Widely followed crypto analyst Rekt Capital says that Bitcoin (BTC) is completing a classic technical pattern that hints at lower prices to come.

The analyst tells his 351,000 followers on the social media platform X that BTC has almost printed a full double top pattern after being exhausted near the $30,000 range.

Rekt said well over a month ago that if the double top pattern played out, then a move to around $22,000 would be the likely result.

The analyst said in early August,

“If BTC drops to ~$26,000 by mid-September then a double top (DT) may be forming.

A breakdown from ~$26,000 would validate the DT.

And a measured move for the DT would be ~$22,000.

Worth noting but still very early stages and lots can still change in the meantime.”

With BTC hovering at the $26,000 mark, the analyst says that the double top pattern is now in play.

“The BTC double top is happening.

Slowly but surely.”

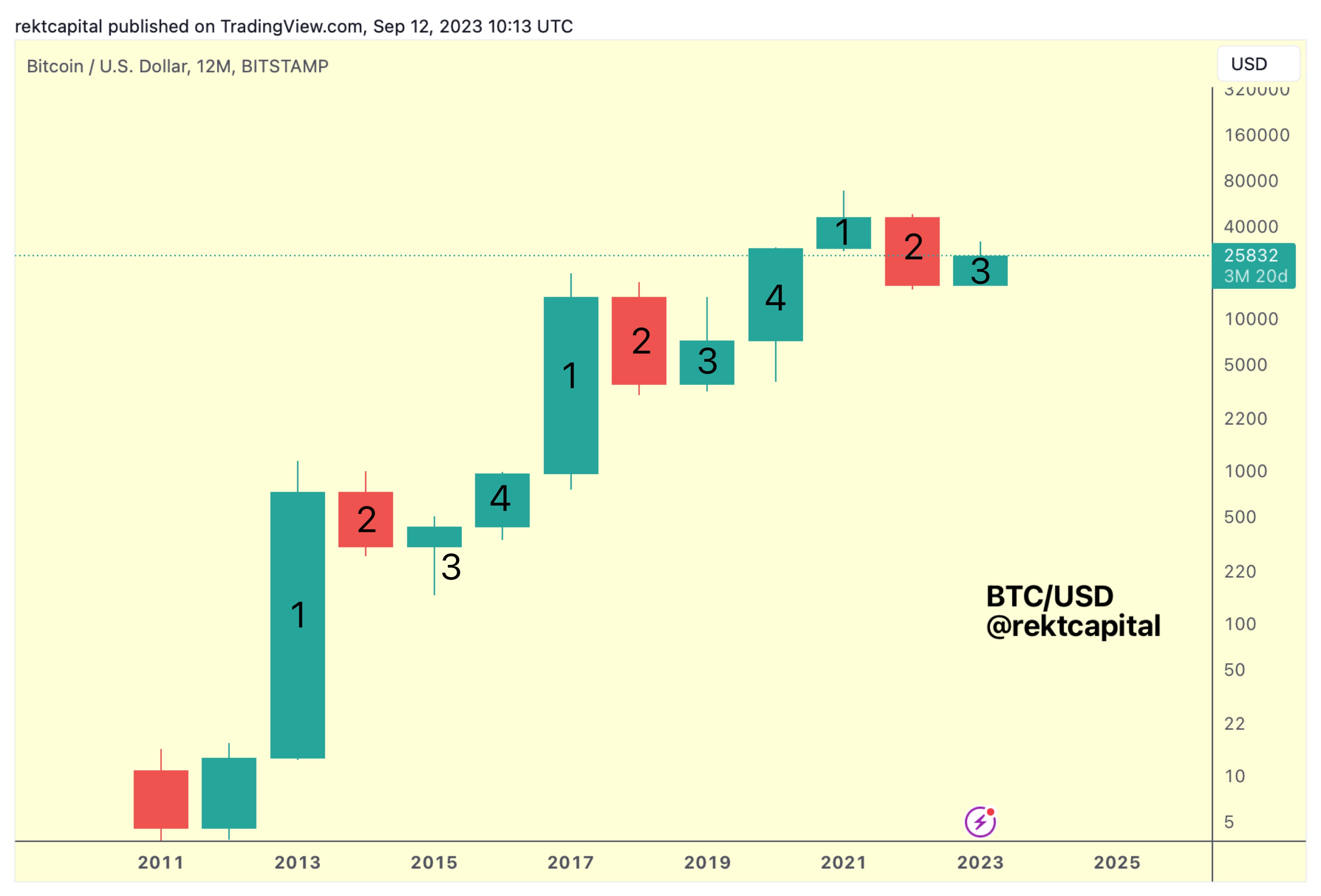

Zooming out on the long term, Rekt looks at Bitcoin using yearly candles to depict BTC’s traditional four-year cycles.

Bitcoin’s four-year cycle is largely based on the halving, an event that slashes BTC miners’ rewards in half. The cycle begins the year after BTC’s halving (year one) and ends during the year of the halving (year four).

According to the analyst, the third year of each cycle often has both upper and lower wicks on its candle as the price historically trades sideways above and below the yearly open. However, Rekt says Bitcoin is unlikely to dip below its yearly open this time around.

“In the BTC Candle 3, we tend to see both upside and downside wicks.

2015 and 2019 show that upside wicks tend to happen later in the year.

And downside wicks tend to happen earlier in the year.

At this stage, it’s unlikely BTC will form a downside wick in 2023.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Liu zishan