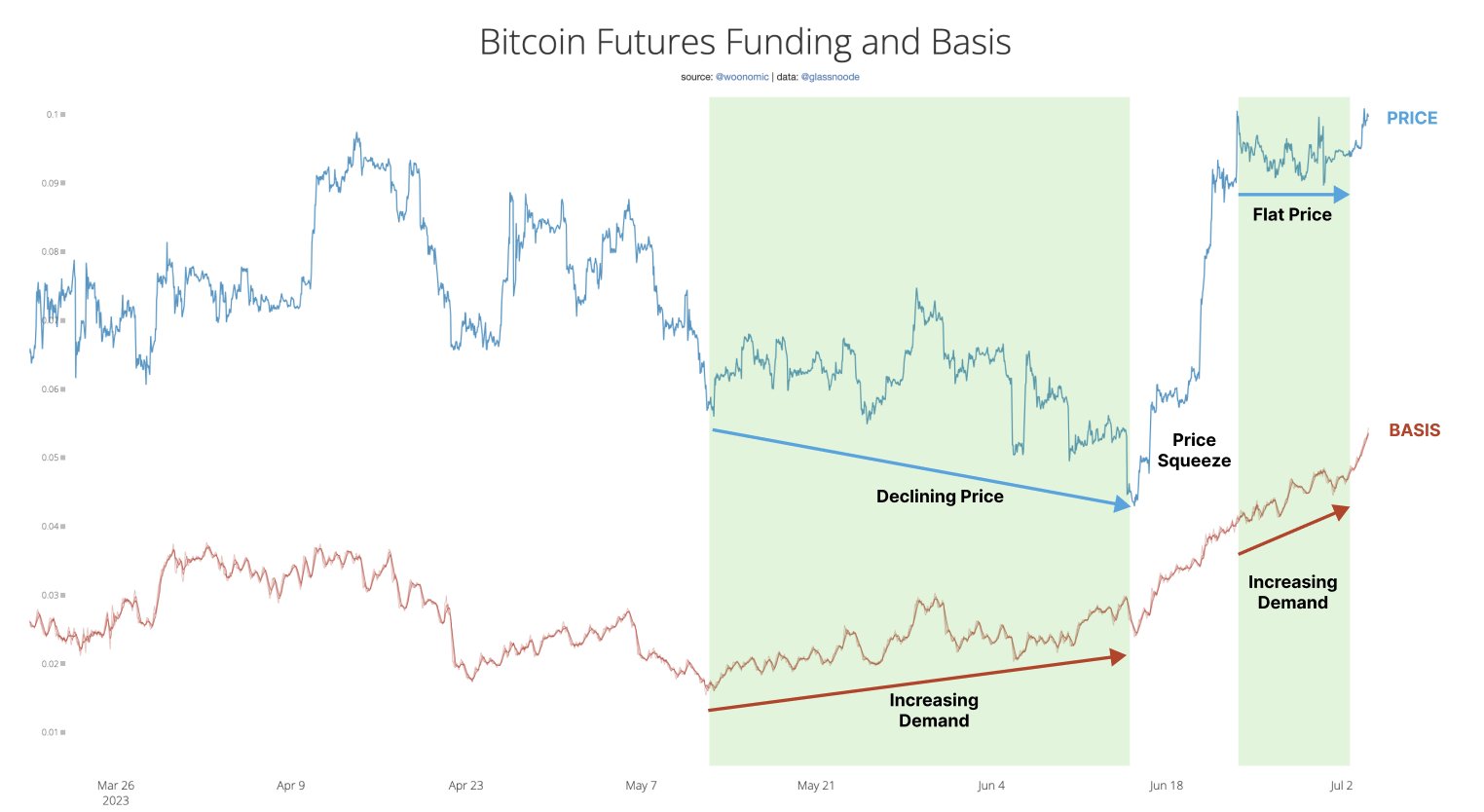

Popular crypto analyst Willy Woo thinks on-chain data suggests Bitcoin (BTC) could be in the early stages of a price squeeze.

Woo says a short squeeze, which happens when large numbers of traders who shorted an asset decide to cut their losses in response to an unexpected price bump, triggering additional rallies, could be in the works for BTC.

“Price action has largely been dominated by demand stemming from the calendar futures markets, the instrument of pros and institutions. Even now, demand keeps surging, suggesting we are in the early stages of another price squeeze.”

The trader tells his 1 million Twitter followers that not all Bitcoin metrics are looking completely bullish, however.

“And the flipside: Calendar demand is overbought under statistical analysis. It’ll be important to keep a close eye on basis waning. It could leave quite fast, rugging the bullish price action.

Explainer: Basis is the cost of maintaining an investment. In this case basis = the cost of maintaining a long position so can be used as a way to quantify demand coming from calendar futures.”

BTC is trading at $30,488 at time of writing. The top-ranked crypto asset by market cap is down 0.88% in the past 24 hours but up more than 1.2% in the past week.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DreamStudio