Digital asset research firm Kaiko finds that data from crypto exchanges suggests large traders in the US drove buying demand of XRP after Ripple won a partial court victory over the U.S. Securities and Exchange Commission (SEC) in July.

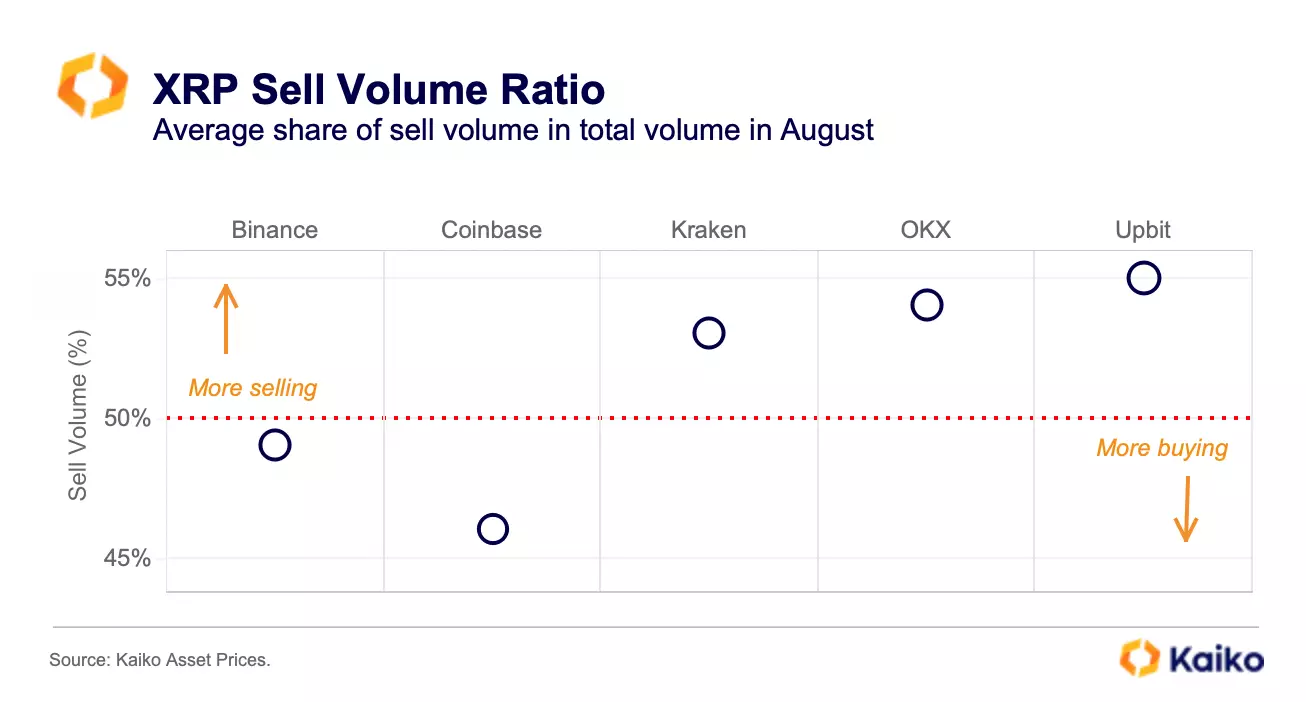

In a new analysis, Kaiko notes that the Korean exchange Upbit and the Seychelles-based exchange OKX witnessed the strongest selling pressure for XRP in August.

Kaiko also finds that Coinbase, the top crypto exchange in the US, saw stronger levels of buying.

The crypto research firm also notes that XRP’s average trade size increased on Coinbase, surpassing all top ten altcoins, excluding Ethereum (ETH).

“This could suggest that buying demand was driven by large traders in the US as investors re-gained access to the token after the July court ruling. Overall, the share of XRP traded on US markets remains lower than on offshore exchanges. XRP is only the sixth-most-traded altcoin in the US by cumulative trade volume while it tops the list on offshore markets.”

The SEC sued Ripple in late 2020, alleging the San Francisco payments company was selling XRP as an unregistered security.

In July, District Judge Analisa Torres ruled that Ripple’s automated, open-market sales of XRP, referred to as programmatic sales, did not constitute security offerings, contrary to what the SEC alleged.

The judge did, however, side with the SEC’s claim that Ripple’s sale of XRP directly to institutional buyers constituted a securities offering.

XRP shot up from trading around $0.47 prior to the ruling to a high of around $0.82 later in July. The 5th-ranked crypto asset market cap has since lost most of those gains and is trading around $0.504 at time of writing.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney