A massive surge in crypto exchange flows suggests institutions could be preparing for the potential approval of spot market Bitcoin (BTC) exchange-traded funds (ETFs), according to the market intelligence firm Glassnode.

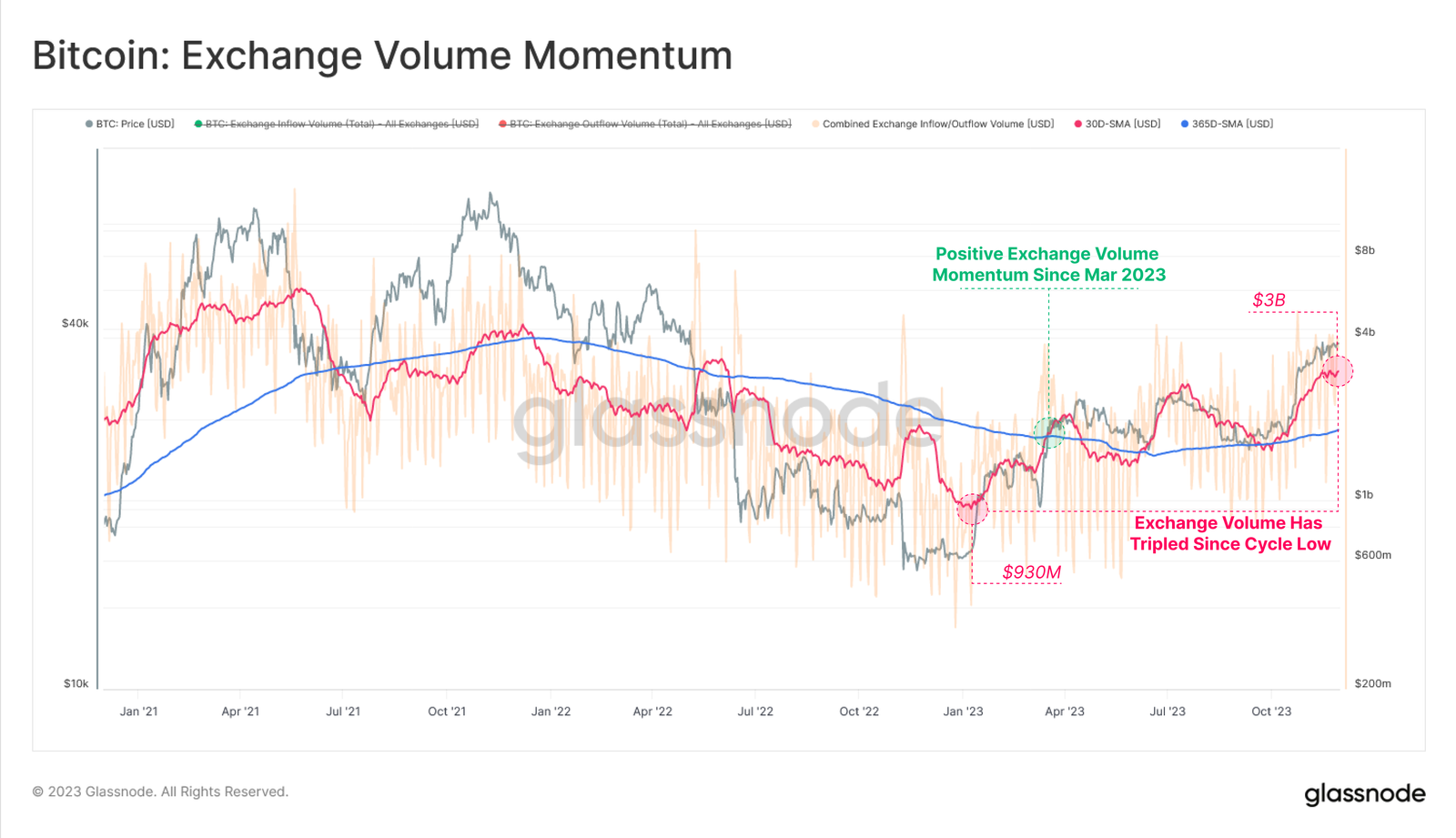

Glassnode notes in a new analysis that the 30-day simple moving average (SMA) of Bitcoin flows in and out of exchanges grew from $930 million from the start of the year to over $3 billion at time of writing, a 220% increase.

“Looking at this from the on-chain volume domain, we can see that YTD (year-to-date) flows in and out of exchanges have grown considerably from $930 million to over $3 billion (+220%).

This underscores an expanding interest from investors to trade, accumulate, speculate and otherwise utilize exchanges for their services.”

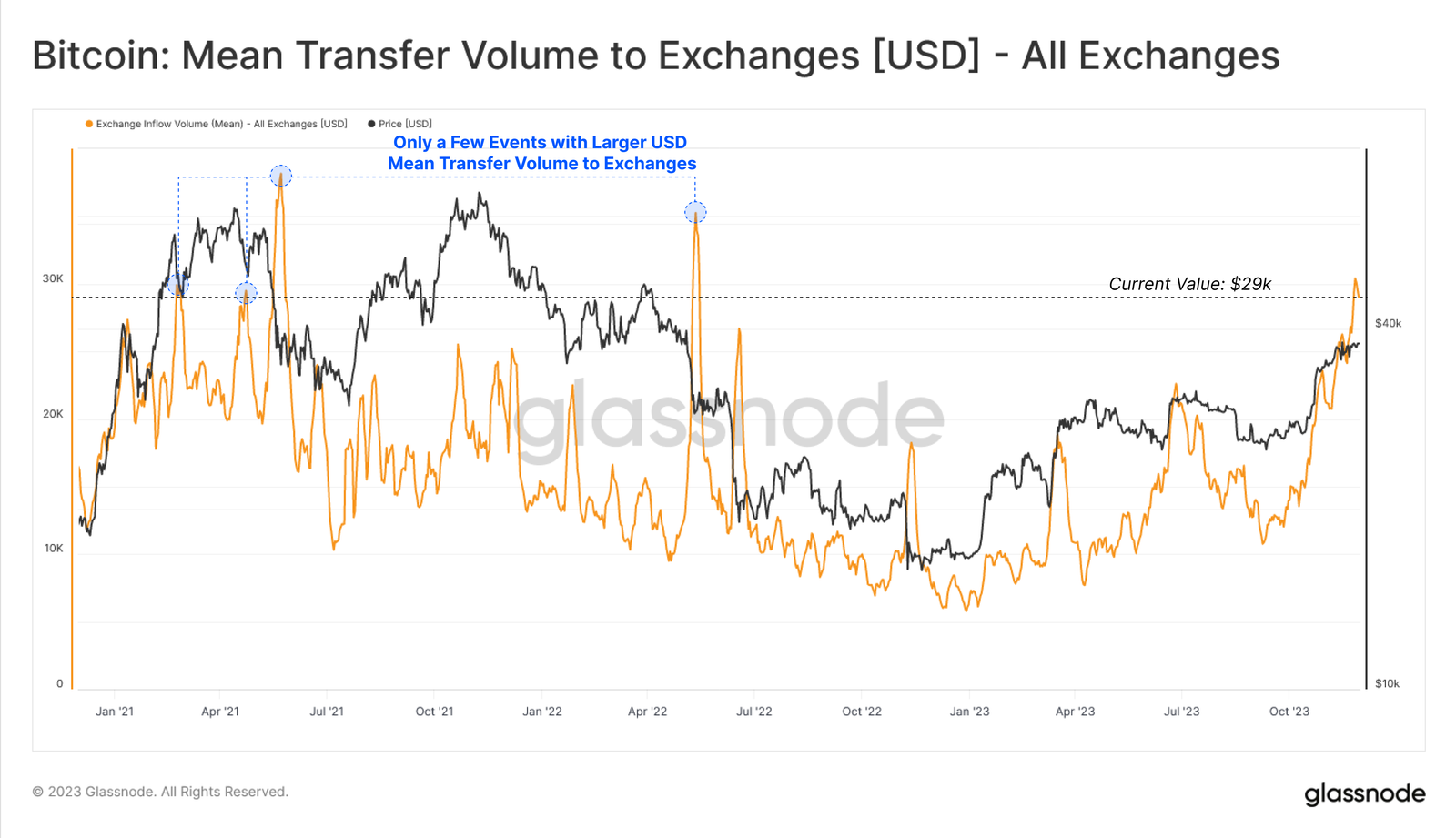

The analytics firm also notes that the average size of Bitcoin deposits to exchanges has grown significantly this year.

“With such a large uptick in exchange volumes, an interesting observation emerges from analysis of the average size of deposits to exchanges. This metric has experienced a non-trivial rally, climbing just shy of the previous all-time high of $30,000 per deposit.

From this, it appears that exchange deposits are currently dominated by investors moving increasingly large sums of money. This is potentially a sign of growing institutional interest as key ETF decision dates approach in January 2024.”

Bloomberg ETF analyst James Seyffart recently speculated that the U.S. Securities and Exchange Commission (SEC) could be gearing up to approve a slew of bids for a spot BTC exchange-traded fund in early January.

Bitcoin is trading at $43,974 at time of writing, up by more than 16% in the past seven days.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney