Nearly $2 billion worth of Ethereum (ETH) is set to be unstaked after the top smart contract platform’s Shapella update went live last week.

In a new report, crypto analytics platform IntoTheBlock finds that 868,631 of staked ETH, worth more than $1.8 billion at time of writing, are currently in queue waiting to be withdrawn.

The market intelligence firm’s data also reveals that 104,000 ETH have been deposited into staking within a 24-hour period following the lead smart contract platform’s recent update.

IntoTheBlock gives insights on which institutions are most engaged in staking Ethereum, which includes several popular crypto exchange platforms.

“Lido is the leading institution engaged in staking, with others categorized as independent stakers coming in second place, followed by Coinbase, Kraken, and Binance respectively.

63.3% of the ETH waiting to be withdrawn by entities belongs to Kraken.”

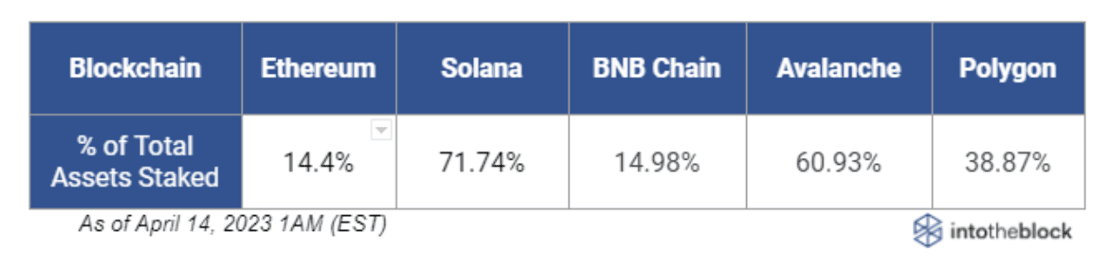

IntoTheBlock compares the amount of ETH staked to that of rival smart contract platforms, such as Solana (SOL), BNB Chain (BNB), Avalanche (AVAX), and Polygon (MATIC). According to the analytics firm, Solana is way ahead of the pack with Ethereum in last place.

“At the moment, 14.4% of total ETH is staked. Will the latest Shanghai upgrade boost investor confidence and increase the total ETH staked?”

The Shapella upgrade, which allows Ethereum stakers to withdraw their staked tokens for the first time, is a portmanteau of “Shanghai” and “Capella,” two different updates that went live simultaneously. While Shanghai reinforced the protocol’s execution layer, Capella made changes to its consensus layer.

Ethereum is trading for $2,117 at time of writing.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/BokehStore/VECTORY_NT