Seasoned trader Tone Vays believes that Bitcoin’s (BTC) current consolidation is setting up the king crypto for an imminent breakout.

In a new strategy session, Vays tells his 123,000 YouTube subscribers that Bitcoin’s consolidation is healthy as it allows BTC to take a breather before continuing its trend.

He gives an example of how Bitcoin consolidated at the height of last year’s bear market. According to Vays, Bitcoin cooled off for a time between May and June 2022 before breaking below the key psychological area of $20,000.

“Consolidations tend to lead to continuations of trends… We saw that here [May 2022]. Consolidation after a big drop led to another big drop.”

Although Vays gives a bearish example, he says that BTC remains in an uptrend as it consolidates between $27,500 and $28,500.

“So now we have a new range, and let’s see if we [are] now going to head to the top of the range. I’m optimistic here, and I think this consolidation is good, and the more time we spend between $27,500 and $28,500, the better the breakout is going to be [this] week.”

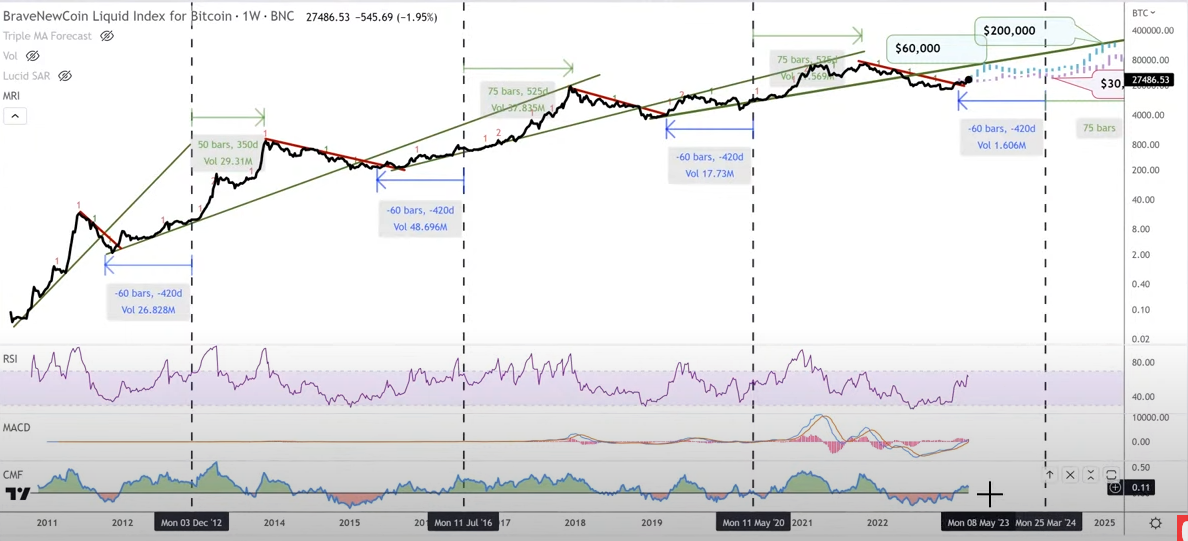

Looking at the monthly chart, Vays says that Bitcoin’s technical indicators are flashing green.

According to the trader, the Chaikin Money Flow (CMF), an indicator that tracks whether market participants are accumulating an asset, has a lot of room to run to the upside. He also says that it is the same case for the moving average convergence divergence (MACD) indicator, a trend reversal indicator.

As for the relative strength index (RSI), a momentum indicator, Vays says that it is starting to approach overbought territory on the monthly timeframe.

“We are in a very interesting time in Bitcoin. Look at the monthly indicators. The basic monthly indicators – RSI, MACD and CMF – they’re super bullish. The RSI is getting a little overheated, but other than that, they’re super bullish.”

At time of writing, Bitcoin is trading for $27,862.

I

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney