A widely followed crypto analyst is highlighting the price level Bitcoin (BTC) bulls must hold as the crypto markets bounce.

With BTC trading for $23,984 at time of writing, analyst Justin Bennett tells his 111,400 Twitter followers that Bitcoin bulls must hold $23,000.

“If BTC is going to bounce, it has to do it soon.

$23,000 is a must-hold level for bulls.”

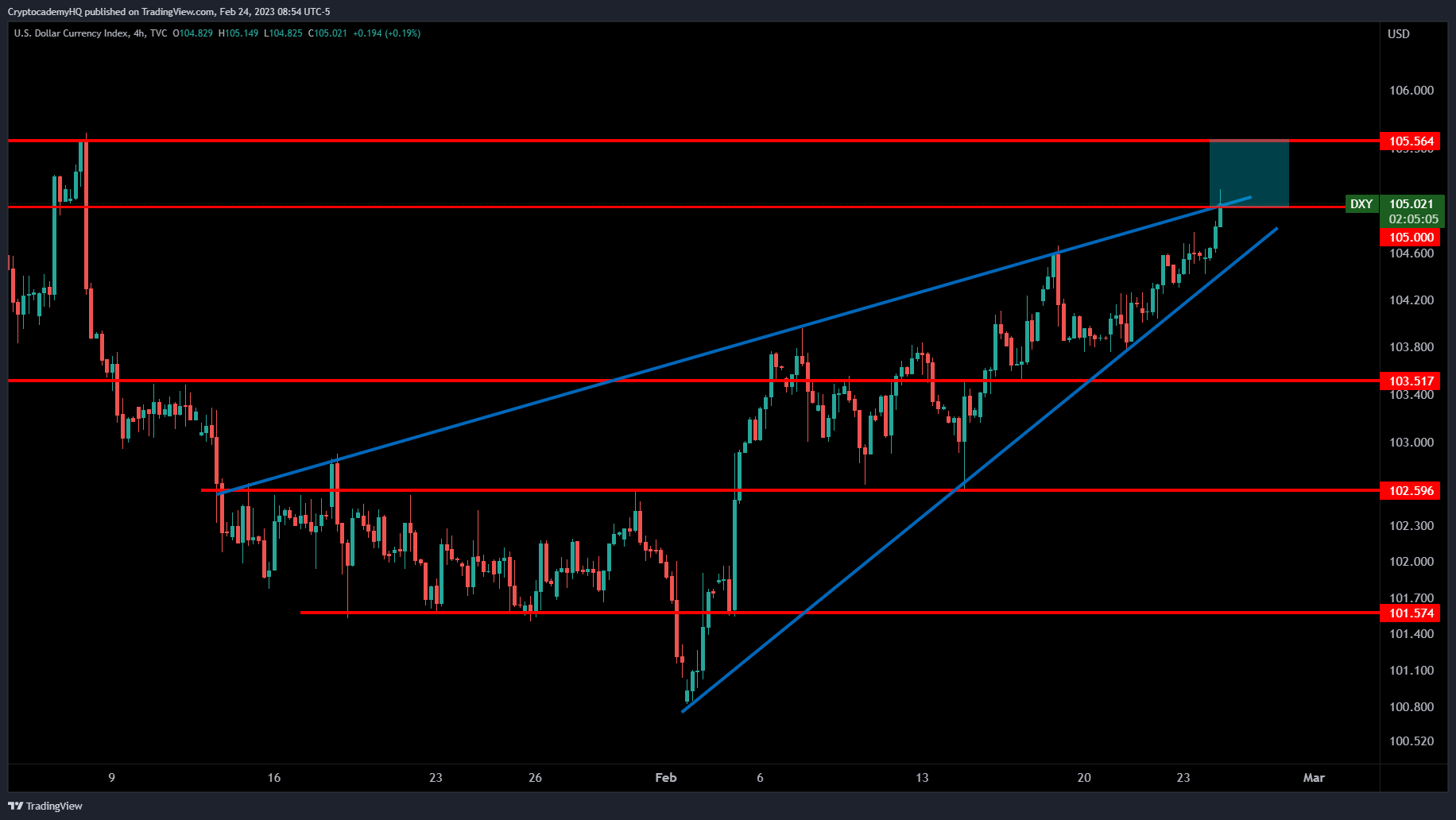

The trader also breaks down the US Dollar Index (DXY), a measure of the strength of the US dollar against a basket of assets, in this case, digital assets. Generally speaking, a stronger DXY means weaker assets and vice versa. According to Bennett, the DXY is currently testing a new, higher level.

“There’s still a lot of indecision out there, but the DXY

just tested 105 resistance.

That’s the weekly pivot I mentioned yesterday, and there’s a daily pivot at 105.60.

Let’s see.”

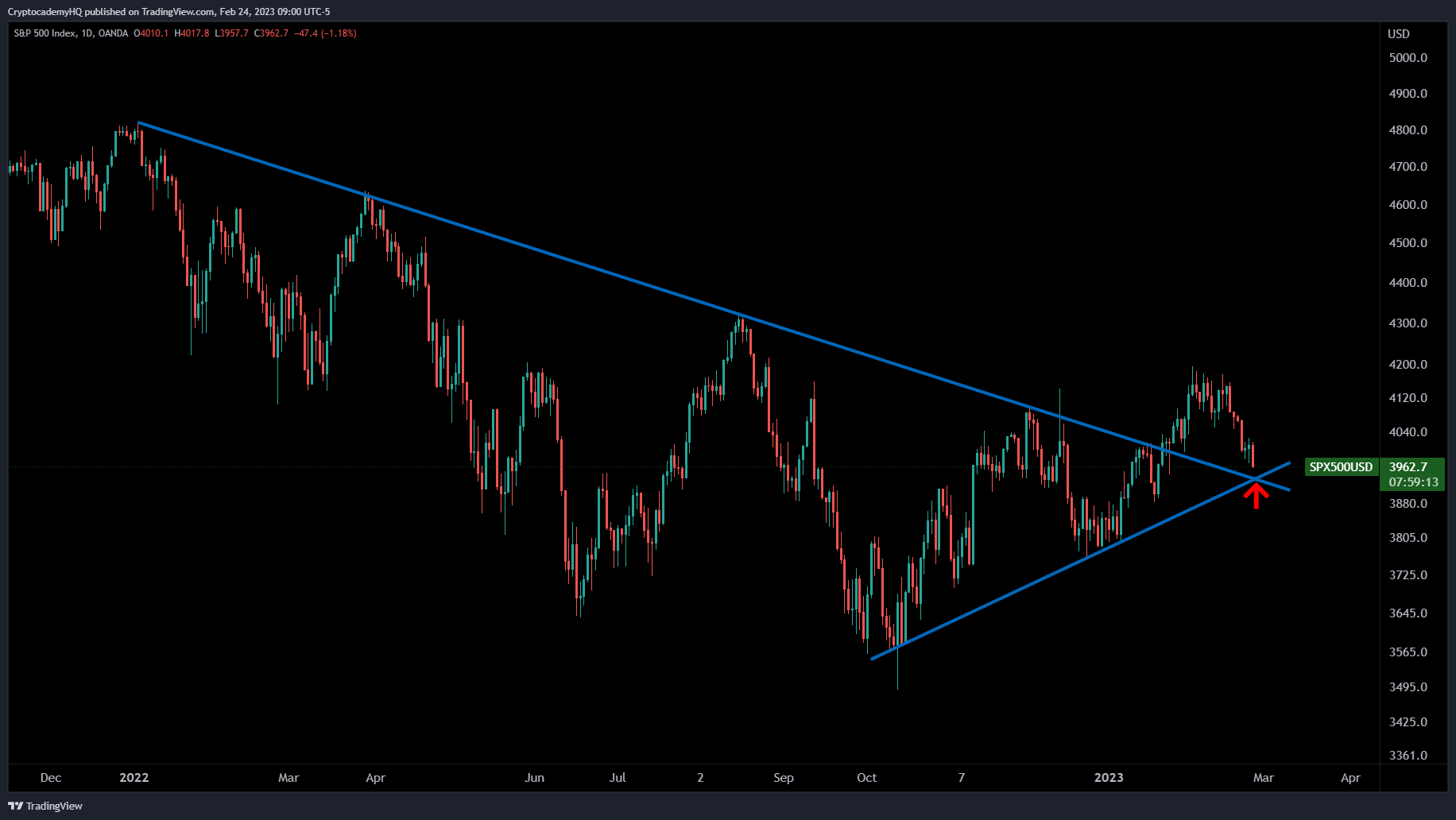

Looking at the traditional stock index the S&P 500 (SPX), Bennett says it’s no surprise the DXY is testing a higher level as the SPX approaches a confluence of support.

“No surprise that this is occurring as the SPX approaches the 3,930 confluence of support.

Betting that the next big move from risk assets hinges on this area.”

Bennett further explains how the next big move for risk assets hinges on the SPX in a follow-up.

“It’s a simple over/under scenario.

Over, and we’re good. Under on the higher time frames, and we’re not good.

Don’t assume you know what will happen here. Blind assumptions are what get people rekt.”

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/yucelyilmaz/Sensvector