Popular on-chain analyst Willy Woo thinks institutions could be the driving force behind the recent Bitcoin (BTC) rally.

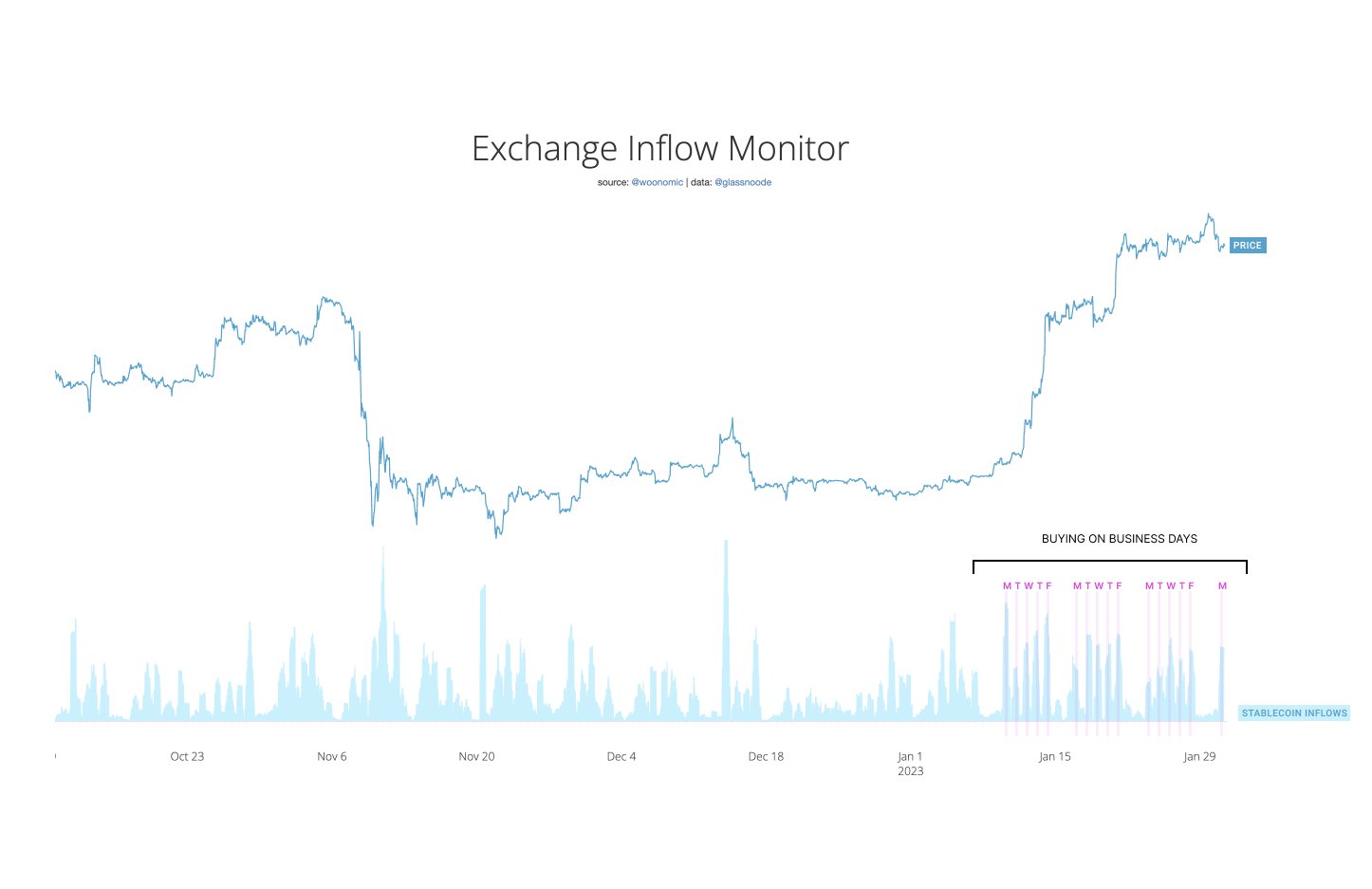

Woo tells his one million Twitter followers that the BTC rally coincides with a new pattern of billions of dollars worth of stablecoins flowing onto exchanges “during work days only.”

“Seems to me like the heat signature of large institutions doing the buying. Timing of the inflows spans approximately 16hrs, with the quiet zone being Asian work hours. This suggests it’s Western institutions across US and Europe.”

Bitcoin is trading at $23,079 at time of writing. The top-ranked crypto asset by market cap has surged by nearly 40% since the beginning of 2023, though it has largely tracked sideways in the past week.

Woo also notes that spot market flows have been dominating the rally rather than derivatives.

“It’s spot buying that’s moving the price and derivatives that are lagging. Implies that long-term institutional investors are coming in via spot buying and moving to custody.”

The crypto trader believes the investing institutions are existing crypto funds that sat out the bear market using stablecoins.

“Remember if you are a fund you will bank with Silvergate or Signature Bank. Silvergate had a bank run and Signature dialed down on crypto exposure. So stables have been the best place to hold USD in past months.”

Despite Bitcoin’s price gains this year, it remains more than 66% down from its all-time high of around $69,000, which it hit in November 2021.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Featured Image: Shutterstock/phanurak rubpol