Legendary trader Peter Brandt is warning that Bitcoin (BTC) is forming a pattern that could spell trouble for the king crypto.

Brandt tells his 696,400 Twitter followers that the price action of Bitcoin appears to be forming a textbook head and shoulders pattern.

A head and shoulders pattern is used in technical analysis as an indicator of a bullish-to-bearish trend reversal.

“A head and shoulders should be taken seriously if it is completed: BTC.”

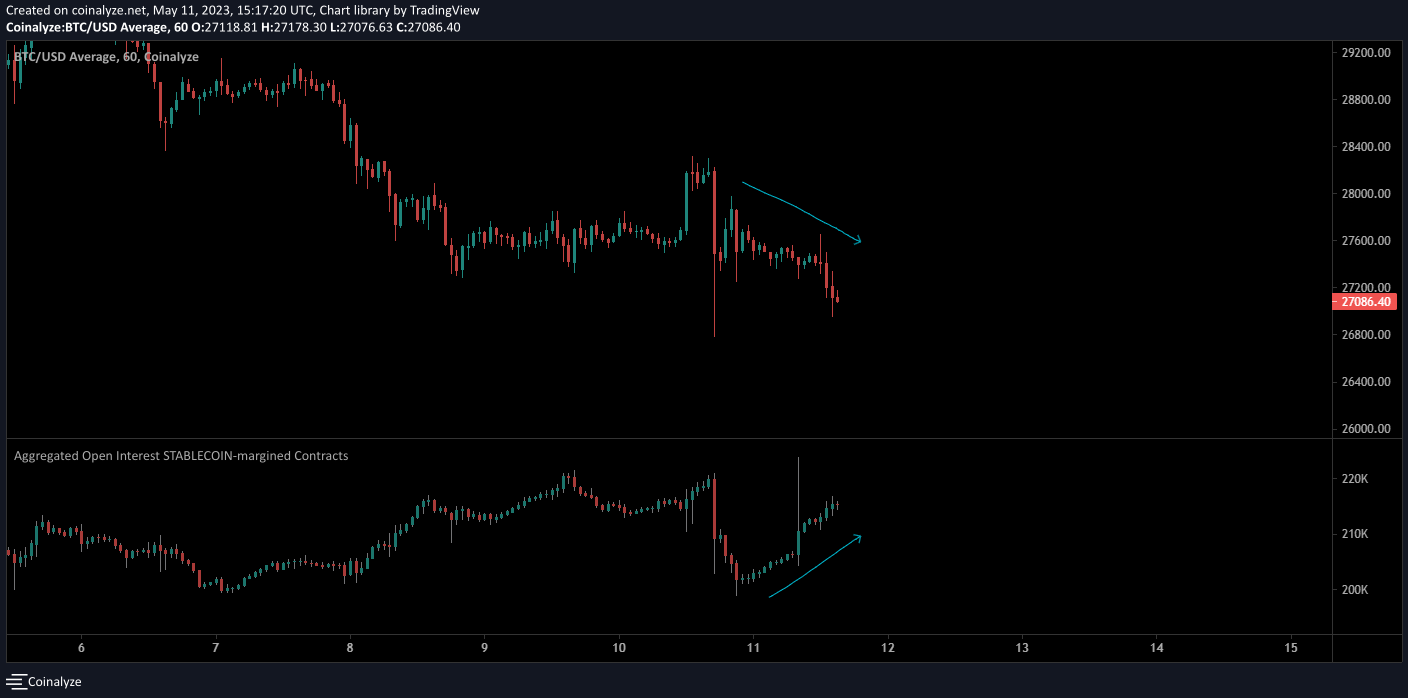

However, closely followed pseudonymous crypto analyst Inmortal tells his 194,600 Twitter followers that he believes Bitcoin’s latest dip may have all the makings of a short squeeze.

A short squeeze happens when traders who borrow an asset at a certain price in hopes of selling it for lower to pocket the difference are forced to buy back the assets they borrowed as momentum moves against them, triggering further rallies.

“Good ingredients for a short squeeze. Price at range low + OI (Open interest) up and price down. But remember, buyers need to step in to force sellers to start closing their positions.”

Inmortal is also predicting Bitcoin’s price action for the next few years. He believes a bull market will start in the third quarter of next year.

“2022 – Bear market, down only

2023 – Sideways and mid cycle rally.

2024 (Q1, Q2) – Sideways.

2024 (Q3, Q4) – Start of the bull market.

2025 – Bull market, up only.”

For the remainder of 2023, Inmortal lays out a number of more detailed scenarios in a Twitter thread, but the one he believes is most likely to occur has Bitcoin retesting the $25,000 level, following a similar 2016 pattern.

“– Local top is in.

– $25,000 retest + sustained demand + consolidation above $29,000.

– Boring Q3, volatility in Q4.

– Similar to 2016 price action.”

Bitcoin is trading for $26,940 at time of writing, down 2.8% during the past 24 hours.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney