Leading on-chain analyst Willy Woo is making a prediction for when the current Bitcoin (BTC) bear market could reverse course.

Woo tells his one million Twitter followers that he thinks the BTC bear market will be longer than the one in 2018, but shorter than 2015.

“The main question I have is how long this cycle’s accumulation zone will be. Judging from all the blow ups, it’s more akin to 2013 with the Mt. Gox collapse (Remember 90%+ of BTC was traded there). I suspect it will be longer than 2018 but shorter than 2015.”

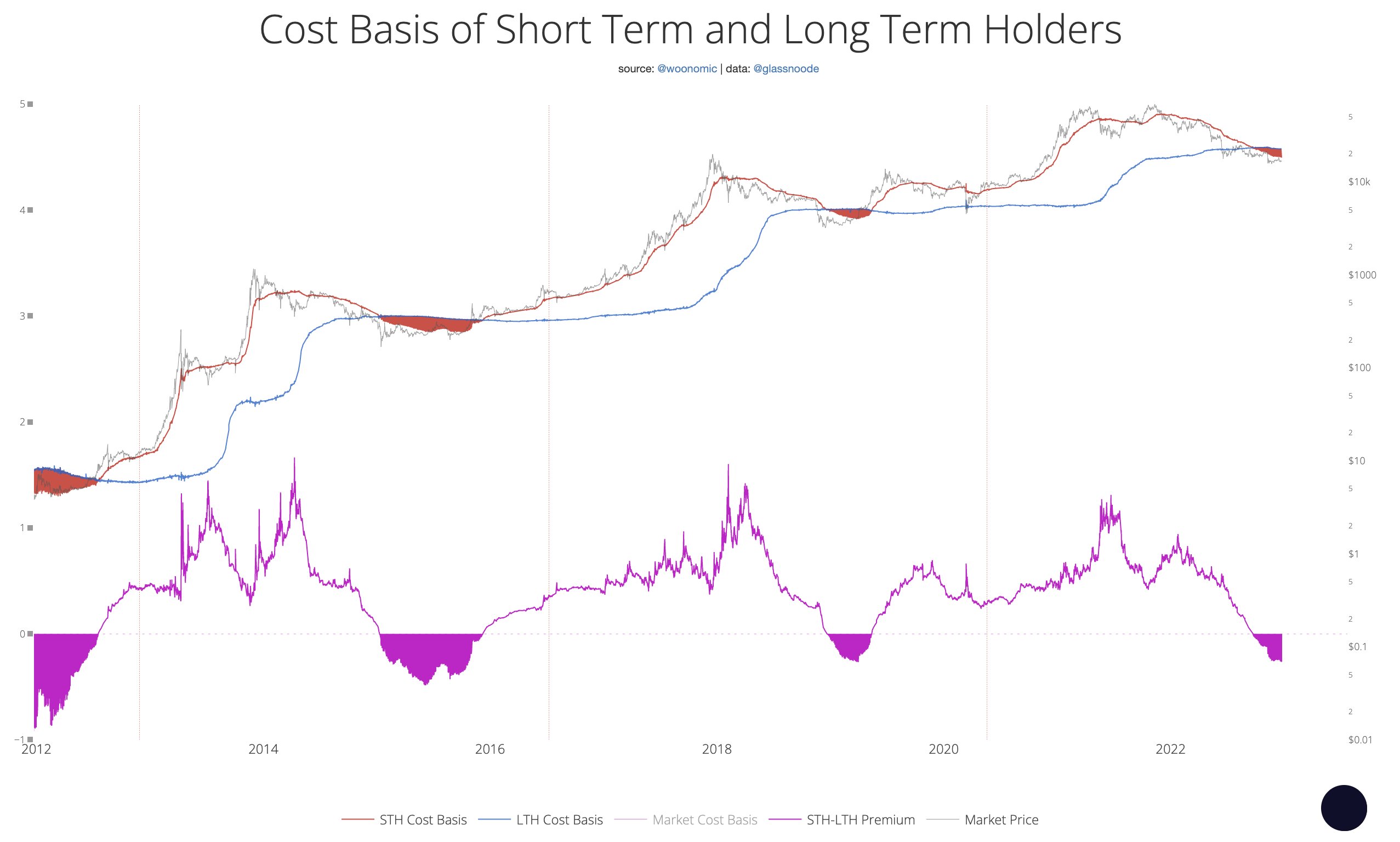

Woo shares a chart showing the cost basis of Long Term Holders (LTHs), those who have held onto Bitcoin for at least 155 days, and short-term holders (STHs). Woo’s chart suggests that when STHs cost basis drops below the cost basis of LTHs, it coincides with a market bottom.

Woo also weighs in on some of the more bullish Bitcoin predictions that put BTC at $1 million per coin, including that of Cathie Wood from ARK Invest. Woo says if Bitcoin reaches $1 million in value as Wood has predicted, it could crash the fiat currency system.

“Bitcoin price above say $1 million per coin could be very unstable. (ARKInvest among others predicts $1 million per coin.) At these corresponding capitalizations BTC becomes a true challenger to fiat, thus it’s a price range where fiat collapses.”

Woo says Bitcoin’s price rally toward $1 million will lead to a battle of governments attempting to push BTC down to protect the dominance of fiat currencies.

“Thus the forces pushing BTC pricing becomes binary, like breaking the sound barrier. There’s increasing bearish pressure on BTC as it approaches fiat market caps, while governments suppress it. If the barrier is broken, BTC gets bullish pressure and escapes towards infinity.”

At time of writing, Bitcoin is changing hands at $16,678.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Marut Laijaroen