An Ethereum (ETH)-based native token for a decentralized finance (DeFi) project is flashing a couple of bullish divergences, according to the crypto analytics firm Santiment.

Aave (AAVE), a DeFi lending protocol, is trading at $93.89 at time of writing and is up more than 2.3% in the past 24 hours.

Santiment notes that the asset’s top 150 non-exchange wallets now hold 9.61 million AAVE, a five-month high.

The analytics firm also says AAVE’s Relative Strength Index (RSI) has dropped below 40, which has historically been a “bounce zone” for the asset.

The RSI is a widely used momentum indicator that aims to determine if an asset is overbought or oversold. The indicator scales from 0 to 100, and a reading of below 30 is typically considered bullish while a reading of over 70 is typically considered to be a bearish sign.

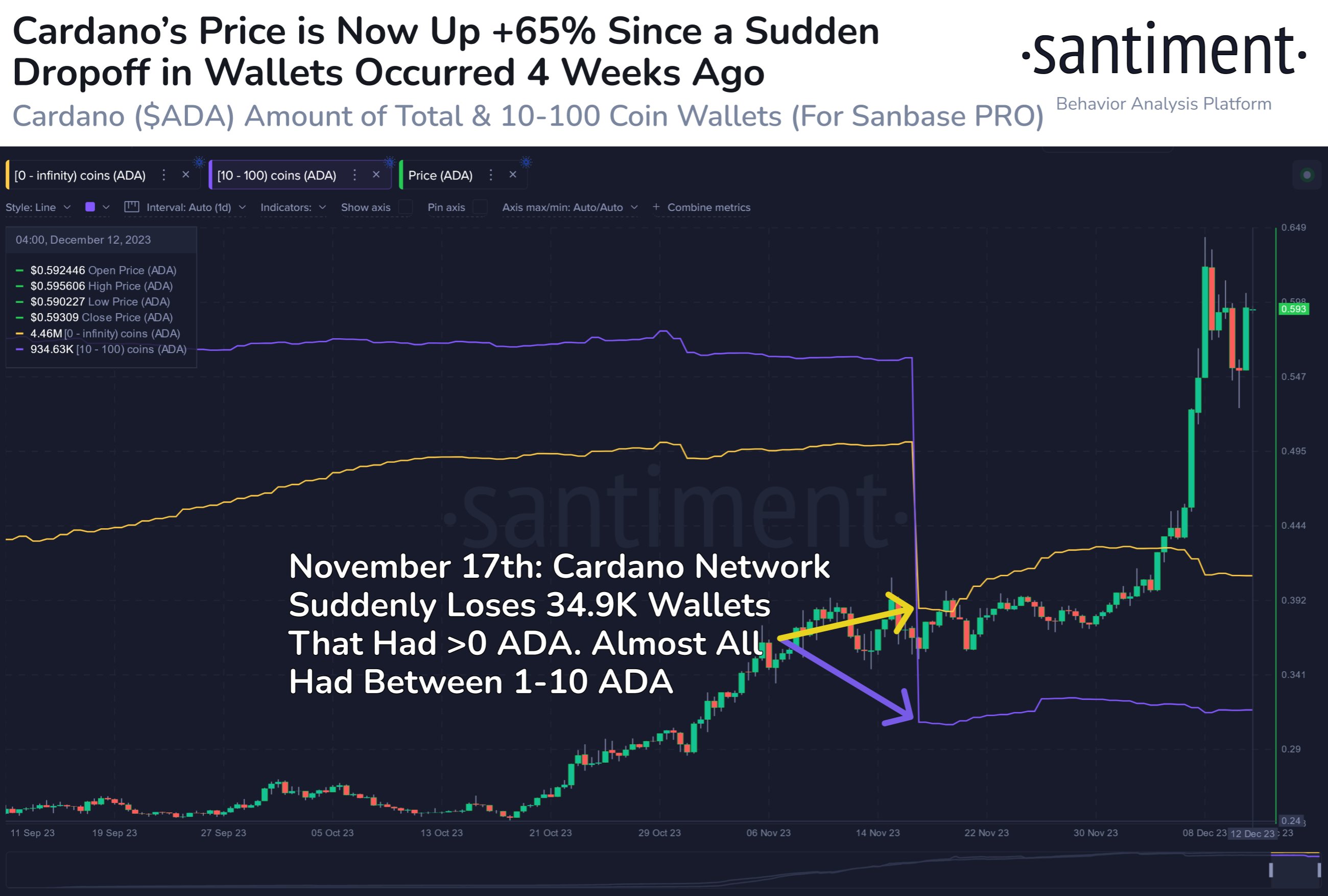

In terms of other crypto assets, Santiment notes that Ethereum competitor Cardano (ADA) noticed a sudden loss of small wallets back in mid-November.

“A drop of addresses this size or smaller often indicates capitulation, and a potential price turning point. ADA is +65% since.”

ADA is trading at $0.635 at time of writing. The eighth-ranked crypto asset by market cap is up nearly 8% in the past 24 hours.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney