The US national debt is growing at an unrelenting pace.

New numbers from the government’s FiscalData system show that on July 27th, the country’s total public debt hit $32.659 trillion. That’s an increase of $392.75 billion in the last month, and an increase of $66.41 billion in the last week alone.

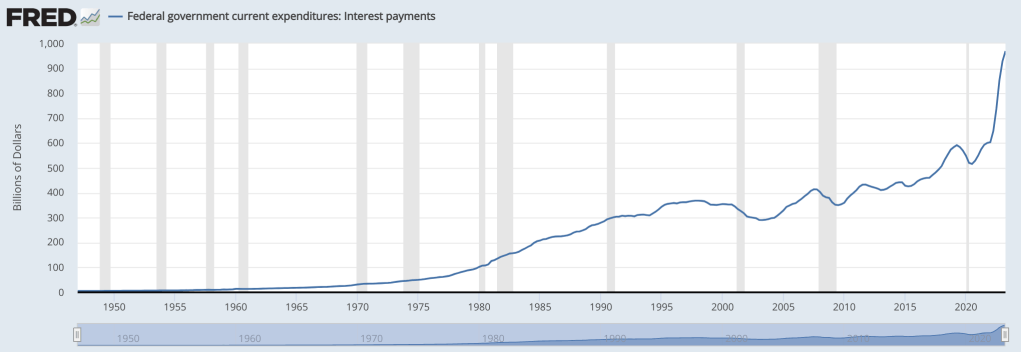

The surge has brought America’s quarterly interest payments on its debt to nearly $1 trillion, according to the Federal Reserve Bank of St. Louis.

The new data comes amid a warning on America’s financial outlook from the Cato Institute.

The libertarian think tank says the country’s ever-expanding debt is now an issue of national security.

“Delaying responsible fiscal reforms in the face of growing federal debt invites economic and national decline. High and rising U.S. federal debt leads to suppressed private investment, reduced incomes, and increased risk of a sudden fiscal crisis.

A weaker economy and growing concerns by international bondholders of U.S. treasuries about the government’s ability and willingness to service its debt—without resorting to high inflation—will drive up interest costs and eventually impact America’s international standing negatively…

National defense is a core responsibility of the federal government. To maximize Americans’ safety and prosperity, prudence should guide both strategy and the budget. A dire fiscal crisis would erode the economic foundation of America’s strength, limiting U.S. capacity to defend its vital interests at home and abroad.”

The Cato Institute believes entitlement reform is a necessity, and says Social Security, Medicare, Medicaid, and other needs-based programs are now half of the federal budget, with defense spending at one-fifth of the budget.

The Institute wants US lawmakers to create a debt commission that tackles entitlement reform and whose recommendations automatically become law once approved by the President.

“A well-designed commission will be composed of a diverse group of experts, guided by clear goals established by Congress, and whose recommendations will be self-executing after Presidential approval; benefiting from so-called fast-track authority.

Asking members of Congress to affirmatively vote for entitlement reforms recommended by such a commission will most likely undermine the debt commission’s recommendations from becoming law. Few legislators are willing to stick their necks out in support of necessary and yet unpopular changes to Medicare and Social Security.

Unsustainable fiscal policy imperils American economic and military strength. By reforming entitlement programs and reducing spending, legislators can prevent high debt from undermining America’s prosperity and security. A well-designed debt commission can help Congress to see this through.”

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney