Financial titans Fidelity and Bank of America are now indirect owners of Bitcoin (BTC) after the two firms heavily accumulated shares of MicroStrategy (MSTR) in Q1 this year.

MicroStrategy is the largest institutional holder of Bitcoin, owning 140,000 BTC worth more than $4.22 billion.

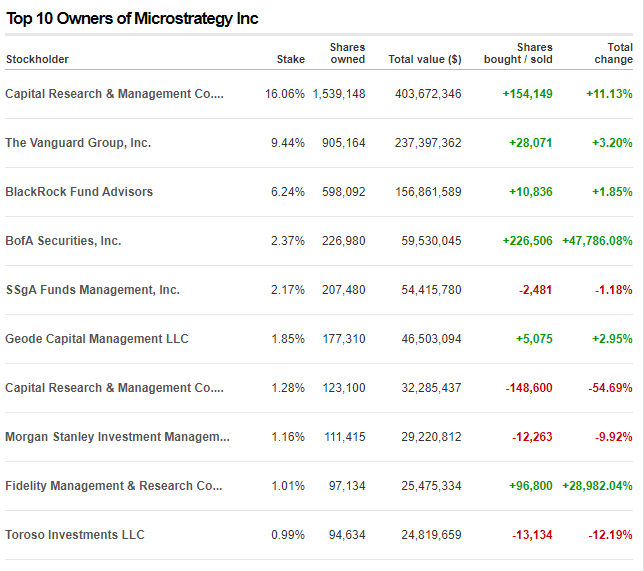

Data from CNN shows that Bank of America is now the fourth-largest shareholder of MicroStrategy after the bank bought tens of millions of dollars worth of MSTR in Q1 of 2023.

According to CNN, Bank of America has a 2.37% stake in MicroStrategy, owning 226,980 MSTR shares worth over $59.53 million as of Q1. The banking giant made most of its MSTR purchases during the previous quarter, buying 226,506 shares to represent a massive 47,786% growth in ownership on a quarter-over-quarter basis.

Meanwhile, Fidelity is the ninth-largest MSTR holder with a 1.01% stake in the business intelligence firm. CNN shows that the financial services company owns 97,134 MSTR shares worth over $25.47 million as of Q1 2023. Fidelity also supersized its MSTR holdings last quarter after accumulating 96,800 shares, marking an increase over 28,982% compared to its Q4 2022 stake in MicroStrategy.

Widely followed crypto trader Doctor Profits tells his 174,400 Twitter followers that both Fidelity and Bank of America are indirectly buying Bitcoin by accumulating MSTR shares.

“Fidelity and Bank of America bought BTC indirectly while becoming one of the top 10 share owners of MicroStrategy that owns more than several billions worth of Bitcoin.

Most of these share purchases took place in Q1 this year.

Think about it for a minute.”

At time of writing, Bitcoin is trading for $30,109, up over 6% in the last 24 hours.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/CHIARI VFX