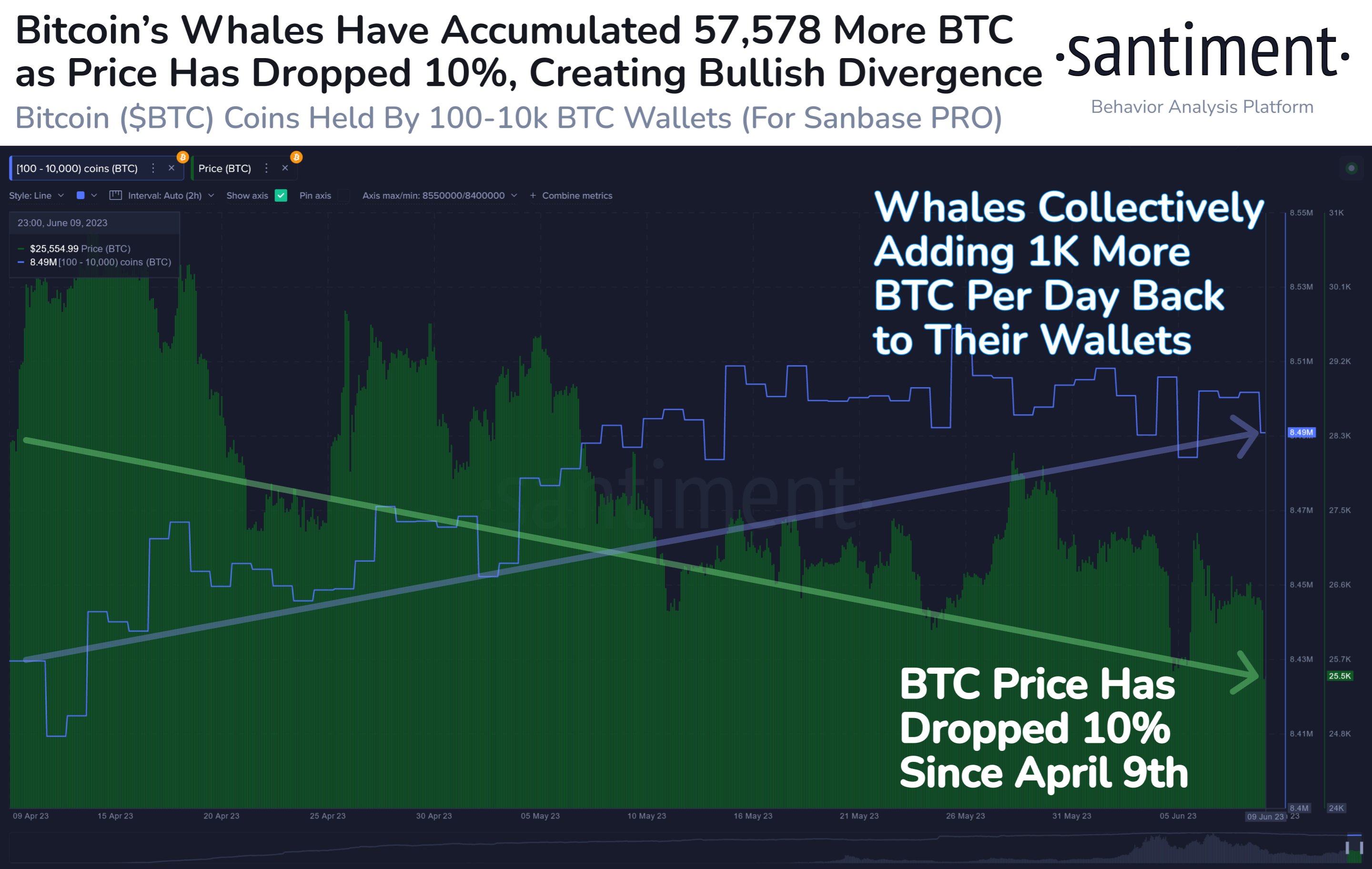

A leading analytics firm says that Bitcoin (BTC) whales are in heavy accumulation mode despite the crypto king’s weak price action over the last few months.

Santiment says that Bitcoin whales have been adding nearly $26 million in BTC per day since April 9th when the crypto king traded close to $28,000.

According to the analytics firm, the whale accumulation suggests that a Bitcoin bounce is on the horizon.

“As altcoin madness has ensued, there quietly is a bullish divergence between Bitcoin’s accumulating whales and falling price. With whale holdings moving up by ~1,000 BTC per day while prices fall, there is reason to believe a strong rebound can occur.”

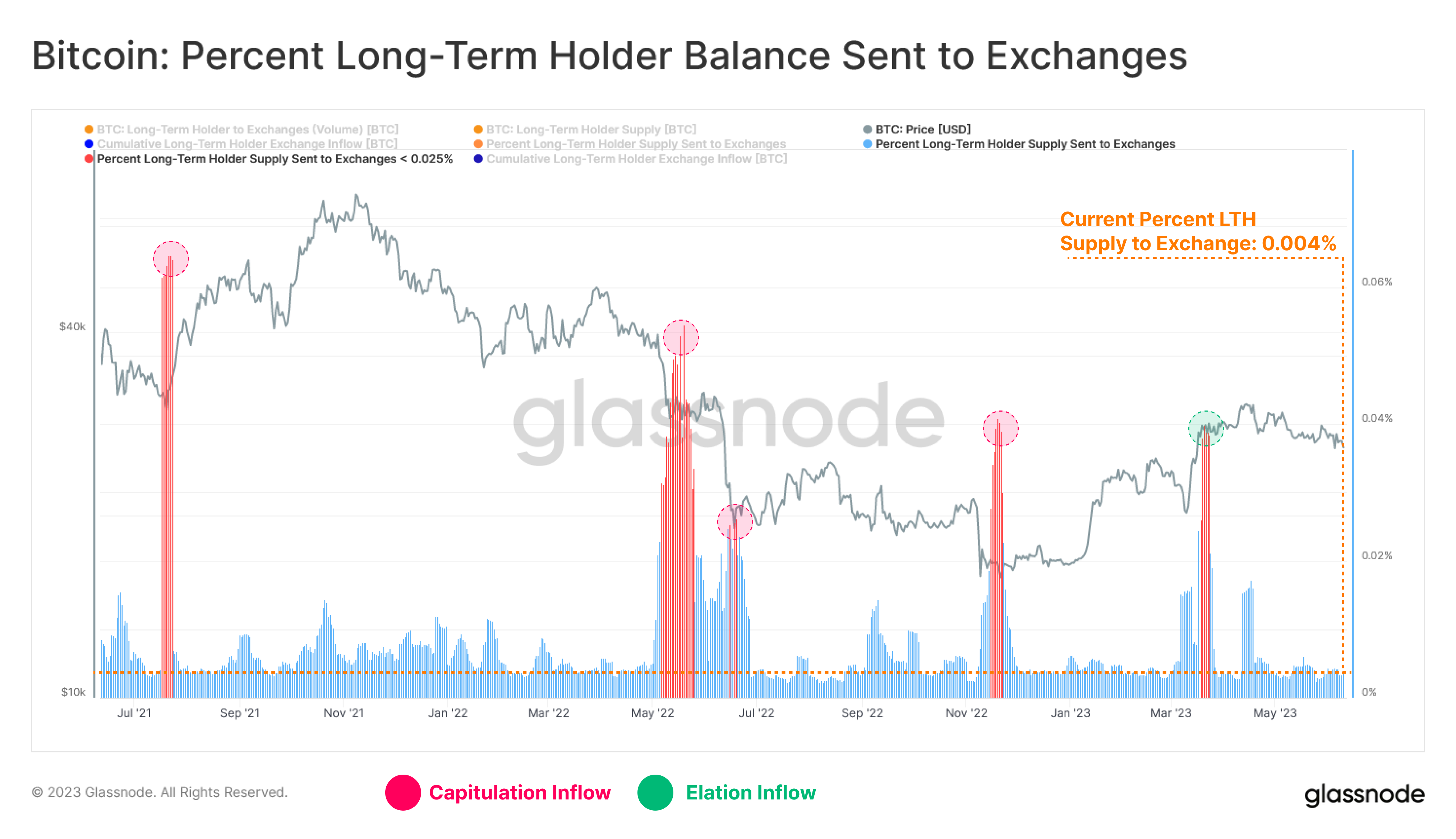

Meanwhile, fellow analytics firm Glassnode is keeping a close eye on the activities of long-term Bitcoin holders. According to Glassnode, long-term BTC holders remain unfazed amid the current market downturn.

“The percentage of Bitcoin long-term holder supply sent to exchanges remains extremely quiet at 0.004%.

This highlights the profound inactivity of the cohort amidst elevated market distress, remaining indifferent to the Binance and Coinbase regulatory charges.”

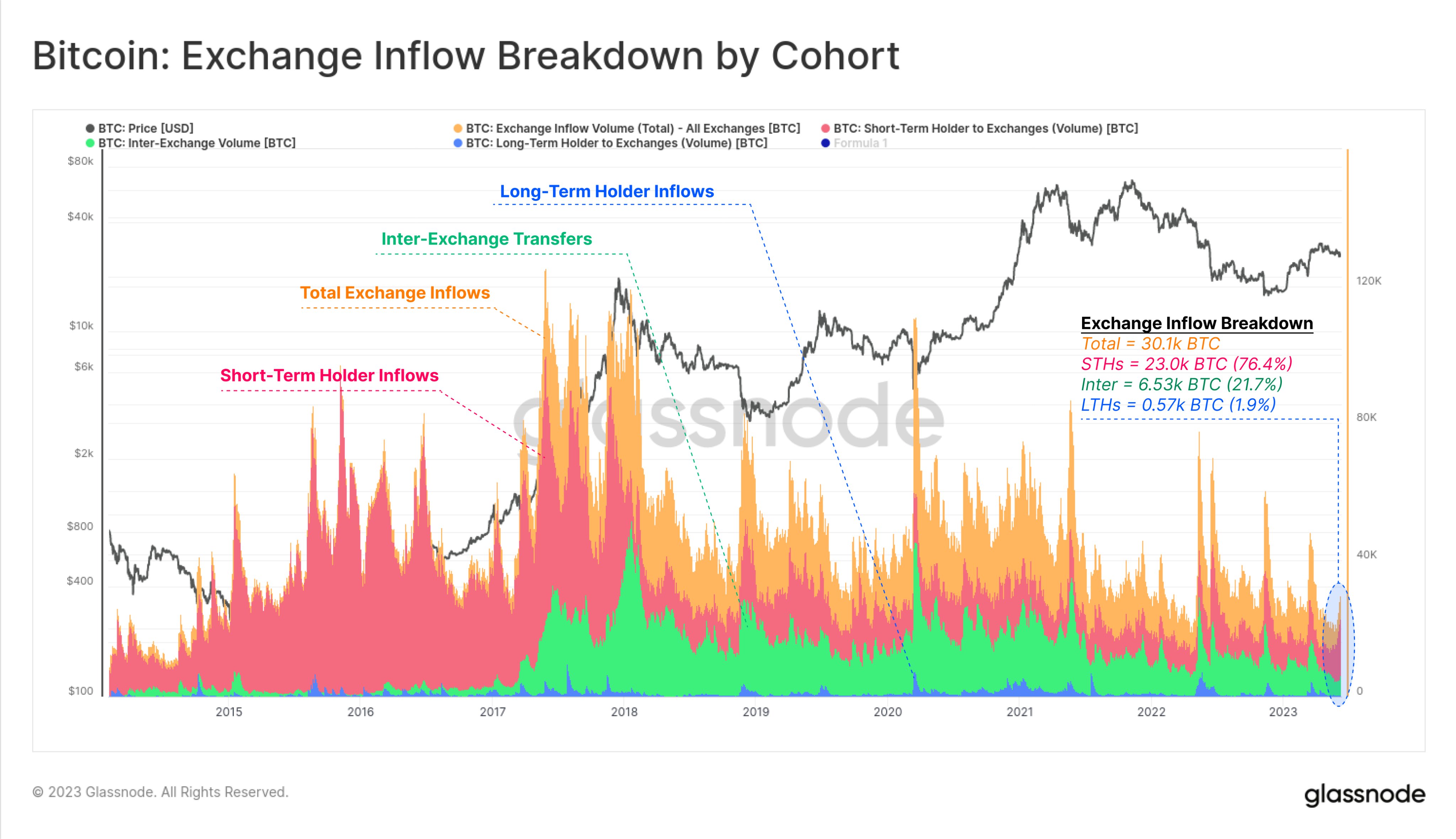

Glassnode is also monitoring exchange deposit volumes to identify which investor cohort may be unloading their Bitcoin stacks in the midst of market turbulence. According to the analytics firm, short-term holders account for the overwhelming majority of BTC transfers to crypto exchanges.

“Focusing on aggregate Bitcoin exchange deposit volumes, we can establish a breakdown by cohort type. We can thus identify which investor groups have reacted most significantly to the recent regulatory news:

- short-term holders account for 76.4% of deposit volume (23,000 BTC)

- long-term holders account for just 1.9% of deposit volume (570 BTC)

- inter-exchange transfers account for 21.7% of deposit volume (6,530 BTC).”

At time of writing, Bitcoin is trading for $25,974.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney