On-chain metrics suggest the Bitcoin (BTC) bear market could be over, according to the crypto analytics firm Glassnode.

Glassnode’s “Recovering from a Bitcoin Bear” signal combines eight different metrics that analyze four primary factors: whether the market is trading above key price models, whether there have been any upticks in on-chain activity, whether the market is realizing profits and the level of long-term holder supply dominance.

All of the signal’s eight metrics currently look bullish for Bitcoin and indicate the top crypto asset by market cap could be in the early stages of a bull market.

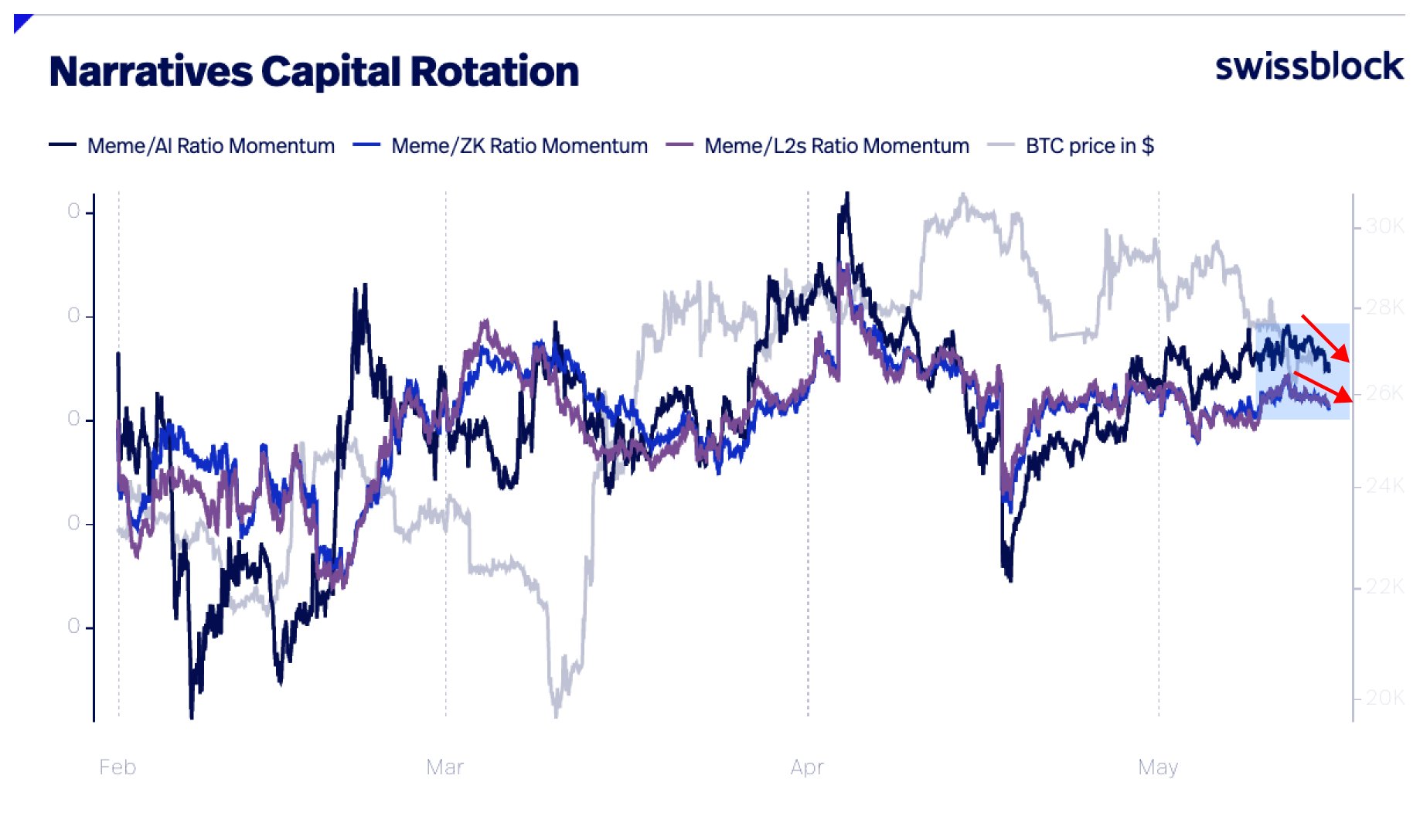

The pseudonymous crypto analyst Negentropic, one of Glassnode’s co-founders, also notes that momentum is currently shifting from memecoins to layer-2 protocols and artificial intelligence (AI) projects.

“This is likely by smart money taking profits and buying value at a discount. Bullish sign for Bitcoin and crypto. Shorts are swimming against the tide.”

The crypto analyst also notes that Bitcoin is currently “showing an upward direction but lacks momentum.” He says demand needs to kick in for the top crypto asset.

Bitcoin is trading at $27,012 at time of writing. BTC is down 1.23% in the past 24 hours and more than 2% in the past seven days. It remains up by nearly 63% since the start of 2023, however.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Sergey Nivens/Fotomay