Digital assets manager CoinShares says that one Ethereum (ETH) rival is being favored by institutional investors as the crypto markets rake in their biggest inflows in months.

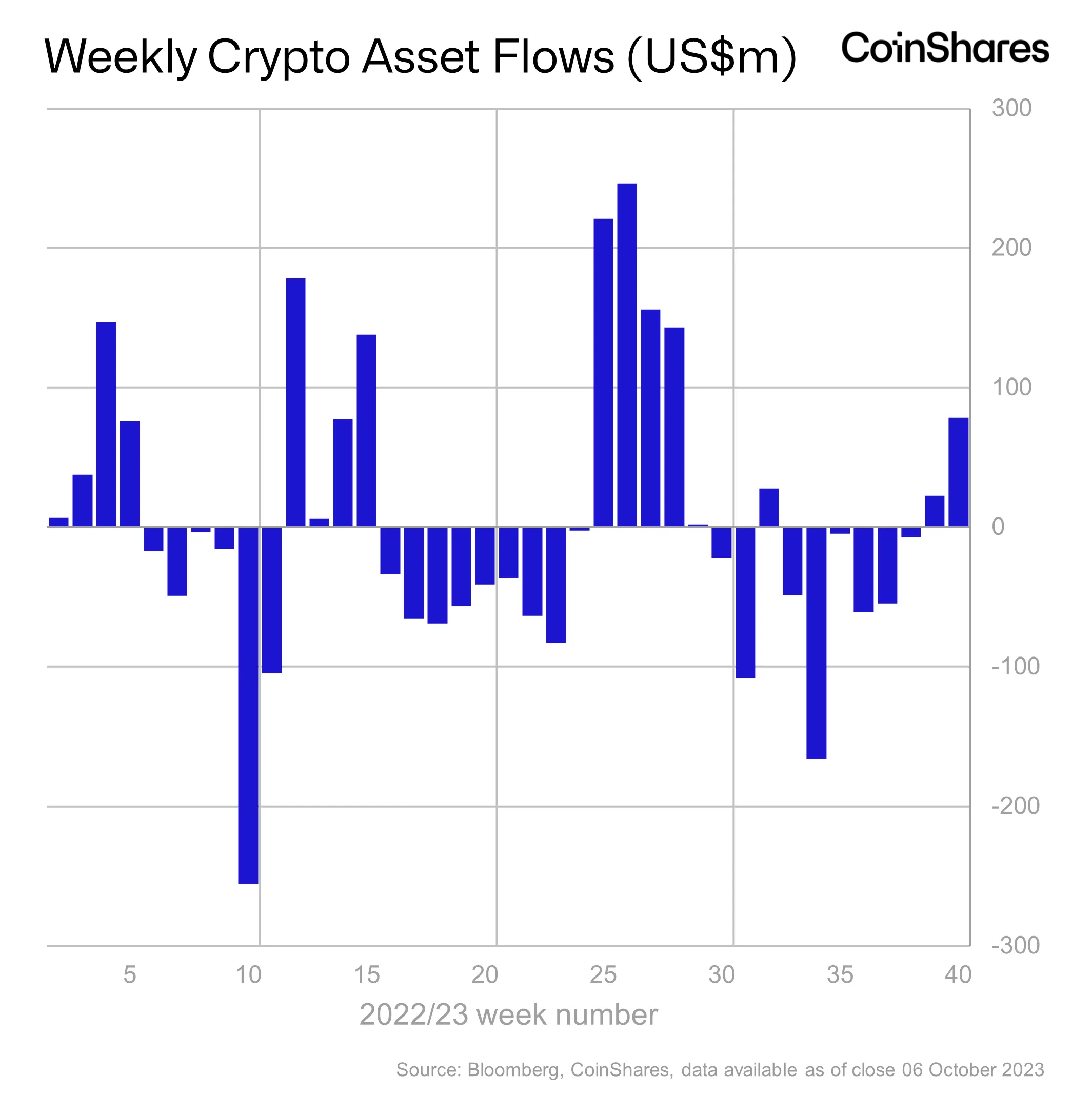

In its latest Digital Asset Fund Flows Weekly Report, CoinShares finds that digital assets took in inflows of $78 million last week, the second week of positive inflows in a row.

“Digital asset investment products saw inflows for the second week totaling $78 million, while trading volumes for ETPs (exchange-traded products) also rose by 37% to $1.13 billion for the week. We also saw a rise in Bitcoin volumes of 16% on trusted exchanges.”

According to CoinShares, most of the inflows came from Europe, while North American markets saw substantially lower inflows.

“Regionally, the divide continues, with 90% of inflows from Europe, while the US and Canada saw just $9 million inflows combined, suggesting a continued divergence in sentiment.”

Per usual, king crypto Bitcoin (BTC) took the lion’s share of inflows, totaling $43 million last week.

Most altcoins also saw inflows. Ethereum saw $10.2 million, Cardano (ADA) saw $0.2 million and multi-asset products say $0.4 million in inflows. However, Coinshares says the big winner was ETH rival Solana (SOL), which saw almost $24 million in inflows last week.

“Solana saw its largest week of inflows of $24 million since March 2022. Continuing to assert itself as the altcoin of choice, particularly in light of the recent Ethereum product launches.”

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/tykcartoon/WhiteBarbie