A closely followed crypto trader says Decentraland (MANA), ApeCoin (APE) and Frax Share (FXS) are setting the stage for big rallies.

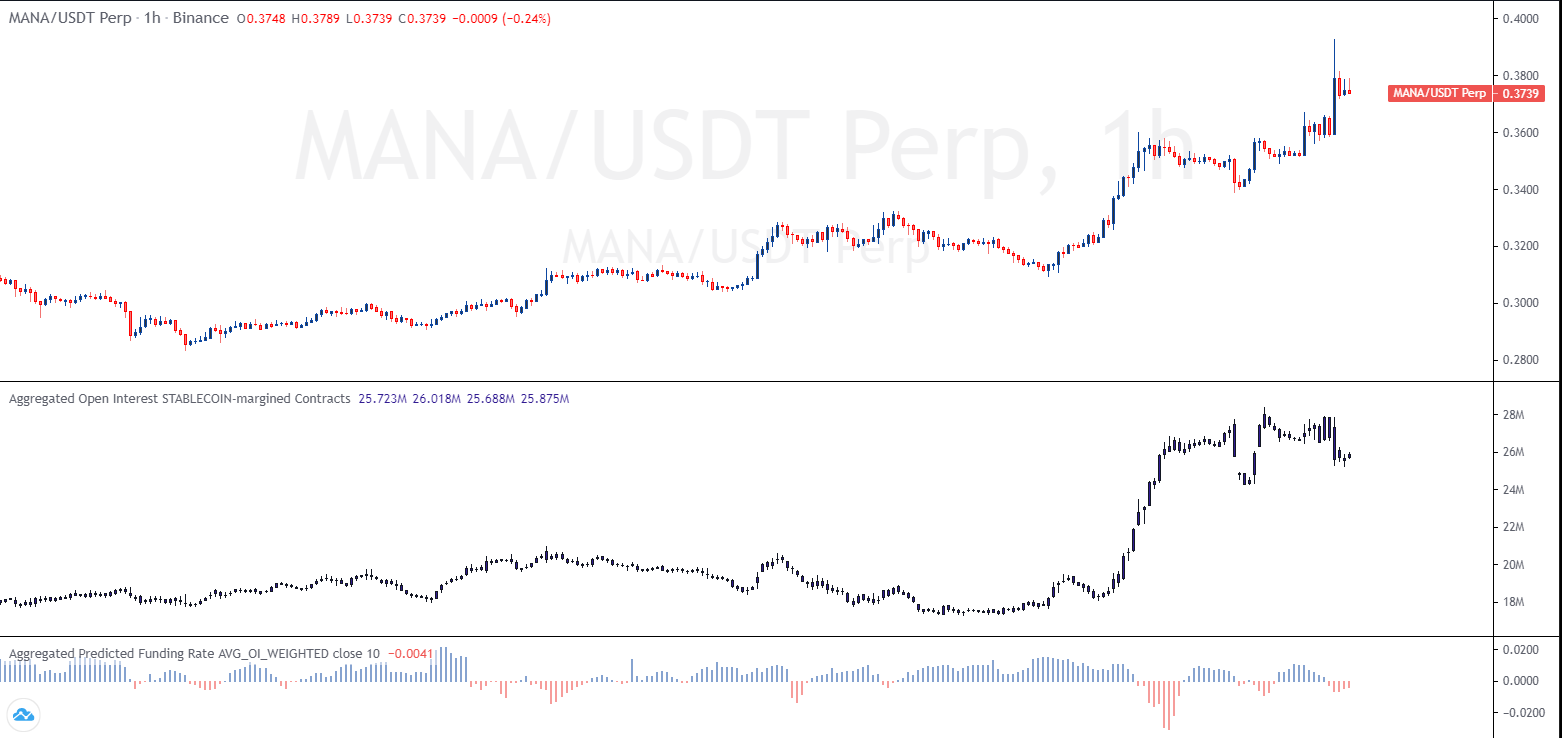

The pseudonymous trader Cantering Clark tells his 156,700 Twitter followers that the metaverse protocol Decentraland is showing a short bear squeeze, signaling further upside.

“GameFi and metaverse pumping. If I had to guess, MANA has the potential to get even more violent to the upside given that OI [Open Interest] is nearly double what it normally was, before a bunch of Barry-related shorts and hedges were tagged on. This squeeze has more fuel.”

A short squeeze happens when traders who borrow units of an asset at a certain price in hopes of selling them for a lower price to pocket the difference are forced to buy assets back as the trade moves against their bias.

At time of writing, MANA is valued at $0.41, up over 38% from its low this month of $0.295.

Looking at APE, Cantering Clark says the native token of the Bored Ape Yacht Club community is likely going to continue upward after taking out its immediate resistance.

“A close through $4.30 for the weekly is setting up right now with only 30 minutes left. If metaverse and GameFi are going to continue to pump, APE catches wind in its sails.”

APE is valued at $4.52 at time of writing. A move toward the analyst’s target of $7.20 suggests an upside potential of nearly 60% for APE.

Lastly, he says FXS, the governance token for the Frax stablecoin protocol, appears to be forming a solid bottom and could be gearing up for a breakout.

“I see FXS catching a bid again, and this three-day chart has a granite bottom. I am betting on this breaking up, and positioning accordingly.”

At time of writing, FXS is changing hands at $5.53.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney