Crypto legal expert Jeremy Hogan says that the possible misappropriation of user funds by disgraced crypto exchange FTX could amount to a criminal offense.

Hogan tells his 243,300 Twitter followers that FTX’s terms of service forbade the crypto exchange from using its customers’ digital assets for any purpose whatsoever.

FTX filed for chapter 11 bankruptcy on November 11th amid accusations that its founder Sam Bankman-Fried misused customer funds.

Says Hogan,

“The FTX terms of service are VERY clear.

All digital assets were to be held in users’ accounts and NOT be used by FTX for any purpose (e.g. speculative investments).

There’s no wiggle room. It’s what I would call a ‘gran problema’ for them.”

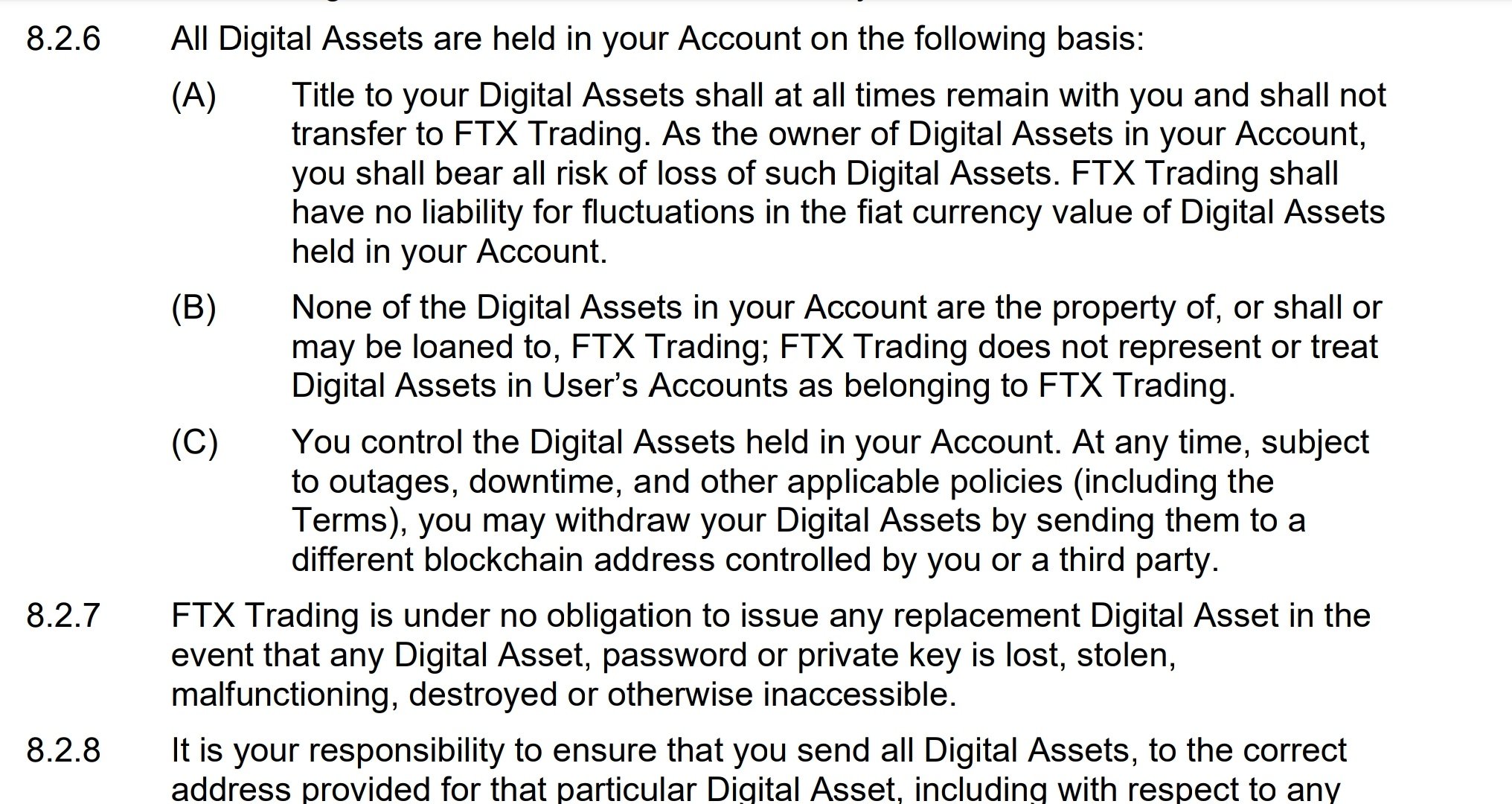

Among other things, FTX’s terms of service states that the crypto exchange will never assume ownership of users’ digital assets.

“None of the Digital Assets in your Account are the property of, or shall or may be loaned to, FTX Trading; FTX Trading does not represent or treat Digital Assets in User’s Accounts as belonging to FTX Trading.”

Contrasting FTX with collapsed digital asset lender BlockFi, the crypto legal expert says the latter had a different language in its terms of service.

“BlockFi, on the other hand, was very clear in its terms of service that it was not custodian or fiduciary of any customer assets.

And that, in legal fallout terms, could be the difference between a ‘money’ problem and a ‘prison’ problem.”

According to BlockFi’s terms of service for private clients, the crypto lender assumes full ownership rights of users’ digital assets that are under a loan.

“Except where prohibited or limited by applicable law, BlockFi has the right, without further notice to you, to pledge, repledge, hypothecate, rehypothecate, sell, lend, or otherwise transfer, invest or use any amount of such cryptocurrency provided by you under a Loan, separately or together with other property, with all attendant rights of ownership, and for any period of time and without retaining in BlockFi’s possession and/or control a like amount of cryptocurrency, and to use or invest such cryptocurrency at its own risk.”

BlockFi filed for chapter 11 bankruptcy earlier this week

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/NeoLeo