A bullish signal is flashing for Bitcoin (BTC) that previously led to huge gains, but the same metric also comes with a big warning.

Blockchain analytics firm IntoTheBlock says that Bitcoin’s volatility is dropping to significantly low levels that have historically come right before BTC soared.

In a new tweet, analysts at IntoTheBlock say that when trading volume remains at the current level for about five weeks, the king crypto’s price soars by approximately 46%.

If Bitcoin follows the historic pattern, BTC would skyrocket from its value of $27,159 at time of writing to more than $39,600.

However, the firm notes that there were three times when the same signal preceded a 50% collapse.

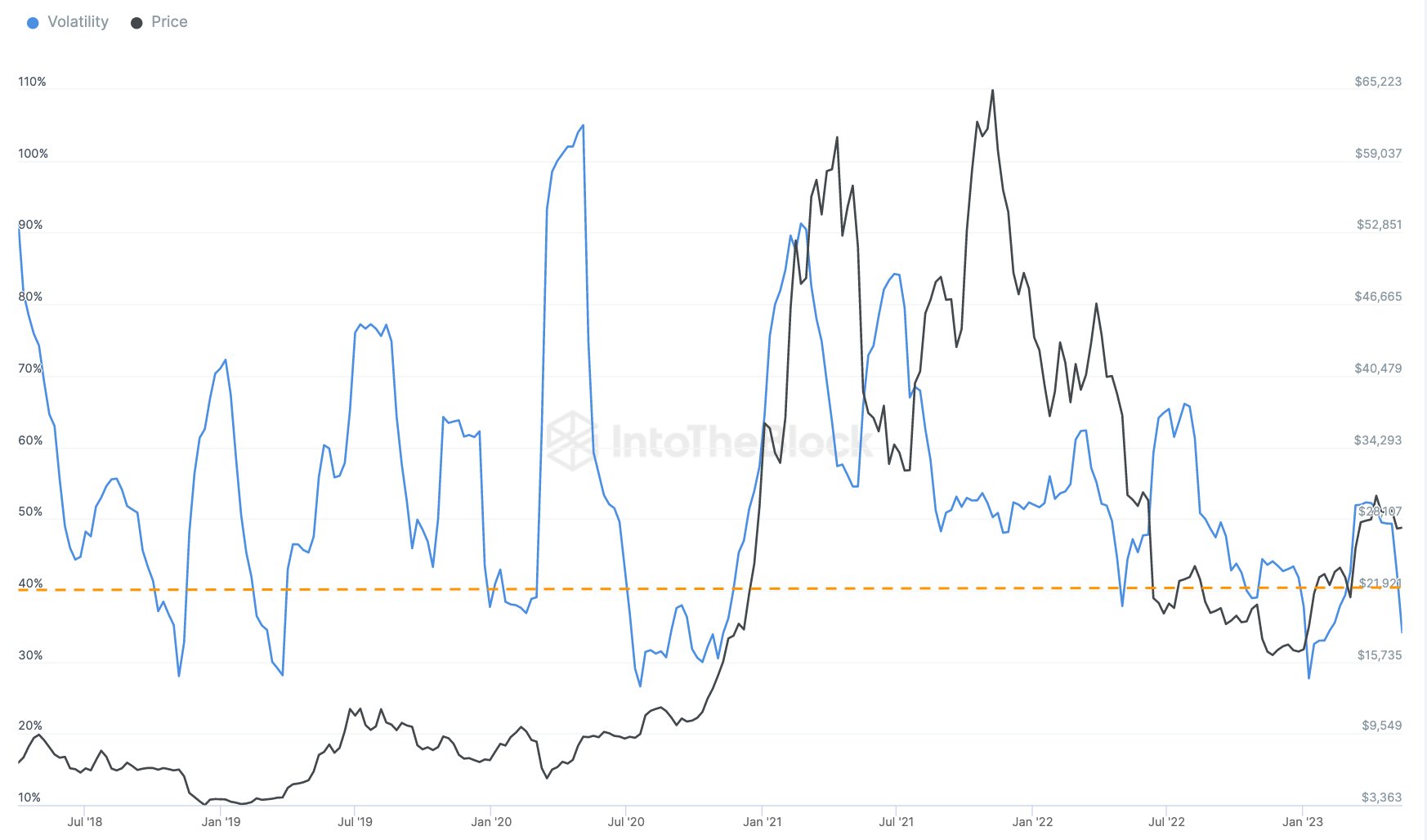

“BTC volatility reaches historically significant lows.

60-day annualized volatility has fallen below 40% for the eighth time in the past five years.

On average BTC volume remains below this level for five weeks and results in a 46% price gain.

However, three crashes of 50% have followed similar conditions.”

According to IntoTheBlock, 64% of Bitcoin holders are in the money, or above the breakeven price, while approximately 33% are holding Bitcoin at a loss. Of the total Bitcoin owners, 69% have held their BTC stack for more than one year.

Also on the radar of the firm’s analysts is peer-to-peer payments network Litecoin (LTC), which has a halving event – when miner rewards are cut in half – in about 76 days. They say LTC is attracting a lot of attention on social media, which is a bullish signal.

“With the reward halving for Litecoin approaching, LTC saw a substantial increase in social chatter. Despite the recent uncertainty in the market, the talk about Litecoin has remained high. What do you think is next for Litecoin?”

Litecoin is trading for $91.48 at time of writing, down 0.4% during the last 24 hours.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Yurchanka Siarhei/phanurak rubpol