A popular crypto analyst says that Bitcoin’s (BTC) path toward a massive bull cycle remains intact despite the market correction.

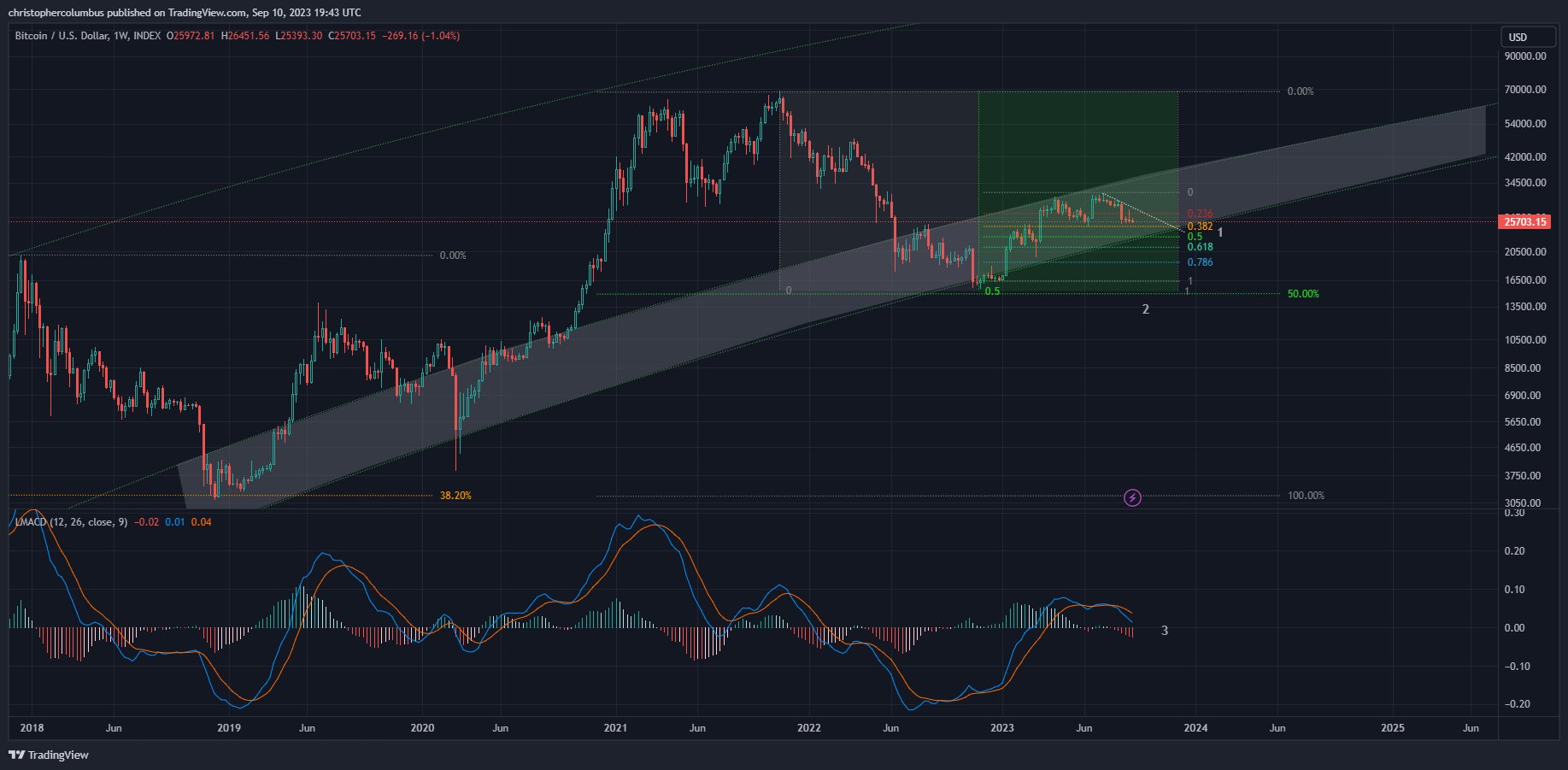

Pseudonymous analyst Dave the Wave tells his 140,100 followers on the social media platform X that BTC appears to be in the midst of a consolidation period after rallying by about 100% from its November 2022 bottom.

The trader also says that the weekly logarithmic moving average convergence divergence (LMACD) indicator is still above the zero line, which has historically acted as support for BTC.

The LMACD indicator is designed to signal changes in an asset’s trend, strength and momentum. Typically, an asset is seen as bullish once it crosses the LMACD zero line.

Says Dave the Wave,

“Technically, not panic stations but plain sailing:

1. A consolidation of this year’s move up.

2. This year’s move up near as long as the move down from peak to low (low holding).

3. Weekly LMACD consolidating to the zero line.

Still in the buy zone for investors.”

According to the trader, indicators are not changing the broader case for a bull cycle even though market sentiment appears to be flipping bearish.

“You can listen to scaremongers, who play on the popular sentiment… or you can keep your eye on the rational technicals.”

The analyst also says that the current Bitcoin correction is nothing out of the ordinary considering BTC’s strong rally earlier this year.

“If people stopped to consider that BTC price retraced a full 50% of its decline from the peak, then they wouldn’t be too surprised to see consolidation here.”

Looking at the trader’s chart, he appears to predict that the current correction could push Bitcoin to the 50% Fibonacci level at around $23,000.

The trader previously predicted BTC will revisit its all-time high at around $69,000 sometime next year followed by a deep corrective move below $50,000.

Bitcoin is trading at $25,139 at time of writing, down 2.9% in the last 24 hours.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney