Crypto analyst Michaël van de Poppe says altcoins are likely ready to trend higher after a long “depression phase” at very low prices.

Van De Poppe tells his 666,000 followers on social media platform X that the numerous applications for crypto exchange-traded funds (ETFs) are indicating coming strength for digital assets.

“Altcoins are in their depression phase and are ready to start trending upwards.

It might sound repetitive, but for most of the altcoins, the lows might be in or close to in.

The interest in crypto is at the same levels as in 2020, while BTC pairs are slowly breaking out.

The interest in the markets isn’t there, while we’ve got some important indicators in the meantime:

– Bitcoin spot ETF around the corner.

– Ethereum spot ETF applications.

– Ethereum futures ETF around the corner.

The institutions are jumping in.”

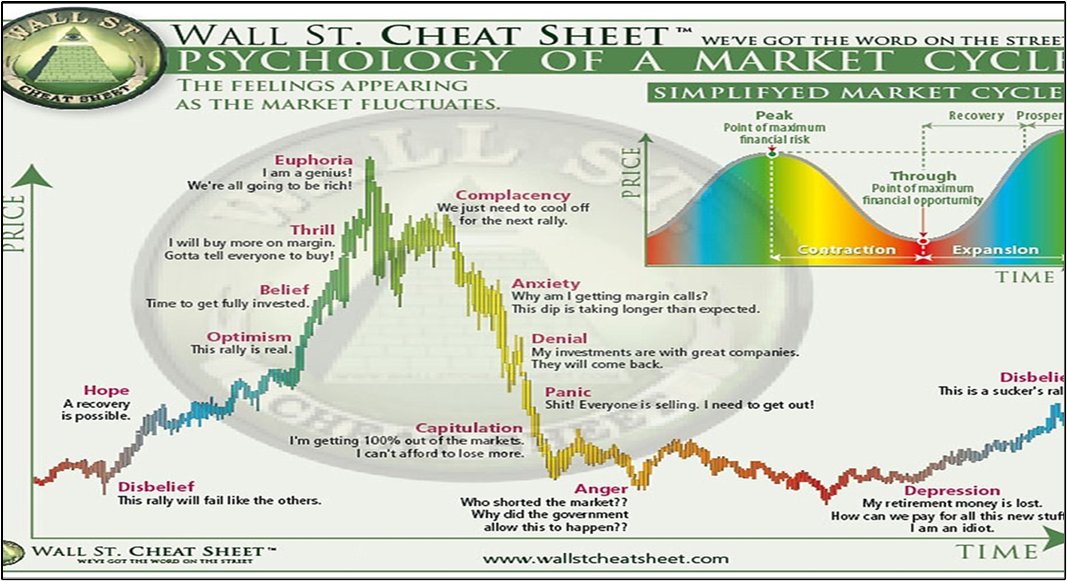

The analyst references the Wall Street Cheat Sheet, a classic chart that attempts to depict the psychological phases that investors go through during volatile market cycles. According to the theory, the end of the cycle is the “depression phase,” where prices are at extreme lows.

The depression stage is typically followed by the “disbelief” phase, where prices begin to rise slightly but most market participants do not see any significance in it.

Looking at Bitcoin (BTC), Van De Poppe says he’s looking for price to leave the range between $24,500 and $26,800. A move to the bottom of the range would indicate a discount and a move to the top of the range would suggest a breakout, according to the analyst.

“Don’t get chopped out in this range of Bitcoin.

It can last for some more weeks. Ultimately ending up with a fake-out and then the real move.

If we break above $26,800. I’ll be a massive buyer.

If we drop to $24,500-25,000, I’ll be a massive buyer.”

At time of writing, BTC is trading for $25,873.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney