Digital assets manager CoinShares says institutional investors are becoming more optimistic about the Ethereum (ETH) competitor Solana (SOL) while they collect profits on king crypto Bitcoin (BTC).

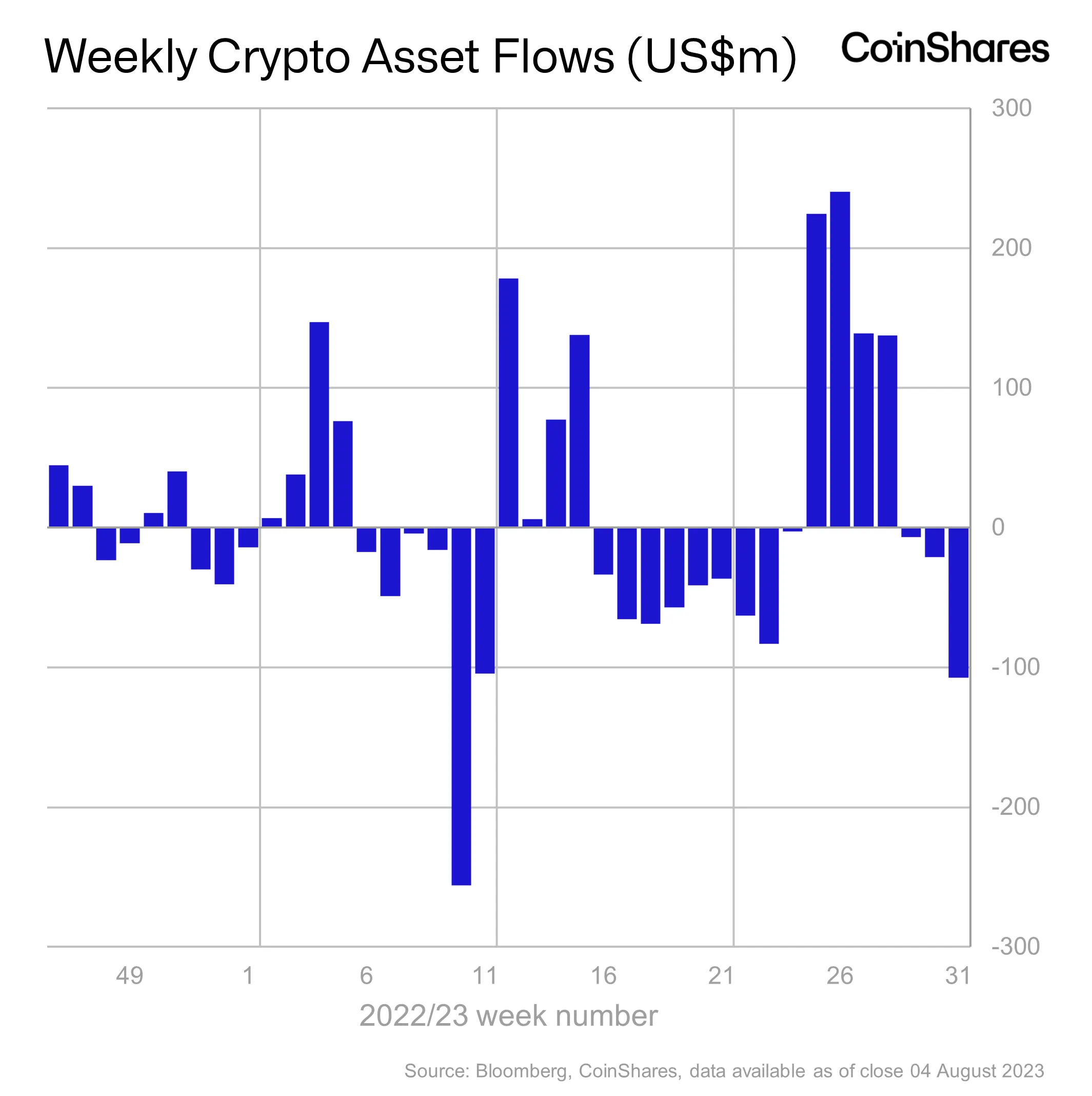

In its latest Digital Asset Fund Flows Weekly Report, CoinShares finds that digital assets saw outflows of over $100 million last week, marking the third week of outflows in a row.

“Digital asset investment products saw outflows this week, totaling US$107m with profit taking gathering pace in recent weeks.”

According to CoinShares, BTC suffered the lion’s share of the outflows.

“Bitcoin was again the primary focus, seeing outflows totaling US$111m, the largest weekly outflows since March, when US regulatory scrutiny began escalating. For the first time in 14 weeks, the outflows into short bitcoin have stopped.”

Between just Ethereum and Bitcoin combined, the markets suffered $117 million in outflows last week. However, altcoin inflows totaled approximately $10 million last week, bringing the net outflows to $107 million.

“Altcoins sentiment seems to be improving though and offset the outflows in Bitcoin and Ethereum. Solana saw the largest inflows, totaling US$9.5m, the largest single week of inflows since March 2022.”

While SOL enjoyed inflows of nearly $10 million, XRP and Litecoin (LTC) took in inflows of $0.5 and $0.46 million, respectively. Meanwhile, Uniswap (UNI) and Cardano (ADA) saw outflows of $0.8 and $0.3 million, respectively.

Multi-asset investment products, those investing in more than one crypto asset, also saw inflows of $0.3 million last week. CoinShares suggests the altcoin inflows suggest investor sentiment on altcoins is improving.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/spainter_vfx