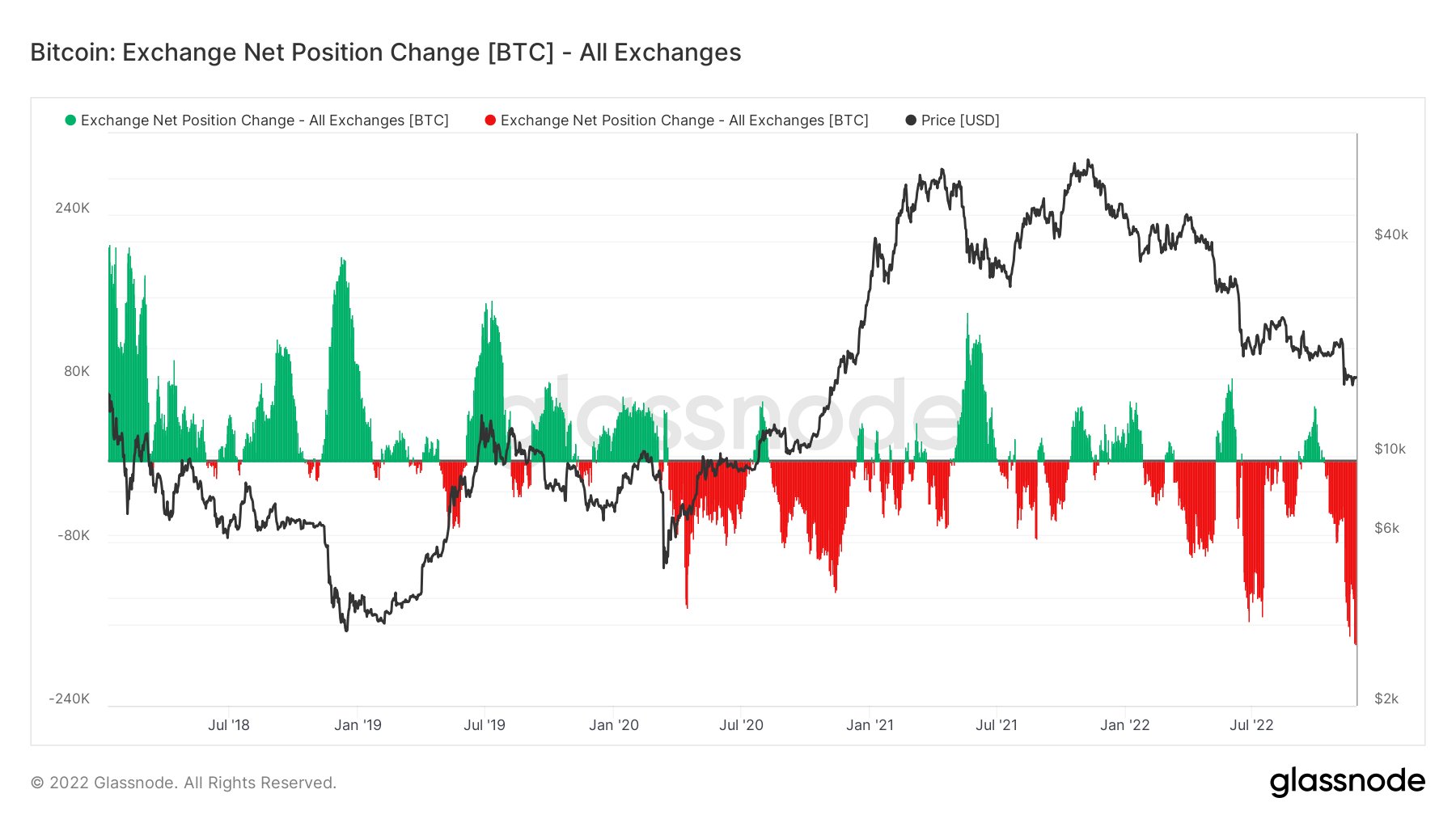

According to Glassnode’s Bitcoin exchange net position change metric, which tracks the 30-day supply held in exchange wallets, 179,250 BTC worth over $2.8 billion at time of writing has exited centralized crypto exchanges in the last month.

Looking at Glassnode’s chart, the current rate of BTC leaving crypto exchange platforms is at its highest in over four years.

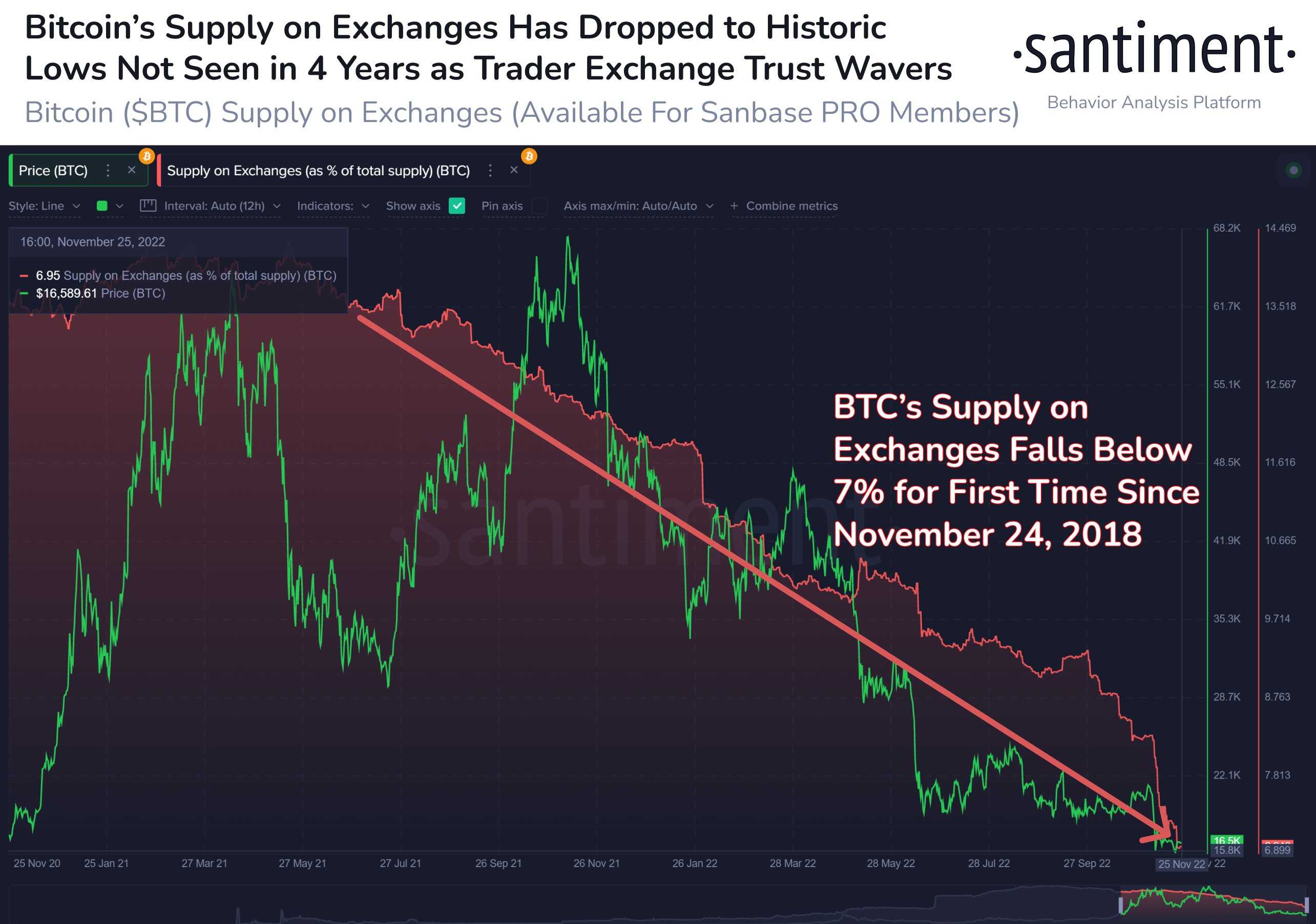

Analytics firm Santiment is also keeping a close watch on the supply of Bitcoin sitting on crypto exchanges. According to Santiment, BTC’s supply on crypto exchanges has fallen below 7% for the first time since November 24th, 2018.

“Just 6.95% of Bitcoin is sitting on exchanges, according to Santimentfeed data. There had already been a gradual shift in BTC moving into self custody going back to Black Thursday (Mar 2020). But with the FTX fallout, this trend has accelerated.”

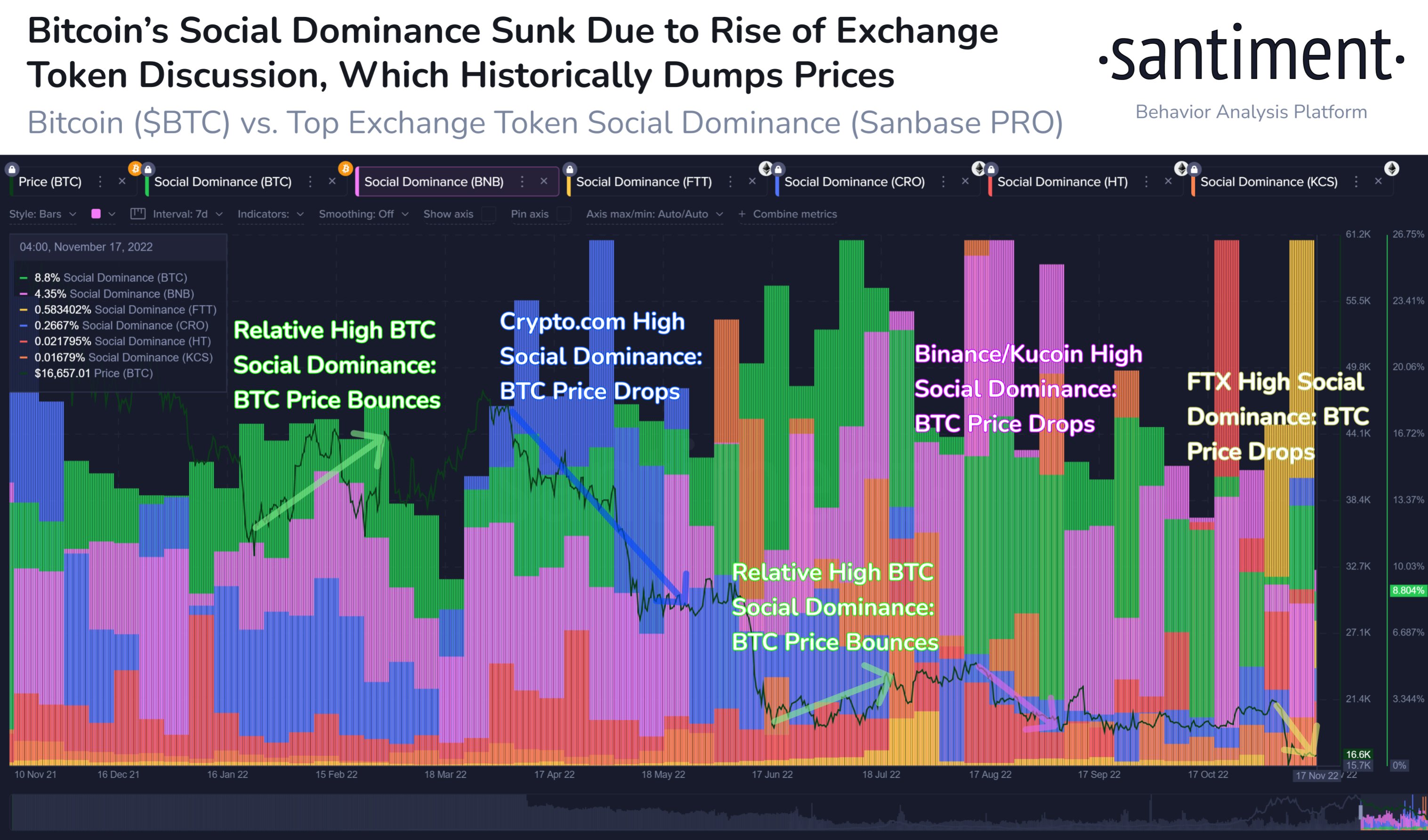

Earlier this month, Santiment noted that crypto has a history of bouncing when market participants shift their focus away from digital asset exchanges.

“Crypto generally thrives when exchanges are NOT a focal point. The most impactful exchange collapse ever will have lasting shockwaves. But as shown, the key for a turnaround will likely be focus moving away from exchange tokens and back to Bitcoin.”

On November 11th, Sam Bankman-Fried’s FTX filed for bankruptcy amid accusations that the crypto exchange mishandled customer funds. The news sent shockwaves across the industry, prompting many investors to withdraw their digital assets from centralized crypto platforms.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Tithi Luadthong/Natalia Siiatovskaia