A popular crypto analyst says that Bitcoin (BTC) will defy all traditional theories of its market cycles next year.

The pseudonymous analyst known as TechDev tells his 402,000 Twitter followers that BTC will challenge conventional wisdom that its price cycles are driven by the halving cycles.

Halving cycles are the four-year intervals when Bitcoin miners’ block rewards are cut in half, which many investors believe have been playing a role in putting pressure on the price. TechDev predicts that BTC largely ignores the next halving, likely to happen in mid-2024, and instead turn bullish early next year.

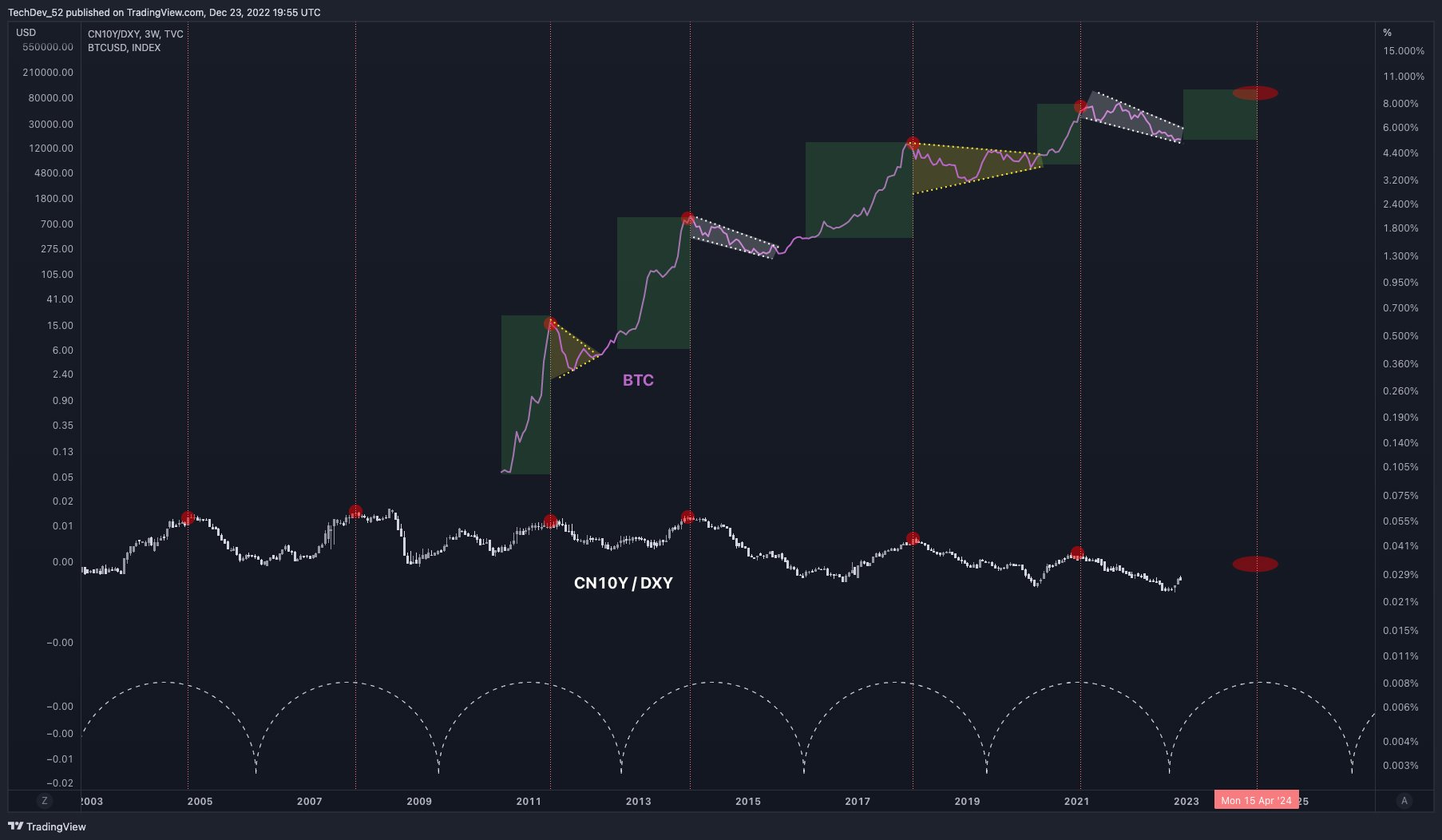

TechDev predicts that a bounce in Bitcoin next year will coincide with a weakening of the US dollar, which he pins against Chinese ten year bonds to depict a cycle of global liquidity.

“2023 to challenge halving theory.”

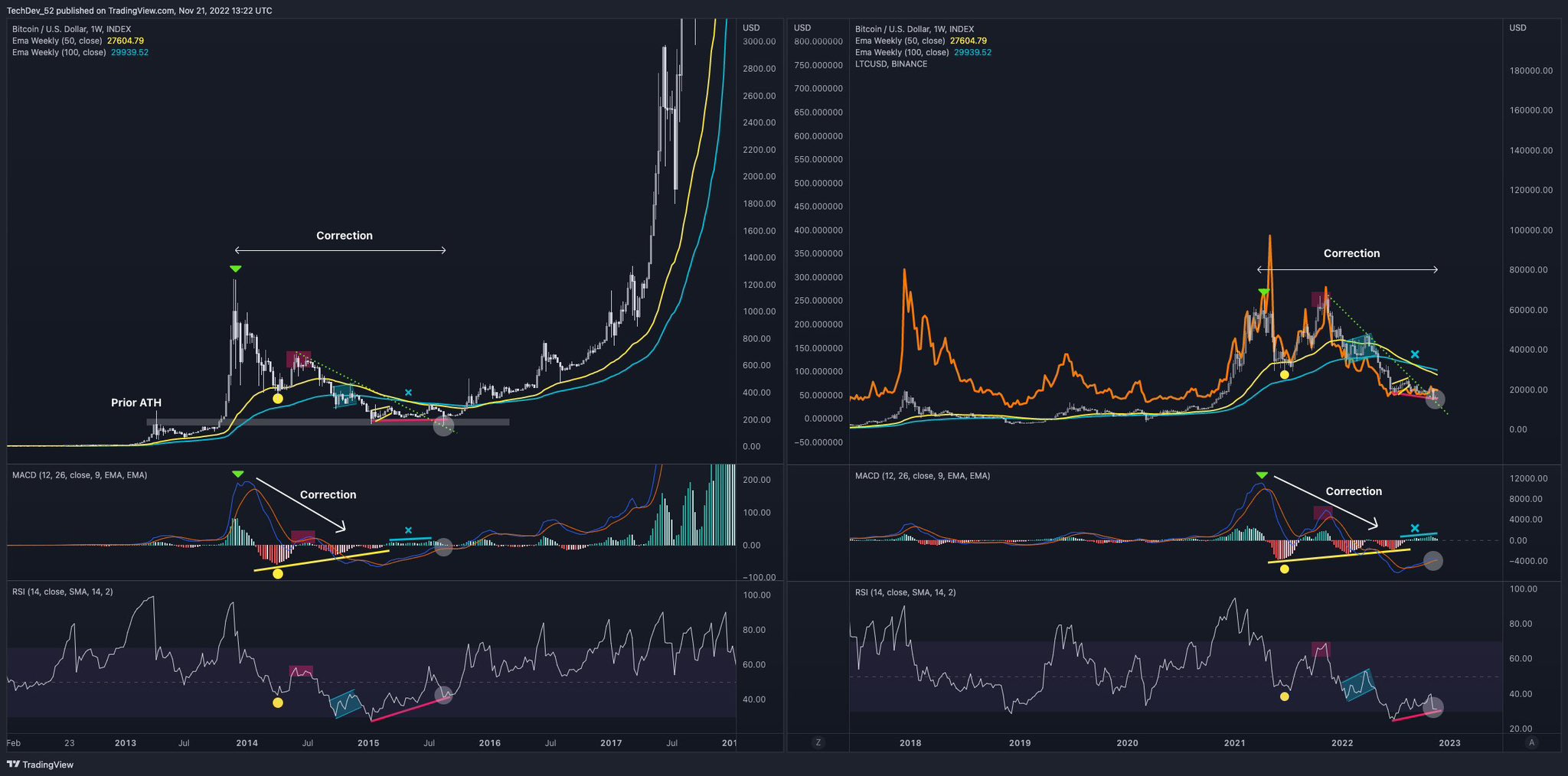

The analyst also argues that Bitcoin reached its top in April of 2021, rather than November, implying that the bear market is deeper than many believe and therefore closer to a reversal. He uses Litecoin (LTC) as an example of a coin that made a lower high in November, rather than the anomalous, slightly higher high seen in Bitcoin.

“BTC ‘topped’ April 2021 imo.

LTC‘s structure (orange) easier for most to digest.

Parabolic top vs. distributive, making Nov ‘21 a lower high.

Majority still doesn’t seem to understand corrective waves can make new highs.

Used to be part of majority.”

At time of writing, Bitcoin is trading at $16,798.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Macrovector