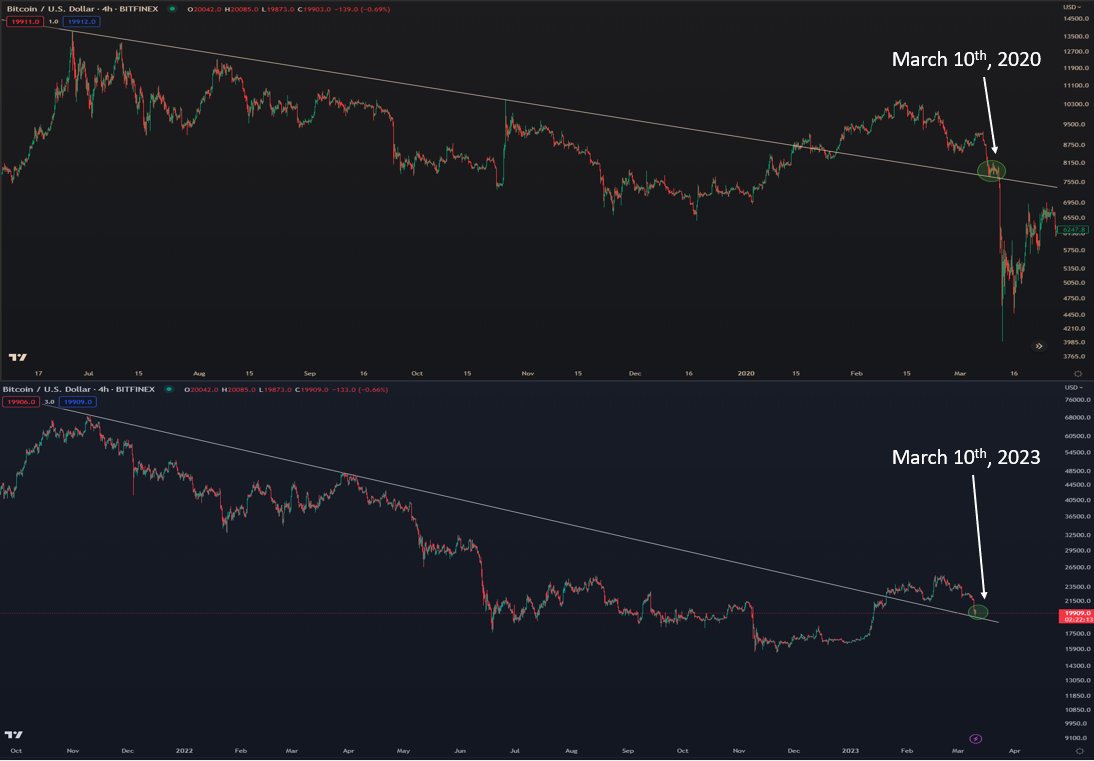

A closely followed crypto trader is issuing an alert to Bitcoin (BTC) holders, saying that the king crypto’s current market structure looks similar to its price action prior to a deep plunge about three years ago.

Pseudonymous analyst Kaleo tells his 566,300 Twitter followers that Bitcoin is currently consolidating above a diagonal trendline after taking it out earlier this year.

According to the trader, the price action is reminiscent of how Bitcoin moved in early 2020 when it rallied from around $6,000 to $10,000 only to capitulate back to $3,000 in March of the same year.

“Please lord be different this time.”

Although Bitcoin’s current market structure appears ominous, Kaleo says that there’s still a chance for BTC bulls to come out ahead as long as the trendline holds.

“Both Bitcoin and SPX are retesting major high timeframe support levels.

In my opinion, there’s no reason to be a doomer / incredibly bearish here as long as these hold.”

Should the trendline fail to hold, Kaleo warns that BTC will likely witness a massive sell-off event.

“If they do happen to break, we’ll see real capitulation. Until then, I see this as a good risk/reward spot to long with clearly defined stops to the downside and huge upside potential.”

At time of writing, BTC is trading for $20,130.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney