Crypto analytics firm Messari says that the Ethereum (ETH) competitor Cardano (ADA) displayed conflicting trends in the second quarter of 2023.

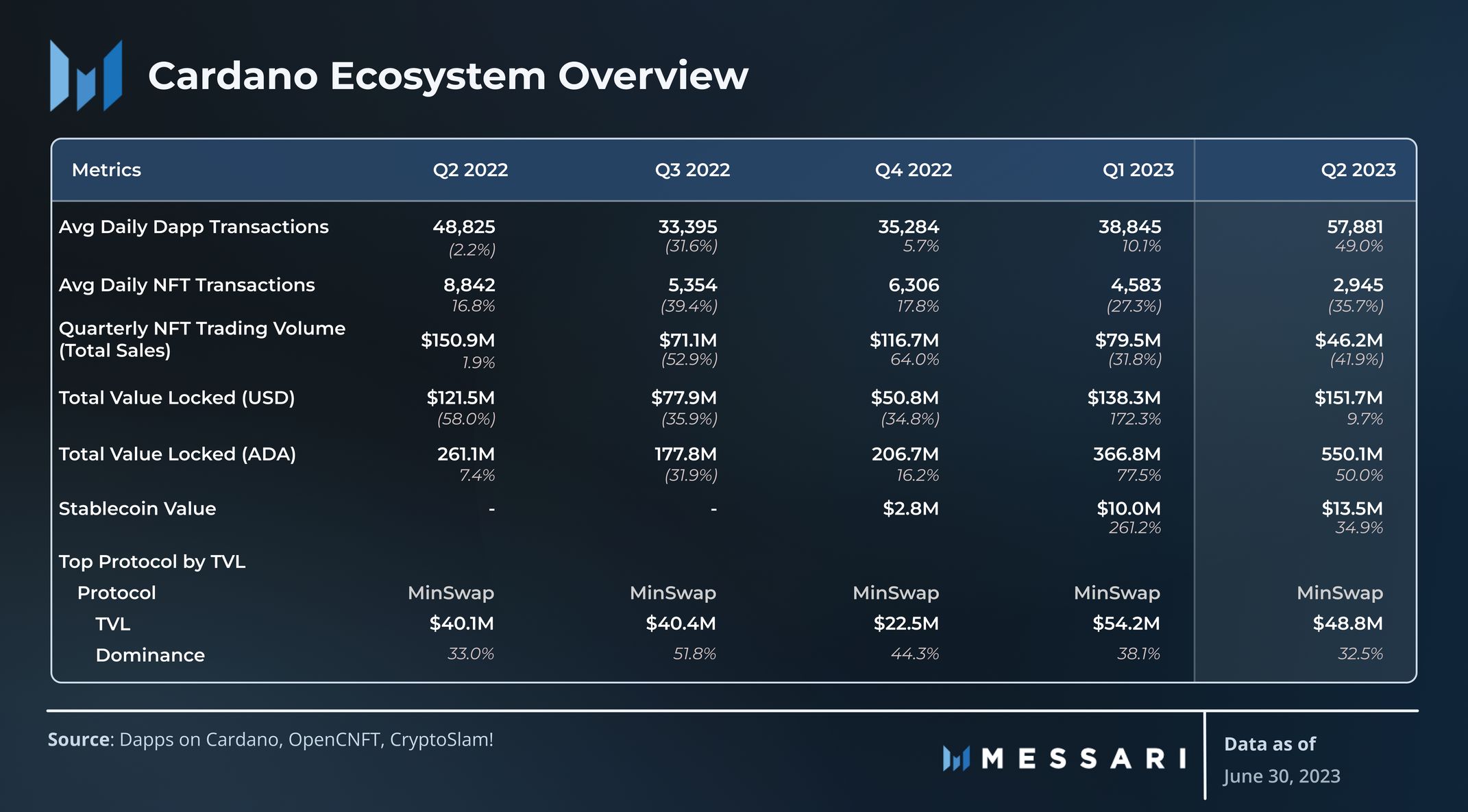

In a new analysis, the analytics firm notes that Cardano clocked an average of 57,881 daily decentralized application (DApp) transactions, an increase of 49% compared to Q1.

The Cardano blockchain also registered $151.7 million in total value locked (TVL) at the end of Q2, a nearly 10% increase from the end of the first quarter. Cardano now ranks 21st among all chains in terms of TVL, up from 34th at the beginning of the year, according to Messari.

The TVL of a blockchain represents the total capital held within its smart contracts. TVL is calculated by multiplying the amount of collateral locked into the network by the current value of the assets.

Despite the increases in DApp transactions and TVL, Cardano also witnessed declining non-fungible token (NFT) activity.

The project clocked 2,945 average daily NFT transactions in Q2, a decrease of 35.7% on a quarter-over-quarter basis. Cardano’s total NFT quarterly trading volume was $46.2 million, a decrease of 41.9% compared to Q1.

Messari says these downward NFT trends are “in line with the broader market.”

ADA is trading at $0.292 at time of writing. The ninth-ranked crypto asset by market cap is down more than 1.5% in the past 24 hours.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney