A widely followed crypto strategist believes that Litecoin’s (LTC) pre-halving rally may have already hit its peak.

Pseudonymous analyst Kaleo tells his 593,200 Twitter followers that the peer-to-peer payments network may be mirroring its price action during the second half of 2021 when it rallied by over 187% only to start a multi-month bear market.

According to the analyst, Litecoin recently respected its bear market trendline when LTC bulls failed to sustain momentum above $110.

“Here’s why I flipped short on LTC:

1) Clear rejection at resistance. Retrace after the recent range breakout looks incredibly similar to what we saw at the end of 2021, which resulted in new lows.”

Kaleo is also looking at the performance of LTC prior to its 2019 halving event. According to the trader, the previous halving marked the beginning of a downtrend for LTC.

“2) The halving is around the corner (date is ~August 2nd). As much as this has been hyped up as a bullish event, that isn’t necessarily what happened in the past. Let’s take a look at what happened after the last halving (8/5/19). It was a sell-the-news event. Price nuked.”

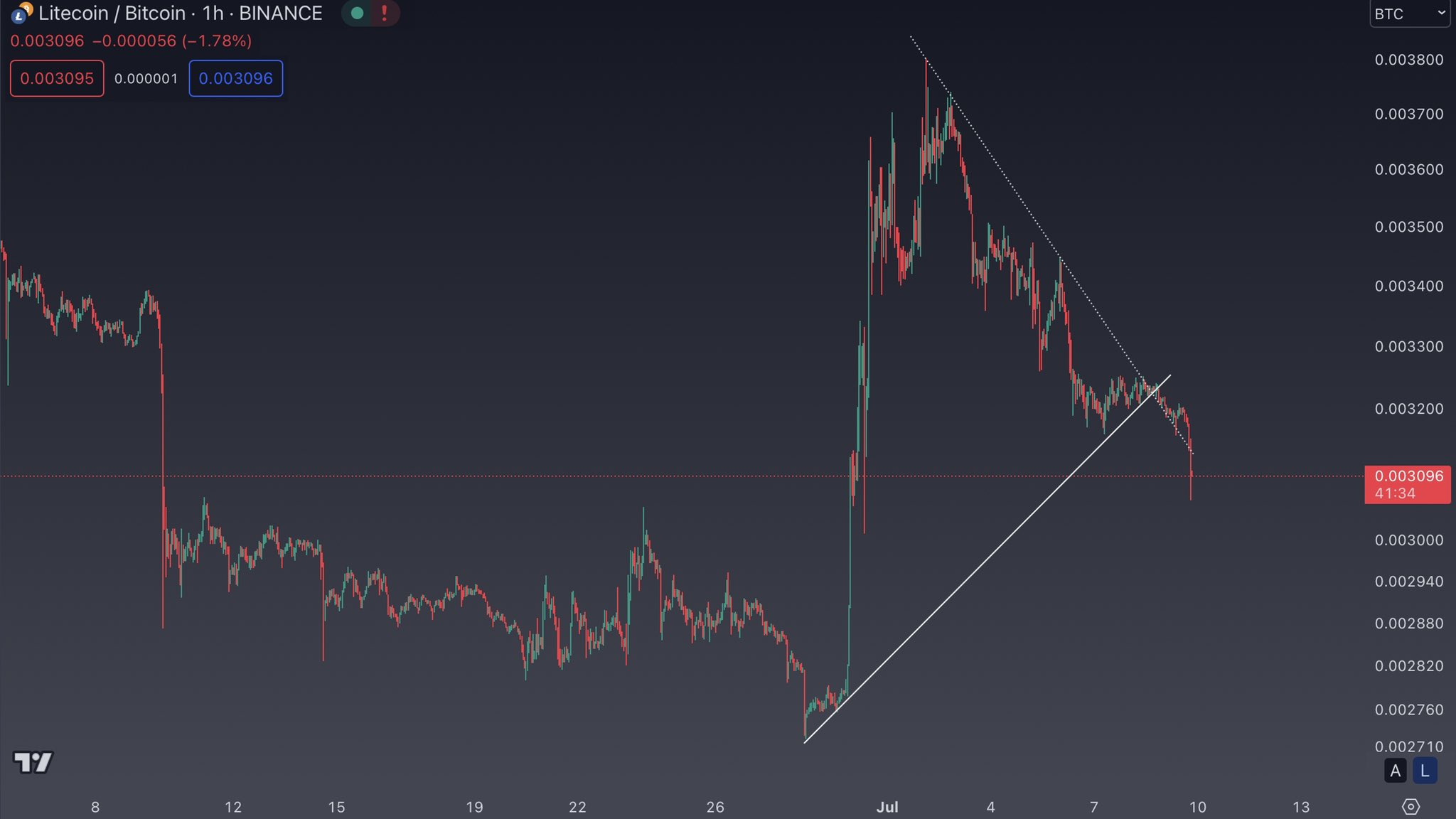

Kaleo is also watching the performance of the Litecoin versus Bitcoin pair (LTC/BTC). The trader says LTC/BTC is flashing bearish signals on the lower timeframe after moving below diagonal support.

“3) Low timeframe we’ve seen a clear breakdown of support in LTC vs. BTC.”

Going back to the LTC/USD chart, Kaleo predicts a short-lived rally for Litecoin before the altcoin resumes its downtrend.

“4) Zooming in, LTC is currently hanging on to support vs USD, but I wouldn’t count on anything more than a dead cat bounce here.”

At time of writing, Litecoin is worth $96.91.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney