Bloomberg Intelligence’s senior macro strategist Mike McGlone warns that Bitcoin’s (BTC) parabolic ascent over the last decade or so looks eerily similar to the 1929 stock market bubble.

McGlone says that the high-interest rate environment reminds him of the conditions that led to the collapse of the stock market in 1930.

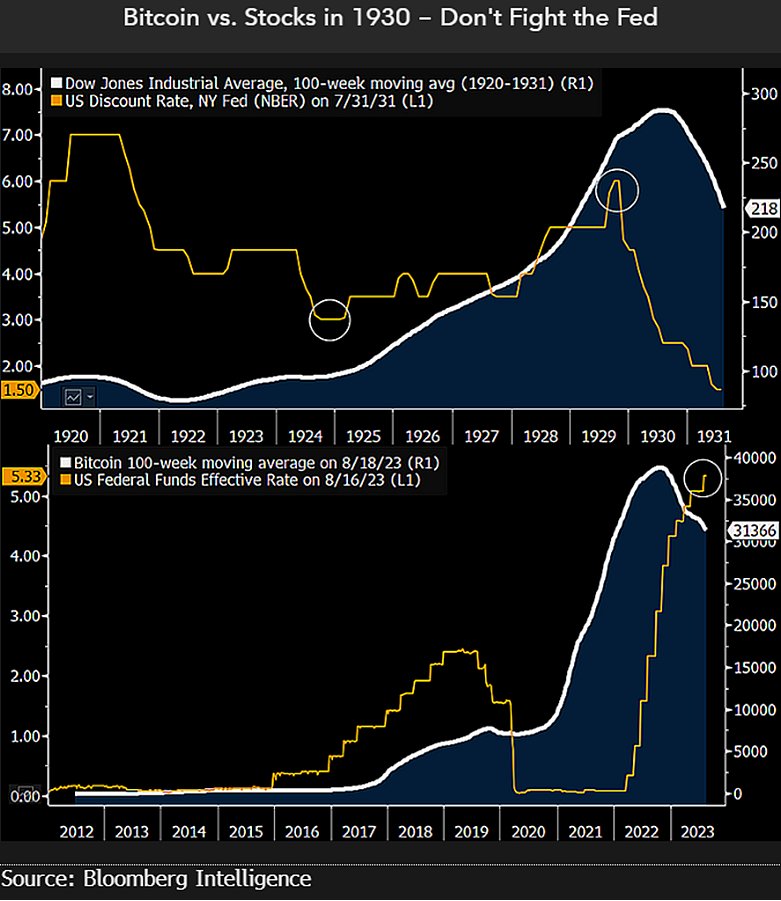

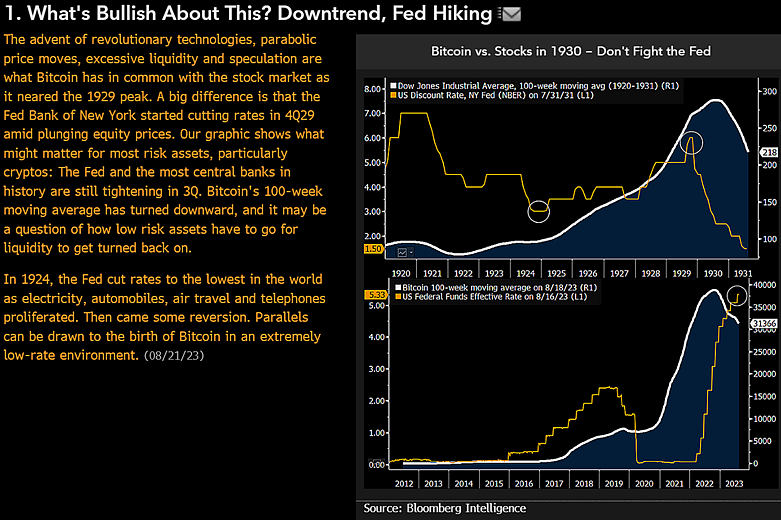

The analyst shares a graphic showing how the US discount rate peaked in 1929 just before the 100-week moving average of the Dow Jones Industrial Average (DJIA) rolled over.

The US discount rate is the interest rate charged to banks on loans collected from the Federal Reserve.

The graphic also shows the steep rise in the Fed’s interest rate over the last year or so with Bitcoin’s 100-week moving average witnessing a downtrend.

“One of the best-performing assets in history and a leading indicator – Bitcoin – appears similar to the stock market in 1930. Statistician and entrepreneur Roger Babson began warning about elevated equity prices well before economist Irving Fisher proclaimed a ‘permanently high plateau’ in 1929. The Fed tilts our bias toward a stance similar to Babson’s.”

McGlone also highlights that the birth of Bitcoin is reminiscent of the tech advancements about 100 years ago when electricity, cars, air travel and telephones proliferated. According to the Bloomberg analyst, the parabolic rise of Bitcoin and the emergence of revolutionary technologies in the 1920s both came at a time when the Federal Reserve kept interest rates low.

“What’s Bullish About This? Downtrend, Fed Hiking…

The advent of revolutionary technologies, parabolic price moves, excessive liquidity and speculation are what Bitcoin has in common with the stock market as it neared the 1929 peak. A big difference is that the Fed Bank of New York started cutting rates in 4Q29 amid plunging equity prices.”

At time of writing, Bitcoin is trading for $26,020.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney