August 3, 2023 – London, United Kingdom

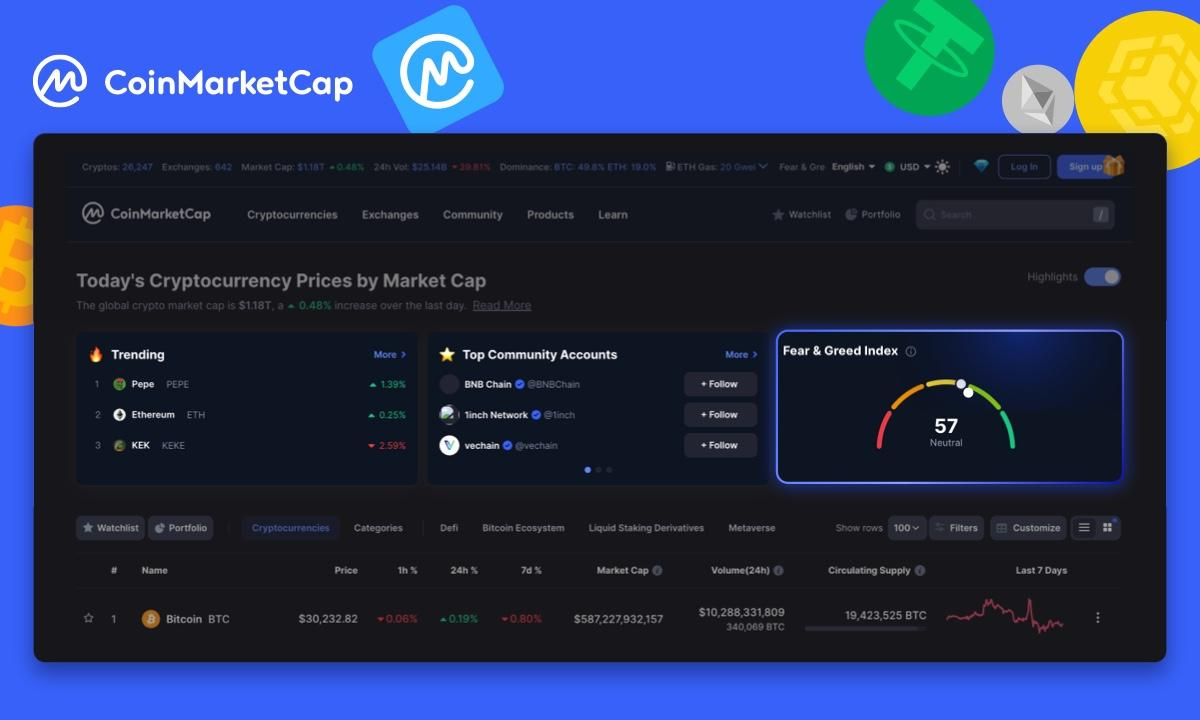

CoinMarketCap, the leading platform for cryptocurrency data, announces the launch of its groundbreaking CMC Crypto Fear and Greed Index.

Designed to meet a crucial market need, this innovative index provides a wide-ranging and quantifiable assessment of fear and greed for the entire cryptocurrency industry.

Amid recent market turbulence, it became evident that there is no crypto equivalent of the traditional Fear and Greed Index, a well-established tool for stock market analysis.

Existing alternatives in the crypto space focus solely on Bitcoin, failing to capture the overall market sentiment of over 20,000 coins listed on CoinMarketCap.

The CMC Crypto Fear And Greed index leverages an array of key components, meticulously engineered to provide users with valuable insights into the overall sentiment of the crypto market.

Price momentum

The index analyzes the price performance of the top 10 crypto coins by market capitalization excluding stablecoins through CoinMarketCap’s API.

By capturing trends in assets like BTC, ETH, XRP, BNB and DOGE, it provides a more holistic view of market sentiment as price fluctuations mirror fear and greed levels in the market.

Volatility

Recognizing volatility’s significant impact on market sentiment, the CMC Crypto Fear and Greed Index integrates the Volmex Implied Volatility Indices, BVIV and EVIV, capturing fluctuations across a broad selection of digital assets and reflecting crucial market data for enhanced decision-making.

Derivatives market

Option contracts provide insights into market participants’ expectations for future returns.

The put-call ratio is utilized to infer the sentiment of retail participants in the option markets.

A higher ratio of puts to calls signals fear in the market, indicating that retail investors anticipate a bear market or a future crash.

Market composition

The relative aggregate value of BTC in the market serves as a vital indicator of market sentiment.

The SSR (Stablecoin supply ratio) is employed for this purpose, measuring the ratio between Bitcoin’s market capitalization and the total market capitalization of major stablecoins.

A low SSR indicates a relatively larger stablecoin supply compared to BTC, while a high SSR signifies stronger BTC dominance.

This metric not only represents the supply and demand dynamics between BTC and USD but also reflects the composition of the market.

CMC proprietary data

CoinMarketCap analyzes social trend keyword search data, such as phrases like ‘crypto moon,’ to gauge market sentiment.

Additionally, as a major traffic platform in the crypto industry, CoinMarketCap collects valuable page view and engagement data, providing insights into market sentiment, retail interest and emerging trends.

By examining user engagement and behavior, the index identifies which coins and projects are generating the most interest and which themes are driving market sentiment.

With its comprehensive approach, the CoinMarketCap’s Crypto Fear and Greed Index provides a uniquely valuable perspective on the cryptocurrency market, empowering users to make better-informed decisions based on a deeper understanding of market sentiment.

As a global leader in cryptocurrency data and research analysis, CoinMarketCap is committed to building innovative tools and resources for participants in the crypto industry.

About CoinMarketCap

CoinMarketCap is the world’s most-referenced price-tracking website for crypto assets in the rapidly growing cryptocurrency space.

Its mission is to make crypto discoverable and efficient globally by empowering retail users with unbiased, high quality and accurate information for drawing their own informed conclusions.

Contact

Alice Liu, research lead at CoinMarketCap

This content is sponsored and should be regarded as promotional material. Opinions and statements expressed herein are those of the author and do not reflect the opinions of The Daily Hodl. The Daily Hodl is not a subsidiary of or owned by any ICOs, blockchain startups or companies that advertise on our platform. Investors should do their due diligence before making any high-risk investments in any ICOs, blockchain startups or cryptocurrencies. Please be advised that your investments are at your own risk, and any losses you may incur are your responsibility.

Follow Us on X Facebook Telegram