A leading crypto analytics firm says that Litecoin (LTC) whale activity is likely to drive LTC’s price upwards before the LTC halving.

In a new report, Santiment says the upcoming LTC20 halving, which cuts the amount of newly issued coins to miners in half, is expected to have a positive impact on the price of Litecoin.

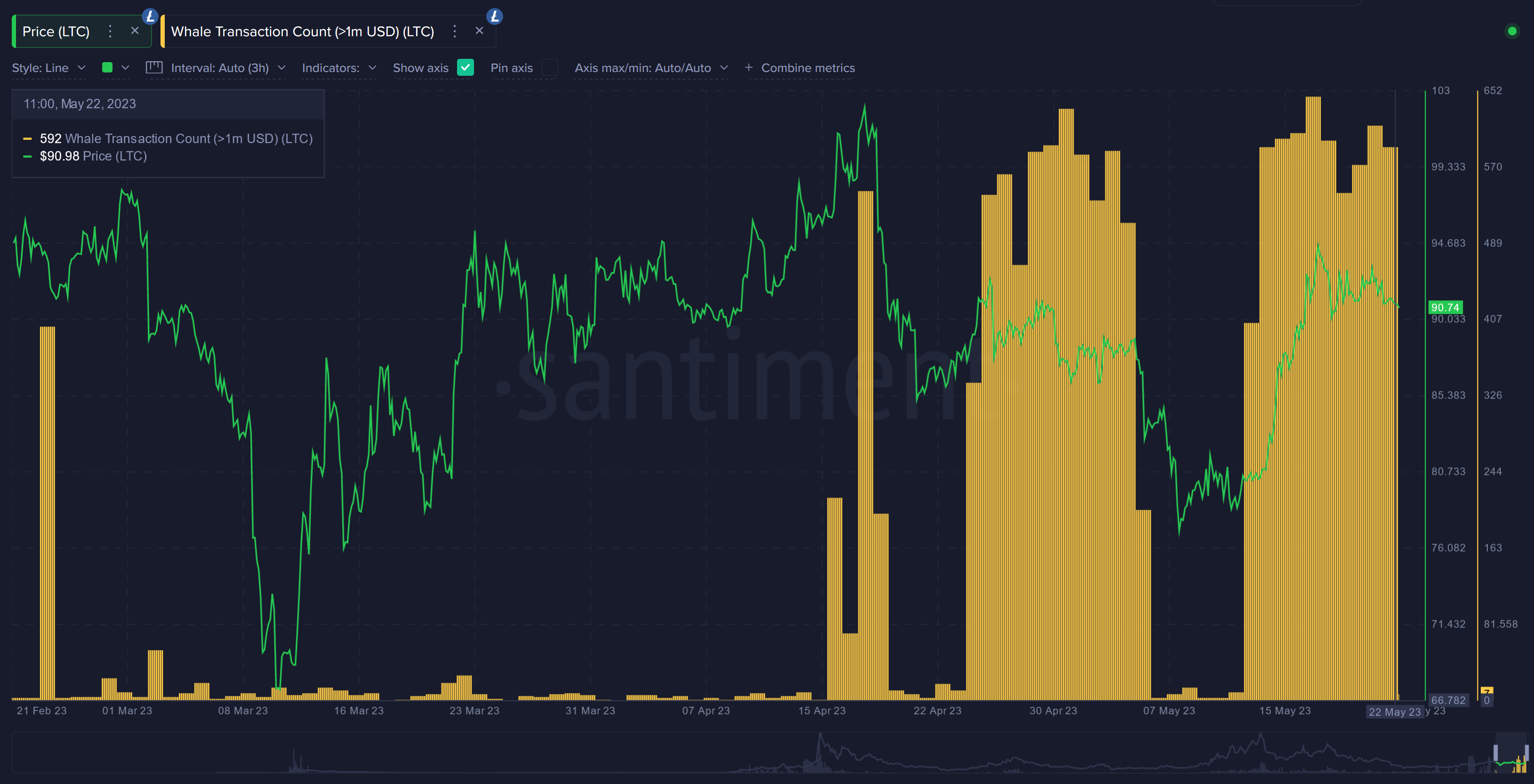

Santiment says Litecoin’s on-chain volume is trending upwards rapidly, and will bode well for price if it continues.

“If this trend of increased on-chain volume continues, it will absolutely be a strong sign that some big players are beginning to jump in on their LTC investments in anticipation of the halving. Similarly, the amount of unique addresses interacting on the Litecoin network absolutely skyrocketed, suddenly reaching a greater than one-year high just as its price was bottoming out.

This was obviously a great signal that addresses were stocking up on what may be the only ‘discount’ before August 10th. Lastly, don’t be surprised if whales push up the price above $100 before an opportunity is given for one final dip. Halving events are known for creating some pretty shocking anomalies. And it has been interesting to see separate waves of 500-600 $1M+ daily transactions on the LTC network. And then all of a sudden, the amount drops by 95% for a week (as shown below).”

Santiment says that trading volumes could slow down in near the term, but then pick up again in mid-June as traders begin to anticipate the event.

Most realistically, because of this, we could see a path where the average trading returns on the short and mid-term time scales cool down for a week or two for Litecoin. And then, as we get within two months of the August event (around mid-June), don’t be surprised to see an even bigger wave of anticipation for LTC 20.

The Litecoin halving is scheduled to take place roughly on August 10, 2023.

LTC is trading for $91.48 at time of writing.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney