The Federal Reserve Bank is printing a record number of $50 bills as Americans feel the urge to hold physical cash.

The Bureau of Engraving and Printing, the agency in charge of money printing operations in the US, created 756.09 million new $50 bills in 2022, reports CNN.

The pile of fresh cash is worth about $37.8 billion.

According to the San Francisco Fed, the printing is due to a rise in demand for physical cash in the US, despite a decreasing use of cash for payments.

Citing results from the Fed’s Diary survey, which attempts to understand consumer payment habits in the US, the Fed finds that the demand for physical cash is likely due to economic uncertainty following the pandemic.

“While the average number of cash payments remained below pre-pandemic levels, aggregate demand for cash continued to increase. As of October 2022, the value of currency in circulation passed $2.23 trillion, a 28 percent increase compared to February 2020,17 but with slower growth since 2021.18,19

The Diary studies since 2020 show a significant factor for this increased demand is consumer cash holdings, both on-person (cash in one’s pocket, purse, or wallet) and store-of-value holdings (cash held in one’s home, car, or elsewhere). Both measures remained elevated compared to pre-pandemic levels and emphasized that demand for cash increases during times of uncertainty.”

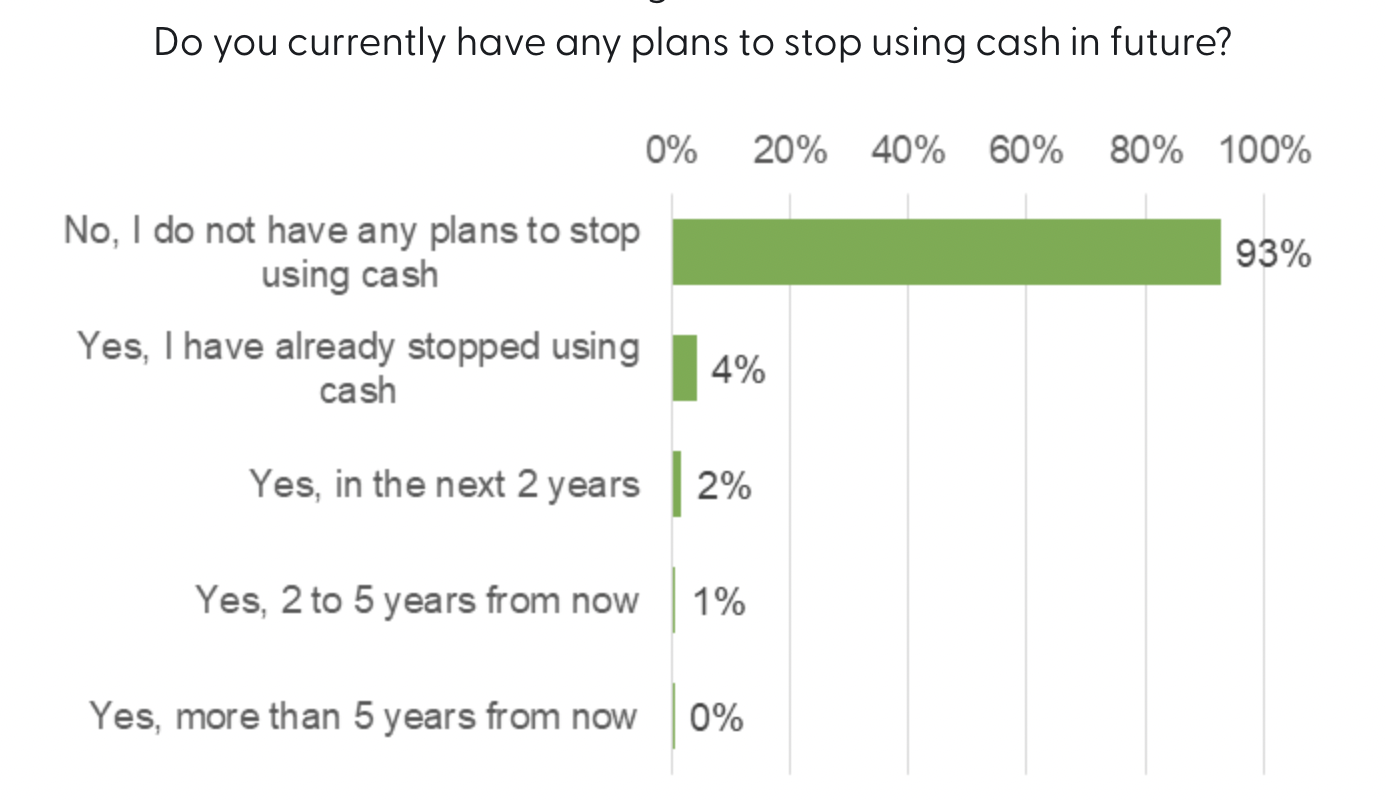

In a survey conducted as part of the same report, an overwhelming 93% of respondents declared they had no intentions to stop using cash.

The report emphasizes a paradox between the increased use of credit cards for payments and the demand for physical cash, noting that the growing preference for electronic payments has not decreased the desire for cash.

“An especially important takeaway from the 2022 Diary results is that most consumers do not expect to stop using cash in the near future. In addition, approximately one in five consumers reported cash as their preferred payment instrument for in-person purchases, indicating a persistent demand for cash for in-person payments despite online payments remaining elevated compared to pre-pandemic.

While some consumers may choose to stop using cash at some point in the future, the underlying cash demand suggested by these results emphasize the importance of continued investment across the various participants of the supply chain to ensure cash access for those consumers who need or prefer to use it.”

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney