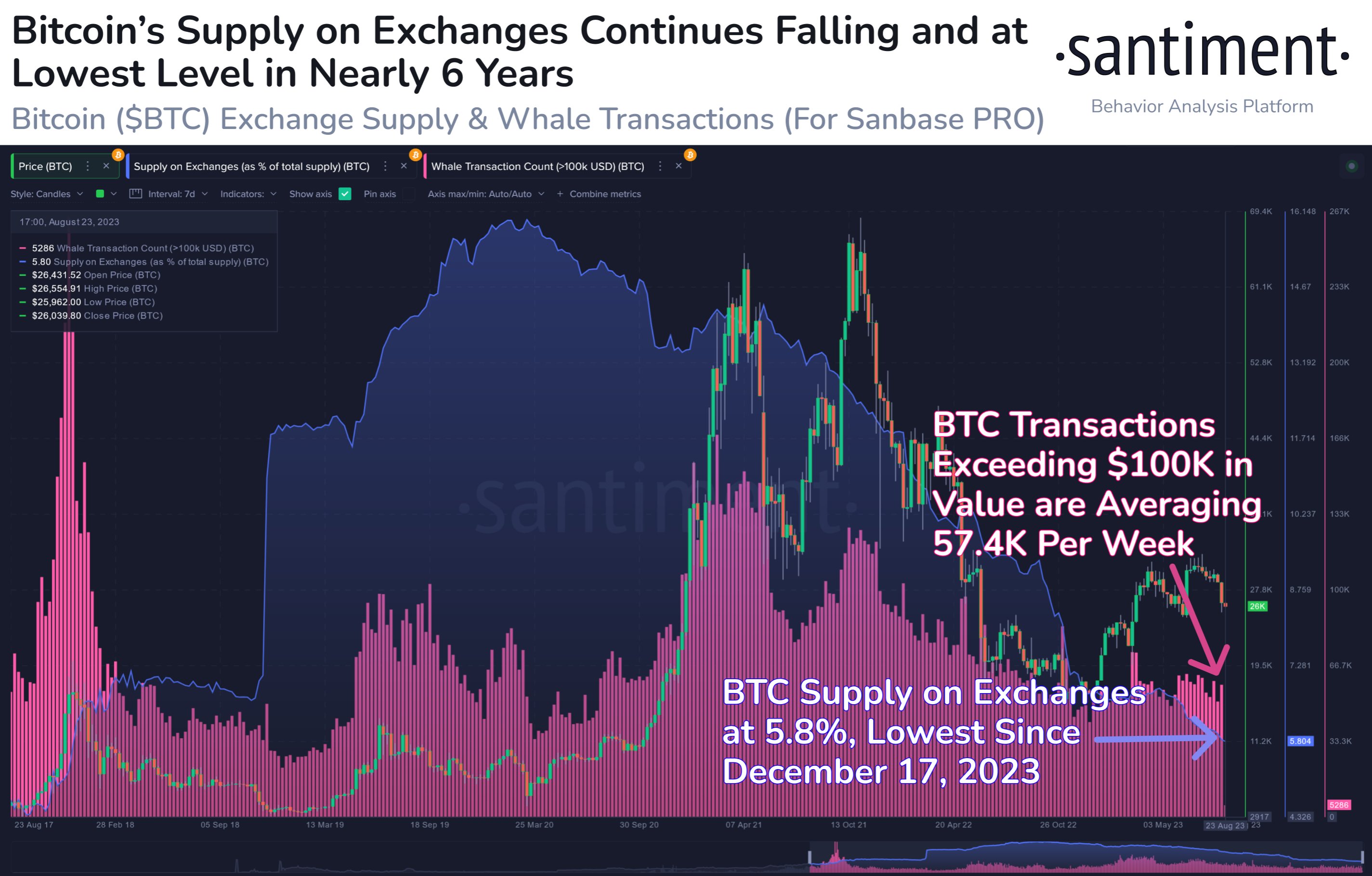

New data from crypto analytics firm Santiment reveals that the supply of Bitcoin (BTC) on crypto exchanges is at its lowest point in over half a decade.

According to the market intelligence firm, only 5.8% of the crypto king’s overall supply is currently sitting on crypto exchange platforms, the lowest level since December 2017.

Santiment also notes that the top crypto asset by market cap is seeing decent amounts of Bitcoin whale activity.

“Just 5.8% of Bitcoin is currently sitting on exchanges, which is officially the lowest level crypto’s top market cap asset has seen since December 17, 2017. We are also continuing to see reasonable amounts of BTC whale transactions (57,400 per week).”

Santiment also says that Bitcoin is currently in the lead in terms of being the digital asset with the highest amount of address activity.

BTC is followed by the stablecoin Tether (USDT), smart contract platform Ethereum (ETH), layer-2 blockchain Polygon (MATIC) and BTC alternative Litecoin (LTC), which all have at least more than double the number of active addresses compared to other cryptocurrencies, according to Santiment.

Bitcoin is trading for $26,001 at time of writing.

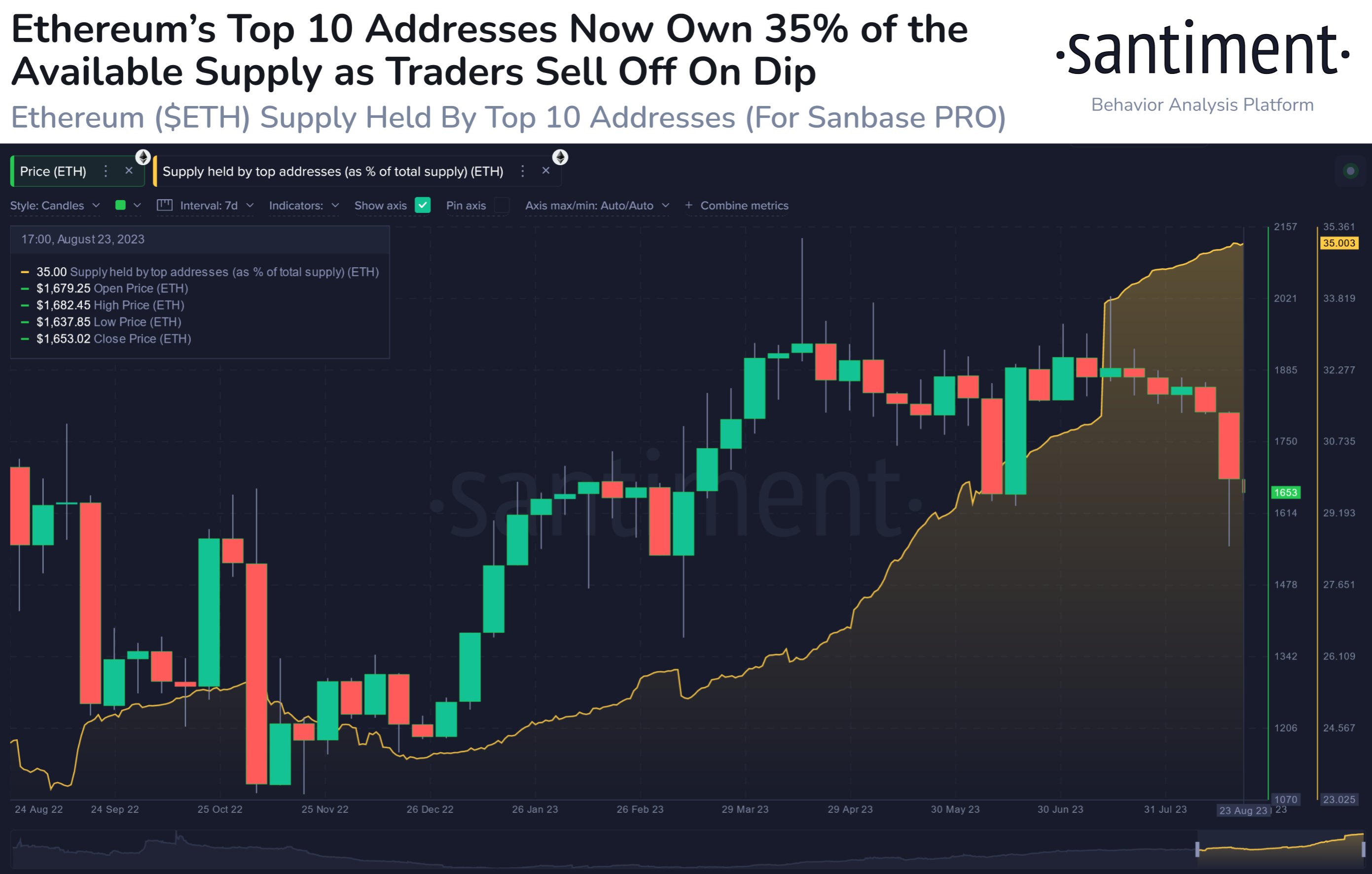

Moving on to Ethereum, the market analytics firm says that the 10 largest addresses associated with the leading altcoin are now holding a staggering 35% of ETH’s overall supply.

According to Santiment, the increase in the holdings of large addresses is likely due to smaller investors capitulating their positions out of fear, doubt and uncertainty (FUD) surrounding the latest crypto market dip.

“The 10 largest addresses on the Ethereum network are now holding over 35% of the available supply. By no means does this mean the [second-largest] asset in crypto is suddenly centralized, but it shows the capitulation of smaller traders showing FUD from this dip.”

At time of writing, Ethereum is worth $1,649.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Sensvector/lassedesignen