Blockchain analytics firm Glassnode says that Bitcoin (BTC) adoption is exploding after the introduction of BRC-20 tokens, the leading cryptocurrency’s new experimental token standard.

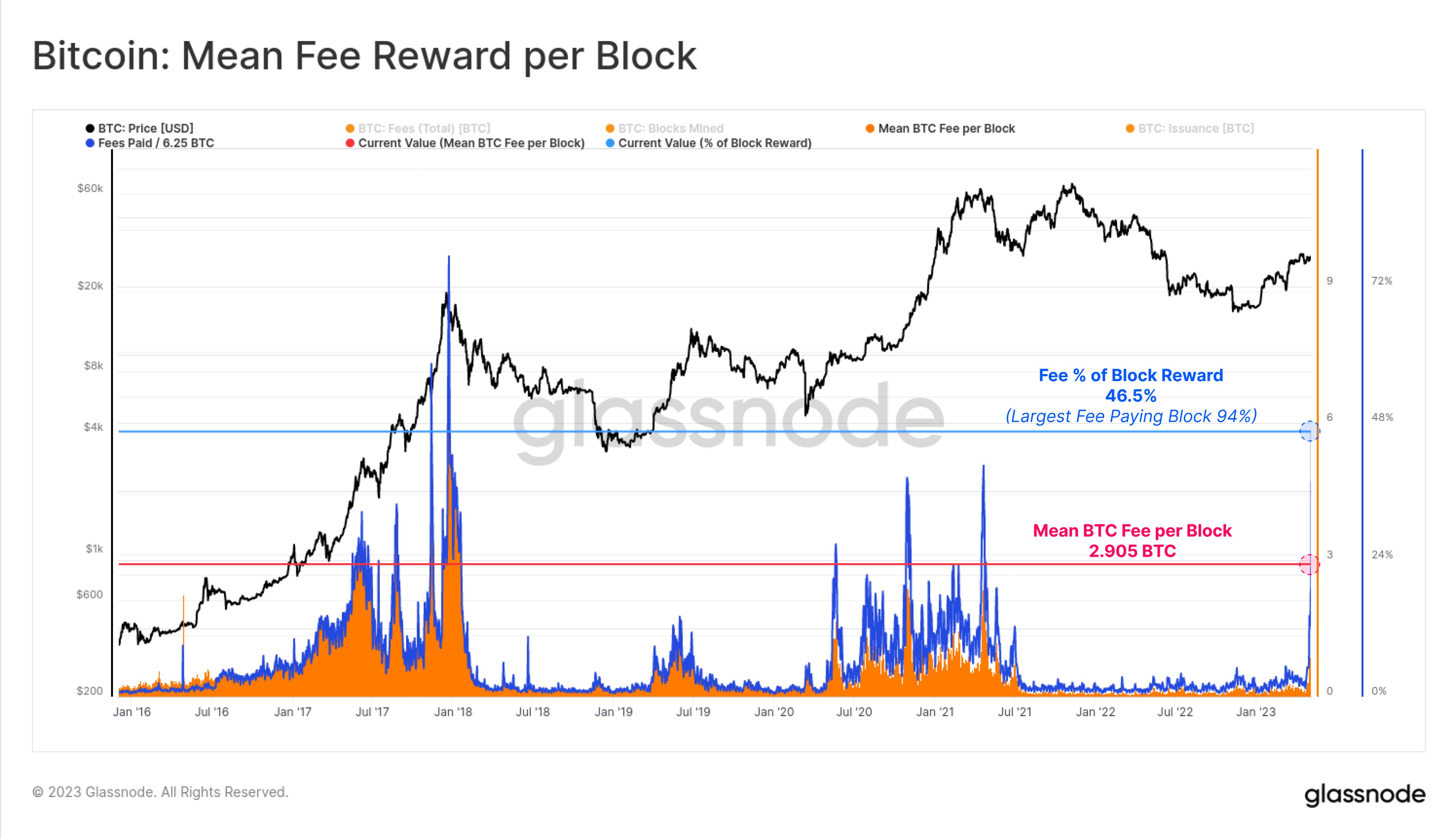

Glassnode says that Bitcoin’s recent demand leap for blockspace has resulted in a revenue increase for miners despite BTC being down 3.68% in the last 24 hours, trading for $27,874 at time of writing.

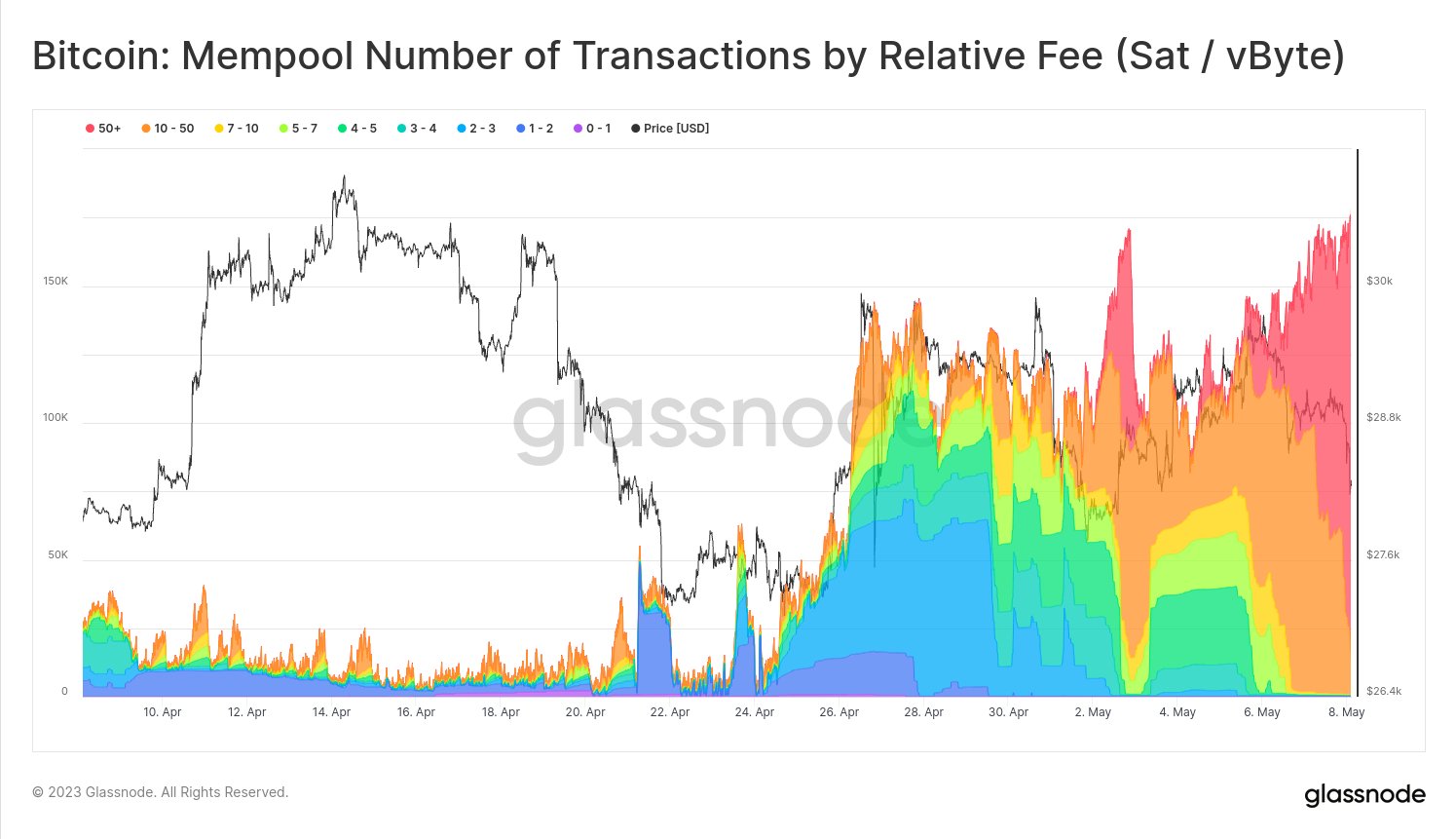

“Bitcoin is experiencing extremely high demand for blockspace, driven by BRC-20 tokens, utilizing text-based inscriptions, and ordinals

This is a revenue boost for Miners, as the average fee paid per block has reached 2.905 BTC, near past bull peaks…

A few recent blocks have seen tremendous total fees paid of 5.87 BTC, approaching 94% of the 6.25 BTC block subsidy.

Our mempool is currently full, and purging transactions approaching the 50sat/vbtye fee rate band.”

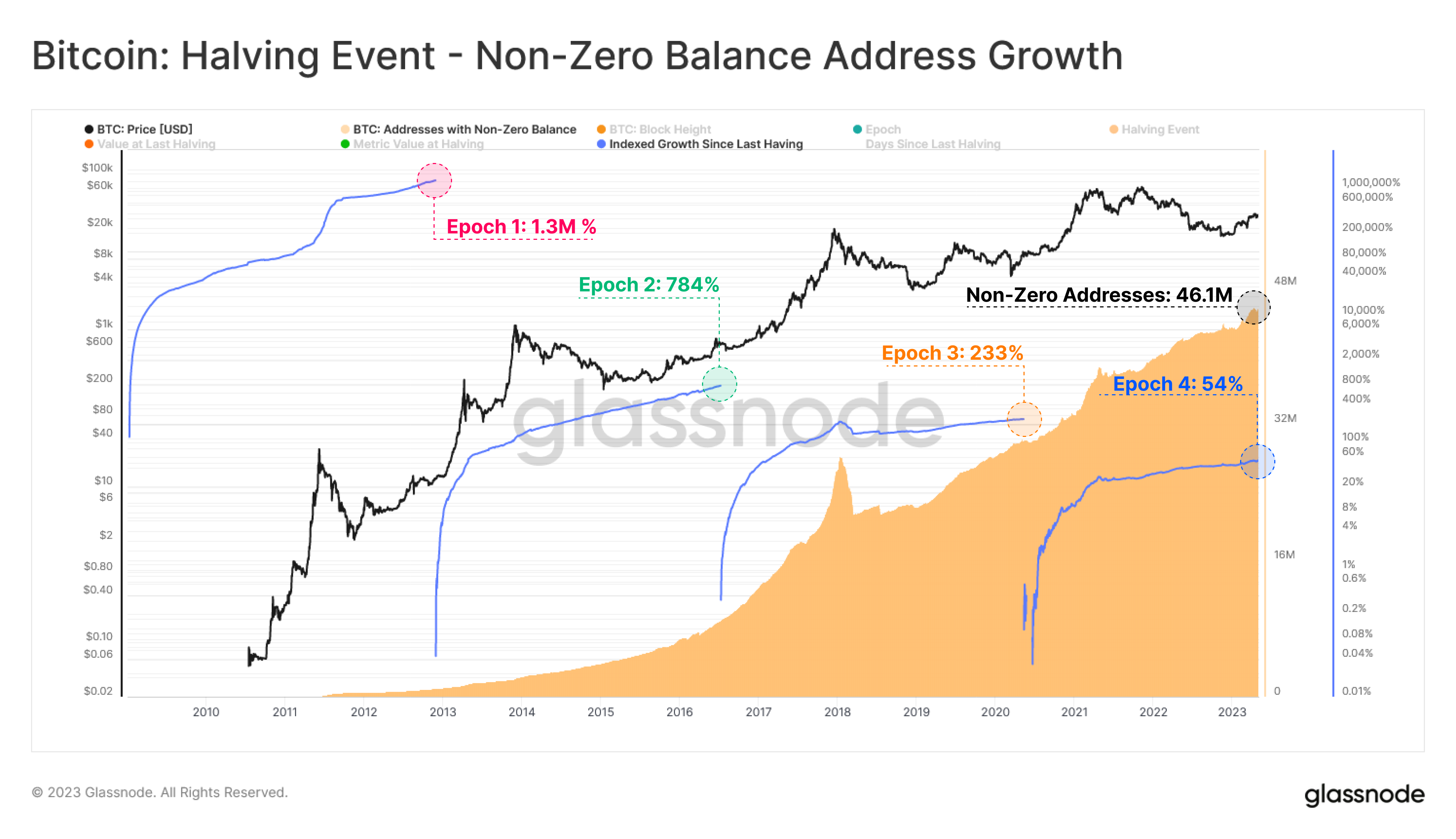

Glassnode says BTC adoption is surging with the number of non-zero addresses, or wallets holding more than 0 BTC, reaching a new all-time high (ATH).

“Bitcoin adoption continues to soar as the number of Non-Zero Addresses reaches an ATH of ~46.1M.

When comparing for growth across Epochs, we note a decline in relative growth, but an increase in absolute growth as the number of Non-Zero Addresses continues to expand:

(red) Epoch 1: 1.3M % (+1M Addresses)

(green) Epoch 2: 784% (+8M Addresses)

(yellow) Epoch 3: 233% (+21M Addresses)

(blue) Epoch 4: 54% (+16M Addresses)”

BRC-20 is a new experimental token standard built for Bitcoin, created by the pseudonymous on-chain analyst Domo.

BRC-20s, which borrow ETH’s “ERC-20” designation, use ordinals, or inscriptions built into Satoshis, to deploy, mint and transfer tokens. While loosely modeled after the ERC-20, the BRC-20 is substantially distinct due to the different architecture of Bitcoin’s blockchain.

Explains Domo,

“This is just a fun experimental standard demonstrating that you can create off-chain balance states with inscriptions. It by no means should be considered THE standard for fungibility on Bitcoin with ordinals, as I believe there are almost certainly better design choices and optimization improvements to be made.

Consequently, this is an extremely dynamic experiment, and I strongly discourage any financial decisions to be made on the basis of its design. I do, however, encourage the Bitcoin community to tinker with standard designs and optimizations until a general consensus on best practices is met (or to decide that this is a bad idea altogether!).”

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE-2bit