A widely followed crypto analyst is breaking down Bitcoin (BTC) as the top crypto by market cap bounces on the price charts.

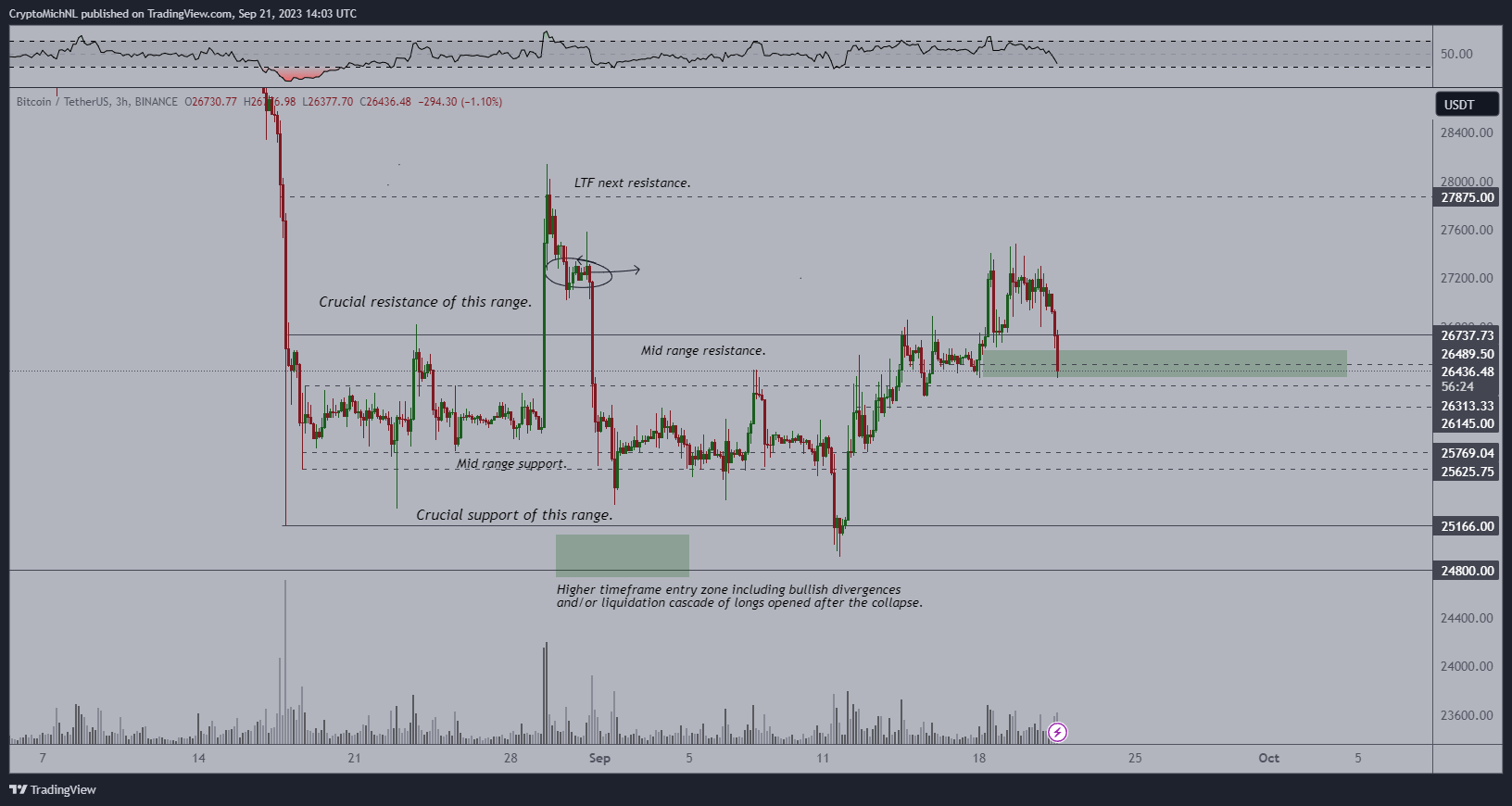

Crypto trader Michaël van de Poppe tells his 667,500 followers on the social media platform X that BTC’s “crucial” levels are around $26,700 and $28,000.

“The chop continues on Bitcoin.

Let’s see what happens after FOMC (Federal Open Market Committee).

Crucial levels to me: $26,700 and $28,000. Anything in between is simply chop.

Breaking above $28,000 -> interested for longs.

Breaking south of $26,700 -> buying $26,000.”

The Federal Open Market Committee (FOMC) is the monetary policymaking body of the Federal Reserve System, and its purpose is to set monetary policy to achieve maximum employment and stable prices.

After Wednesday’s FOMC meeting, Van de Poppe says he is expecting a “relief bounce” for BTC soon.

“Bitcoin still on a crucial level here, which should be holding.

Markets correcting after FOMC meeting (dotplot super hawkish).

Expecting a relief bounce up from US open, and depending on that, Bitcoin holds above $26,500.”

According to the crypto analyst, Bitcoin is set to chop again.

“Bitcoin back in the chop.

I think we’ll continue to do so, so the funding game continue to be played out too.”

BTC is worth $26,680 at time of writing, up 0.4% in the last seven days.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/diversepixel/Natalia Siiatovskaia