The Federal Reserve’s lending program to support US banks is in high demand as borrowings shatter $100 billion.

The latest data from the Fed shows that its Bank Term Fund Program (BTFP) has issued loans to the tune of $100.16 billion as of June 7th, compared to $93.61 billion borrowed the week ending May 31st.

BTFP was rolled out at the height of the banking crisis to provide liquidity to banks that are struggling to meet withdrawal requests. The program allows banks to pledge their assets, including government bonds and mortgage-backed securities, as collateral to access additional funding. BTFP was designed to eliminate a bank’s need to sell those assets in times of distress.

The rising number of loans issued by the Fed via the BTFP suggests that the banking industry remains in serious need of additional funding to satisfy depositor obligations.

It also indicates that banks are still feeling the pressure of the Fed’s tight monetary policies.

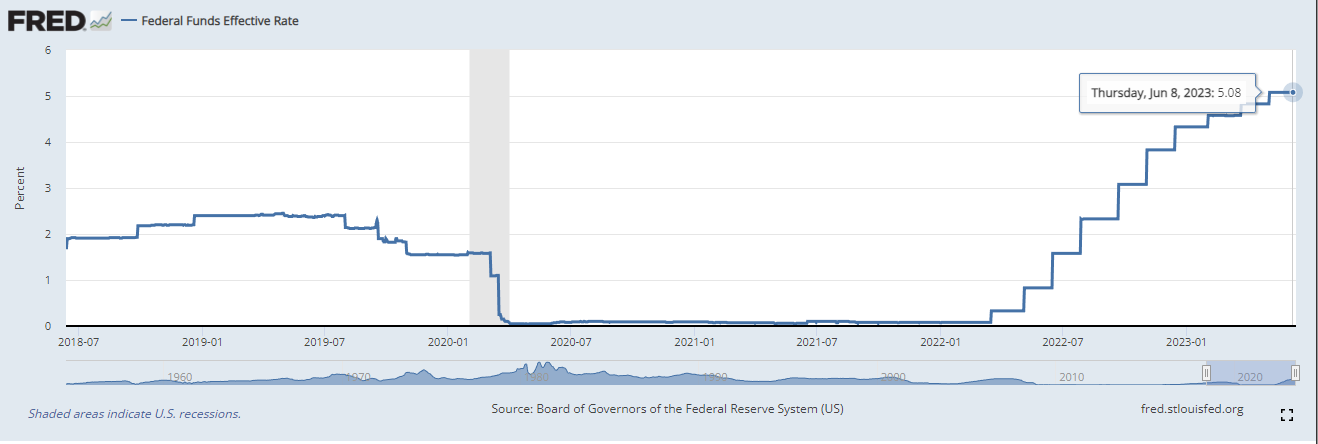

The central bank has imposed 10 straight rate hikes over the last 14 months, driving its benchmark interest rate to 5.08% – a level not seen since 2007.

Due to the Fed’s aggressive rate hikes, banks that accumulated treasuries a few years ago when interest rates were close to zero are witnessing their holdings decline in value as investors seek newly issued US debt that pay higher interest.

Banks across the US are reportedly nursing $620 billion in unrealized losses due to the rapid rise in interest rates.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney