Bloomberg Intelligence’s senior macro strategist Mike McGlone is warning that Bitcoin (BTC) may face strong headwinds before the end of 2023.

McGlone tells his 58,900 Twitter followers that Bitcoin’s recent stall around the $30,000 price level may indicate that unfavorable economic conditions are coming.

“Yes, Bitcoin matters – if it stalls, there may be a bigger issue. Stalling at about $30,000 amid hype about potential for an ETF (exchange-traded fund) launch and the seemingly unstoppable stock market, a Bitcoin pause may signal bigger economic issues.”

McGlone says that Bitcoin is up 100% from its 2022 low, but before Bitcoin can print further gains it will likely first dip in price.

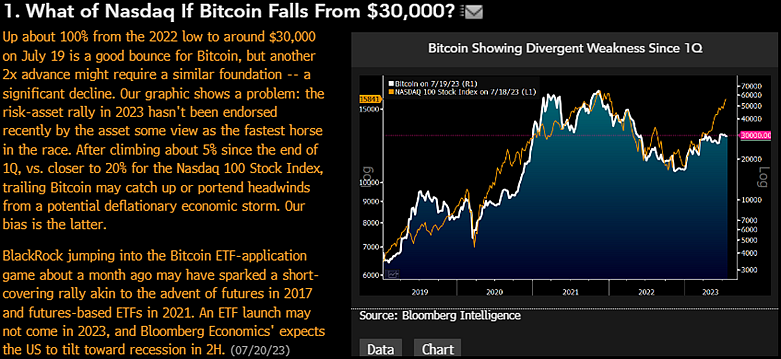

He also highlights how the Nasdaq 100 Stock Index (NDX), which historically has traded similarly to Bitcoin, is outpacing the king crypto, signaling weakness for BTC.

He predicts that in the second half of the year (2H) Bitcoin will decline due to headwinds caused by deflation, a time when there is a decline in the prices of goods and services accompanied by job loss and poor investment returns.

“Up about 100% from the 2022 low to around $30,000 on July 19 is a good bounce for Bitcoin, but another 2x advance might require a similar foundation – a significant decline. Our graphic shows a problem: the risk-asset rally in 2023 hasn’t been endorsed recently by the asset some view as the fastest course in the race. After climbing about 5% since the end of 1Q, vs. closer to 20% for the Nasdaq 100 Stock Index, trailing Bitcoin may catch up or portend headwinds from a potential deflationary economic storm. Our bias is the latter.”

McGlone also says he expects approval of BlackRock’s Bitcoin spot exchange-traded fund (ETF) application would give Bitcoin a boost, but he does not believe a decision on the proposal will happen in 2023.

“BlackRock jumping into the Bitcoin ETF-application game about a month ago may have sparked a short-covering rally akin to the advent of futures in 2017 and futures-based ETFs in 2021. An ETF launch may not come in 2023, and Bloomberg Economics expects the US to tilt toward a recession in 2H.”

Bitcoin is trading for $29,800 at time of writing, down 0.4% during the last 24 hours.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney