Crypto giant Grayscale says the oral argument for its lawsuit against the U.S. Securities and Exchange Commission (SEC) will happen earlier than expected.

Grayscale filed the suit last year to contest the regulator’s rejection of its application to convert the Grayscale Bitcoin Trust (GBTC) into an exchange-traded fund.

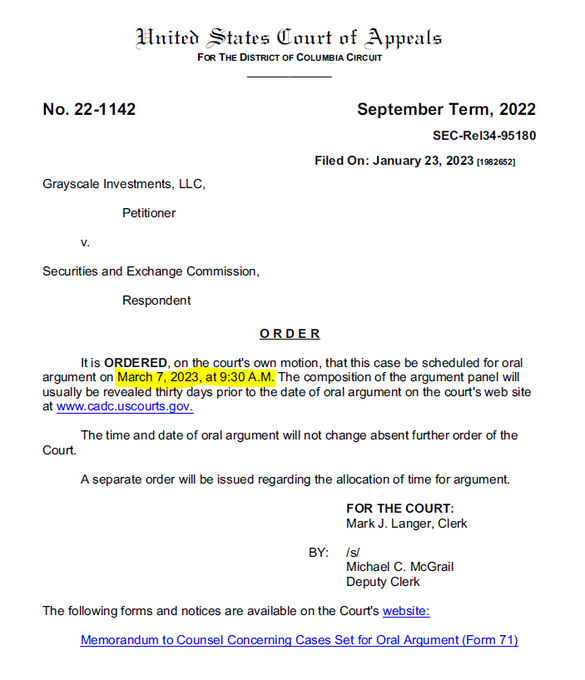

According to Grayscale chief legal officer Craig Salm, the firm expected the oral argument to start by the second quarter of 2023, but a new order from the District of Columbia Court of Appeals sets the schedule for March 7th.

“Mark your calendars. Oral Arguments in our case challenging SEC decision to deny GBTC conversion to a spot Bitcoin ETF was just scheduled for Tuesday, March 7, 2023 at 930 AM EST. We were previously anticipating Oral Arguments to be as soon as Q2 this year. So this is welcome news.”

The filing says the court will announce the composition of the argument panel 30 days before the date of the oral argument. It will also issue a separate order for the allotment of time for the argument.

“The next event to look out for will be selection of the 3-judge panel from the DC Circuit Court of Appeals (about a month before Oral Arguments).”

The SEC argues that Grayscale’s proposal to convert GBTC into an ETF did not meet standards for preventing fraudulent practices, but in an interview on CNBC’s Squawk Box, Grayscale CEO Michael Sonnenshein says that the SEC’s decision contributed to the current crypto fiasco.

“Had the SEC already approved the spot Bitcoin ETF, allowed GBTC to convert into an ETF already, then a lot of the investor harm that you see in crypto would have been prevented A lot of these investors would not have gone to offshore exchanges and gotten caught up in some of the businesses that are not regulated by the US the way that Grayscale is.”

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney