Crypto exchange Bitget’s native token BGB is outrunning most of the markets as it prints a new all-time high after parabolic rallies.

According to Bitget’s managing director, Gracy Chen, the exchange has hit a number of new milestones in the last several months.

Addressing BGB’s big run-up, Chen says that Bitget has been innovating all through the bear market, helping set itself apart from competitors.

She references Bitget’s new proof-of-reserve report, which cites a January 31 snapshot that purports a 227% reserve ratio on the exchange’s assets. After the collapse of FTX, which saw billions of dollars in customer funds vanish and the arrest of its CEO Sam Bankman-Fried, crypto exchanges saw increased scrutiny regarding their reserve systems.

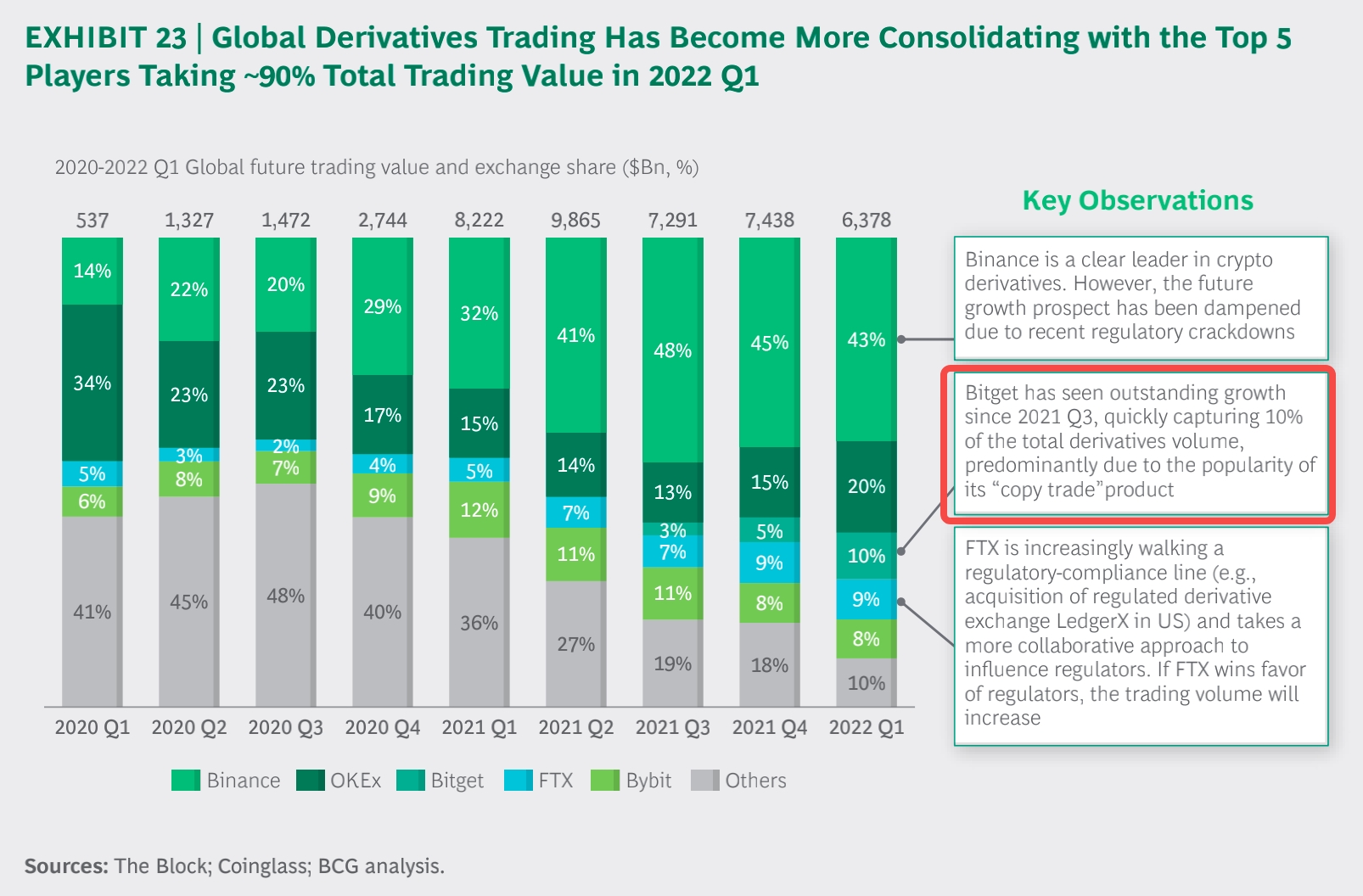

Chen also cites a Boston Consulting report that says BItget’s market share of derivatives trading went from 3% to 11% and saw a 300% increase in volume.

According to Chen, Bitget is also the first crypto exchange to introduce copy trading, whereby users can simply copy the trades of more experienced traders instead of managing their own.

Bitget also aims to provide crypto traders access to lesser-known, smaller-cap altcoins in its “innovation zone.” Earlier this week, Bitget, along with Top US crypto exchange Coinbase, listed BLUR, a brand-new, Ethereum (ETH)-based non-fungible token (NFT) marketplace project.

At time of writing, BGB, which gives Bitget traders certain perks, is trading at $0.461, up 108% in the last seven days. Its market cap is $642,944,742.

Follow us on X, Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/satawat nuntasiri