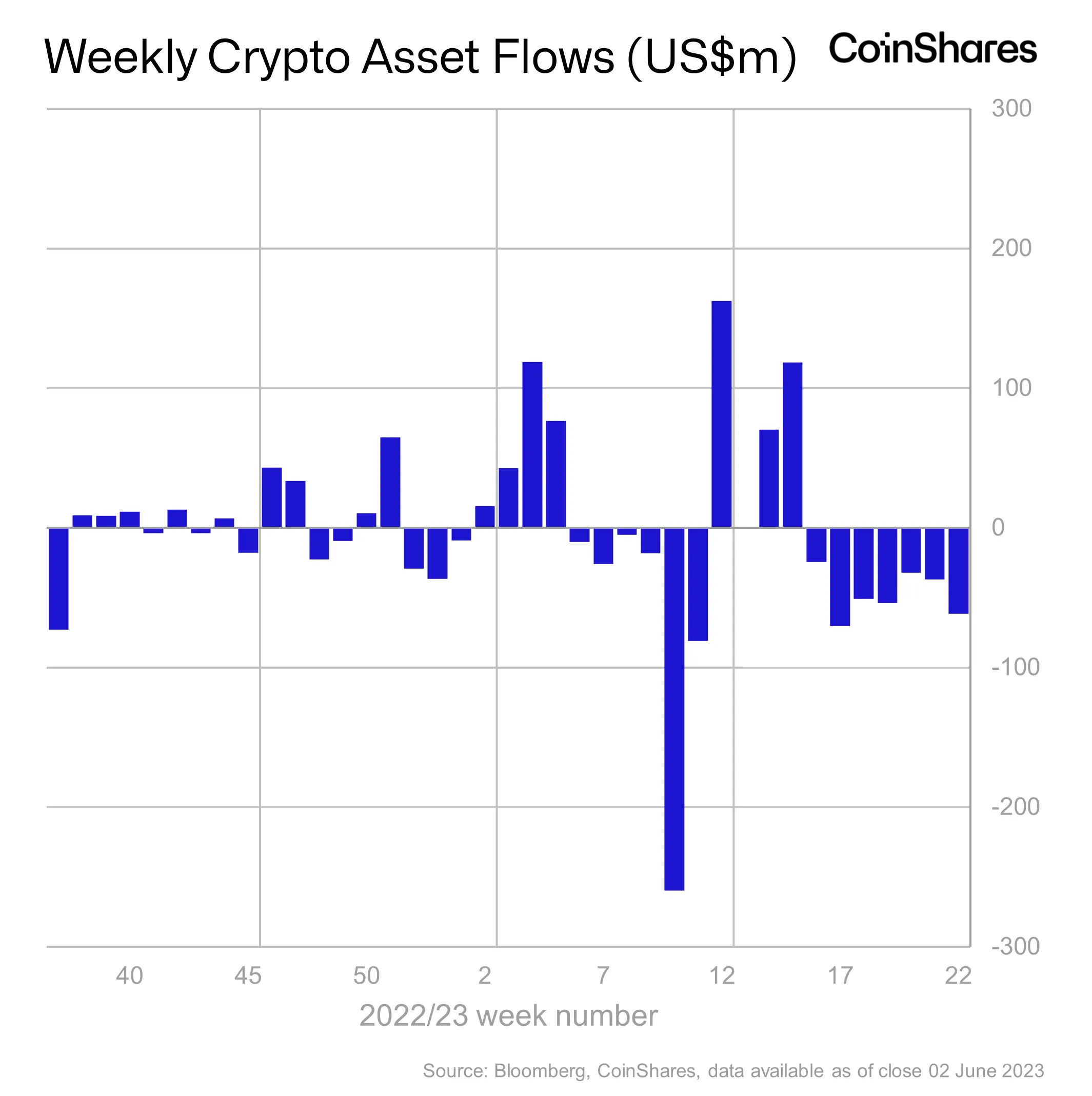

Digital assets manager CoinShares says institutional investors are likely taking profits on markets as Bitcoin (BTC) and altcoins suffer major outflows for the seventh week in a row.

In its latest Digital Asset Fund Flows Weekly Report, CoinShares finds that institutional investors sold off $62 million in crypto holdings last week, proportionally similar to the major sell-offs early in 2022.

“Digital asset investment products saw outflows totaling US $62 million, marking the 7th consecutive week of outflows that now totals US $329 million, representing 1% of total assets under management (AuM).

From a proportional perspective, this now matches the run of outflows seen at the beginning of 2022.”

BTC lost $2.7 million in outflows, the same as Ethereum (ETH), according to CoinShares. However, short Bitcoin products, which aim to profit off of downward moves in BTC, saw even more outflows at $6.3 million.

“While the absolute outflows for short-bitcoin are smaller, the total outflow over the last 6 weeks represent 44% of total AuM, compared to just 0.9% for long-bitcoin. This implies investors have been taking profits and exiting short positions rather than implying a structural downshift in sentiment for the asset.”

One Ethereum rival took the biggest hit of all the digital market space last week though, according to CoinShares. Tron (TRX) suffered $51 million in outflows last week.

“Tron, the smart contracting platform, was the primary focus, seeing outflows totaling US $51 million last week, representing 70% of total AuM. We believe this was a single investment product provider removing seed capital rather than anything more ominous.”

XRP and Polygon (MATIC) products enjoyed inflows of $0.6 and $0.4 million, respectively.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Aleksandr Kukharskiy