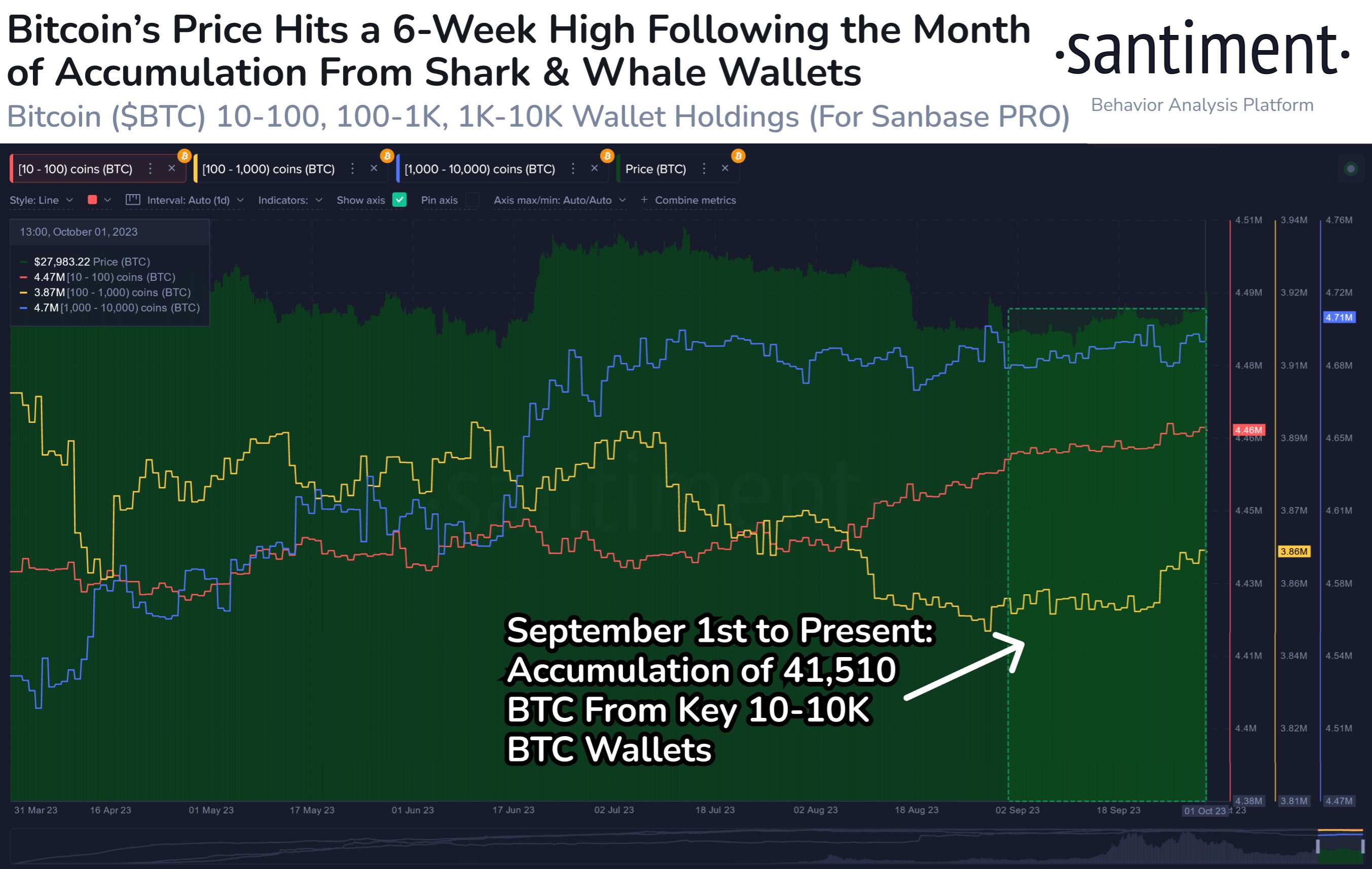

Large Bitcoin (BTC) holders have been snapping up the top crypto asset since the beginning of September, according to the crypto analytics firm Santiment.

Santiment notes that Bitcoin sharks and whales, or entities holding between 10-10,000 BTC, have accumulated a combined $1.17 billion since September 1st.

The firm says that the accumulation pattern makes it more likely that BTC will witness a return to the $30,000 price level, unless those holders start dumping their Bitcoin holdings.

Bitcoin is trading at $27,853 at time of writing and is up nearly 3% in the past 24 hours. The top-ranked crypto asset by market cap briefly surged above $28,000 on Monday, the first time it has jumped above that price point since August.

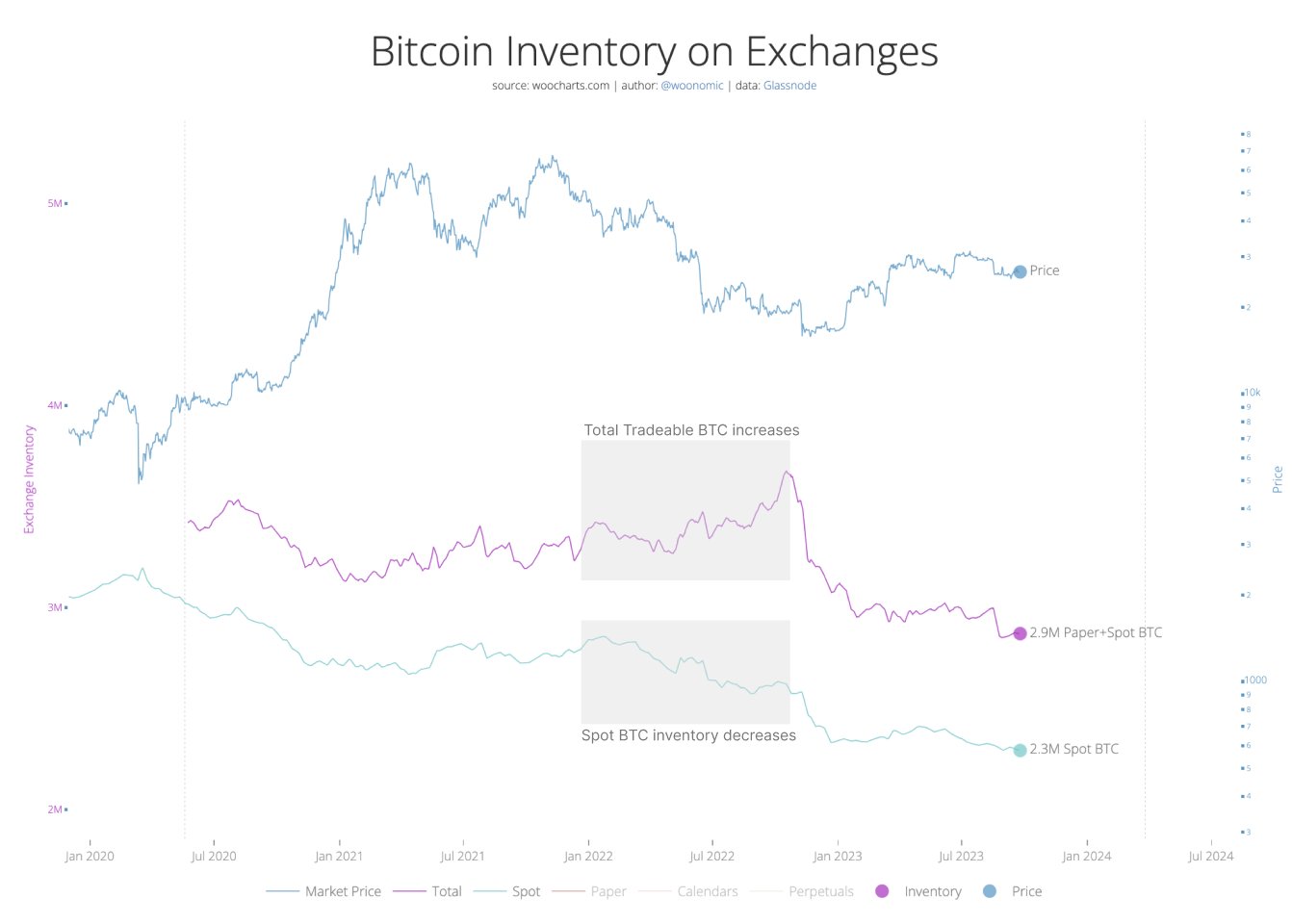

Not everyone agrees with Santiment’s analysis, however. Popular Bitcoin analyst Willy Woo recently told his one million followers on the social media platform X that buying up the inventory of BTC on exchanges won’t actually help boost the asset’s price.

“This is a fallacy. This happened all through the 2022 bear. There’s no supply shock because synthetic BTC via futures markets added to inventory. The market made a bottom when futures markets relented.

If an investor wants to buy exposure to BTC, they can now buy a futures ETF (exchange-traded fund). This doesn’t create a supply shock as these are just paper bets on price going up, a hedge fund can take the other side of the bet, you’ve minted a new synthetic BTC. And the limit on this is infinite.”

According to Woo, the approval of a spot-based Bitcoin ETF will help “rectify this issue.”

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney