Pantera Capital’s Dan Morehead and two investment associates think the crypto winter is over and has been over for months.

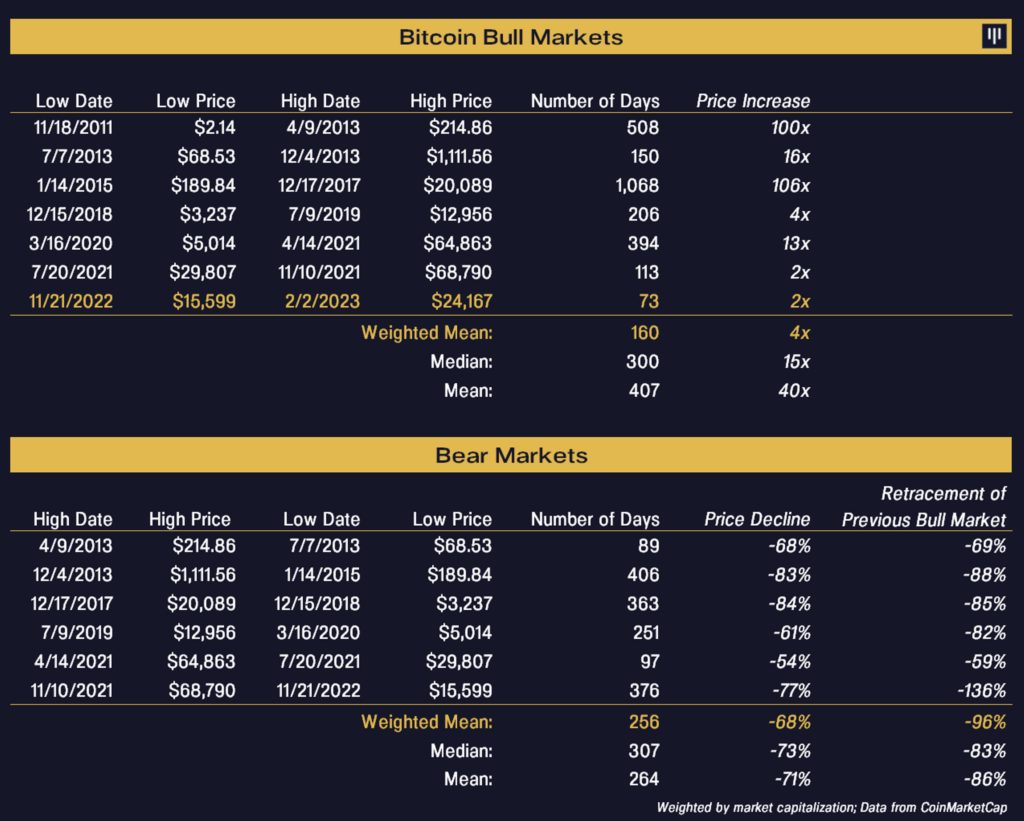

In a recent newsletter, Pantera argues the most recent crypto bear market ended on November 21st and lasted a total of 376 days, more than the median bear market length of 307 days.

Pantera’s investment associate Sehaj Singh notes that Bitcoin (BTC) saw a drawdown of 77% over that time, compared to the median bear market amount of 73%.

“Pantera has been through 10 years of Bitcoin cycles, and I’ve traded through 35 years of similar cycles. I believe that blockchain assets have seen the lows and that we’re in the next bull market cycle – regardless of what happens in the interest-rate-sensitive asset classes.

The decline from November 2021 to November 2022 was the median of the typical cycle. This is the only bear market to more than completely wipe out the previous bull market. In this case giving back 136% of the previous rally.”

Pantera believes crypto is beginning to “grind higher” and is fully in the next bull market cycle already.

Pantera Capital launched the first crypto fund in the US in 2013 and currently has $4.1 billion in assets under management. The company has made 100 venture investments and 110 early-stage token investments.

Read the full Pantera newsletter here.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney