A widely followed crypto analyst is warning that Bitcoin (BTC) could repeat history and undergo a market correction before the end of the year.

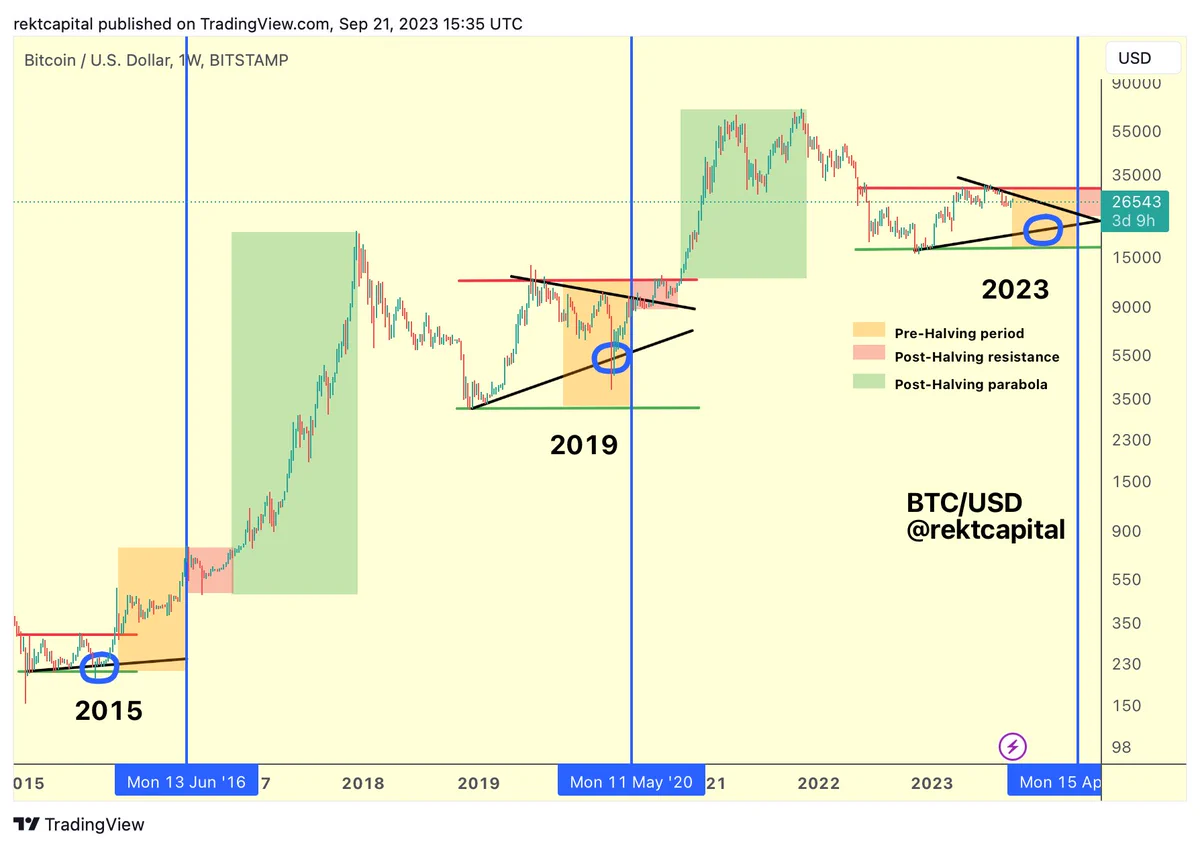

Pseudonymous trader Rekt Capital tells his 352,800 followers on the social media platform X that Bitcoin could decline to $20,000 this year if BTC repeats a pattern seen both in 2015 and 2019, two other pre-halving years.

“BTC: 2015, 2019 and maybe even 2023? Bitcoin has a history of revisiting the macro higher low [price] (blue circle) in its pre-halving period.”

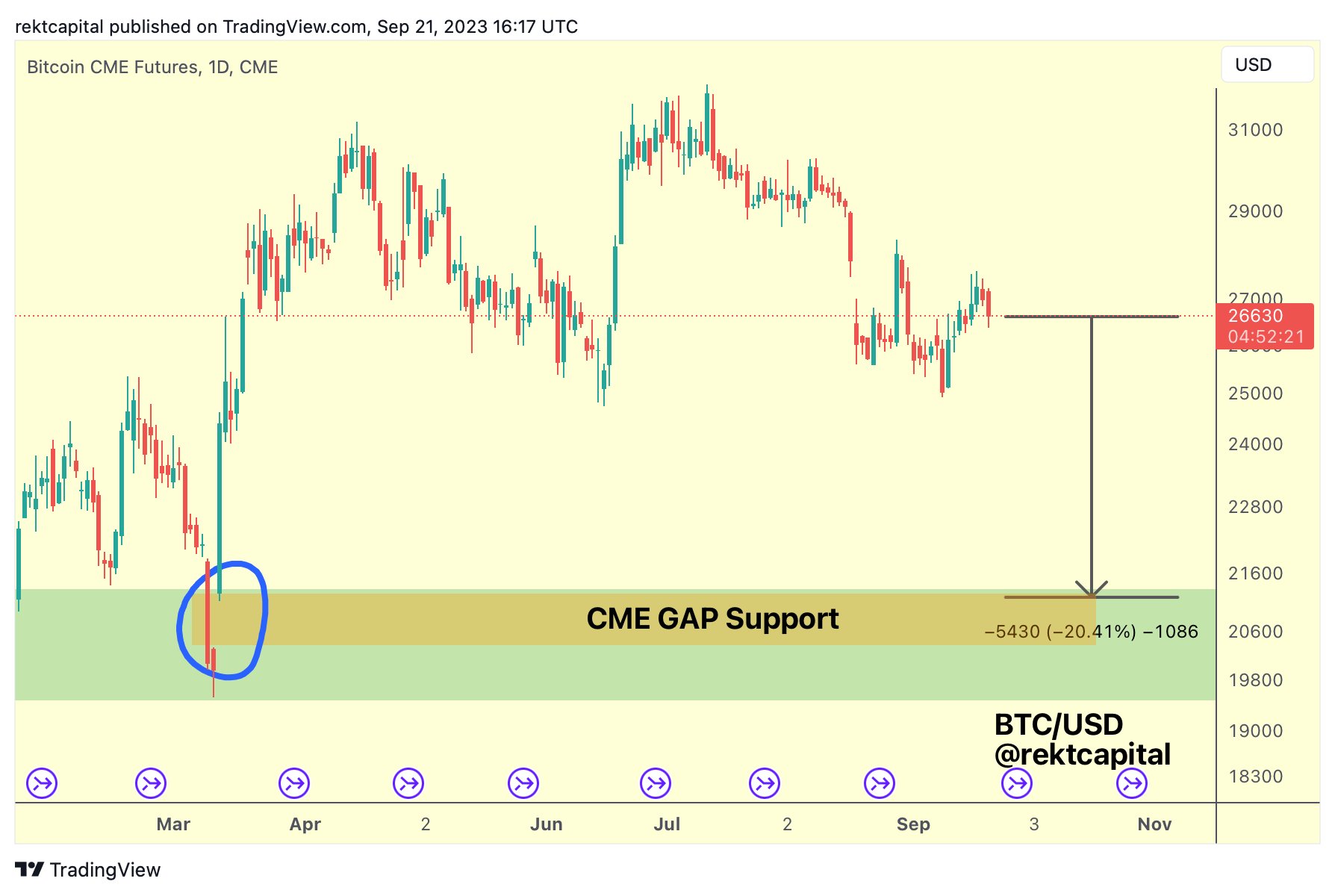

He says another indication that Bitcoin could retest the $20,000 level is that there is a gap created by trades on the Chicago Mercantile Exchange (CME) in that range.

“If Bitcoin continues to form lower [price] highs could BTC fill the CME gap at ~$20,000 later this year or early 2024?

If so, Bitcoin could finally revisit its macro higher low in this cycle (blue circle).”

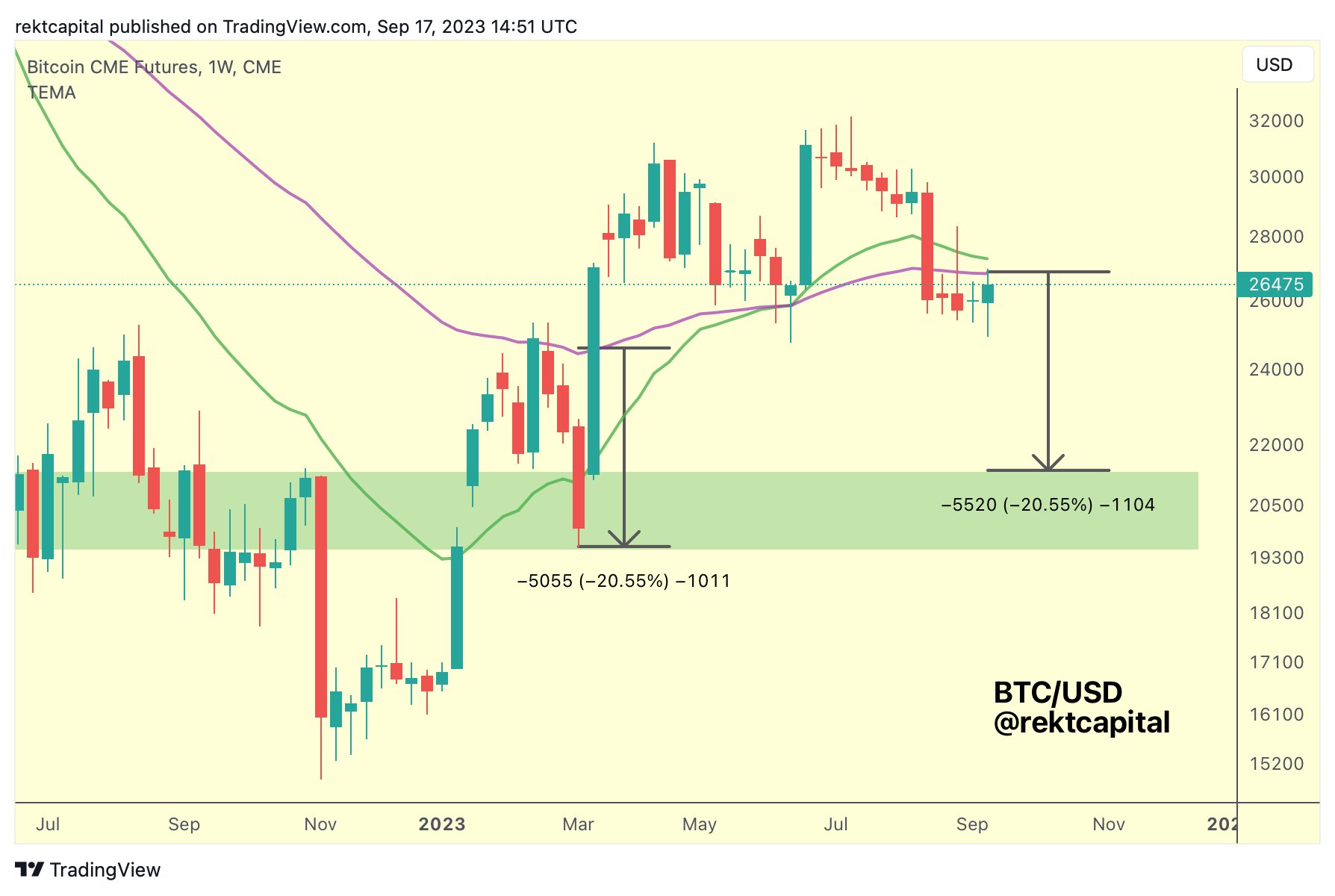

The trader also says another indicator Bitcoin may dip is that it has dropped below the 50-week exponential moving average (EMA).

“The last time BTC rejected from the 50-week EMA (purple) BTC retraced -20%.

If history repeats and BTC were to reject -20% from here, price would drop into the ~$21,000 area (green). This is where the daily CME gap is (orange).”

The trader says his prediction of a Bitcoin dip could be invalidated if BTC can break out past a key price level in the near term.

“It’s really simple. If BTC is able to break the black Lower High resistance then it’ll have a good chance of properly challenging for a ~$31,000 breakout.

But until then there’s always scope for additional downside.”

According to the trader, Bitcoin will likely not revisit the $31,000 level until after the next halving event, when miner rewards are cut in half, which is expected to occur in April 2024. He also predicts a parabolic rally after next year’s halving event that will send BTC over $65,000.

“If ~$31,000 was the Top for 2023 then the next time we see these prices will be months from now, just after the halving (red box).

Only difference between now and then? In this pre-halving period, BTC could still retrace from here.

But after the halving, BTC would break out much higher from current prices.”

Bitcoin is trading for $26,646 at time of writing, down 1.3% in the last 24 hours.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney