A pair of Bloomberg exchange-traded fund (ETF) analysts think there’s a 75% chance an Ethereum (ETH) futures ETF gets approved in the US this year.

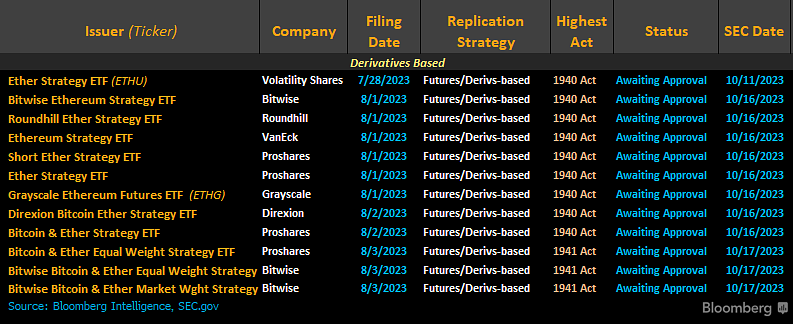

James Seyffart and Eric Balchunas say the odds of approval spiked amid a flood of Ethereum futures ETF application submissions to the U.S. Securities and Exchange Commission (SEC).

“The odds of Ethereum futures ETFs hitting exchanges this year have risen dramatically to 75%, in our view, after a spurt of 12 applications to the SEC in recent days. The SEC appears to be changing its posture toward crypto, based on reports of its back-channel messaging to ETF issuers. Also, we believe the SEC would have a hard time in court defending the denial of Ethereum futures ETFs after approving standard and leveraged Bitcoin futures ETFs.”

Balchunas predicts the SEC will approve an Ethereum futures ETF in October, two years after the approval of the first Bitcoin (BTC) futures ETF.

No US Bitcoin spot ETF applications have been greenlit thus far, though the crypto world eagerly awaits the SEC’s decision on a June application from BlackRock, the world’s largest asset manager.

A spot Bitcoin ETF would give investors exposure to the crypto asset through a brokerage firm, much like commodities such as gold.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney