A widely followed crypto analyst says that Bitcoin (BTC) is flashing one historically rare and accurate bullish signal.

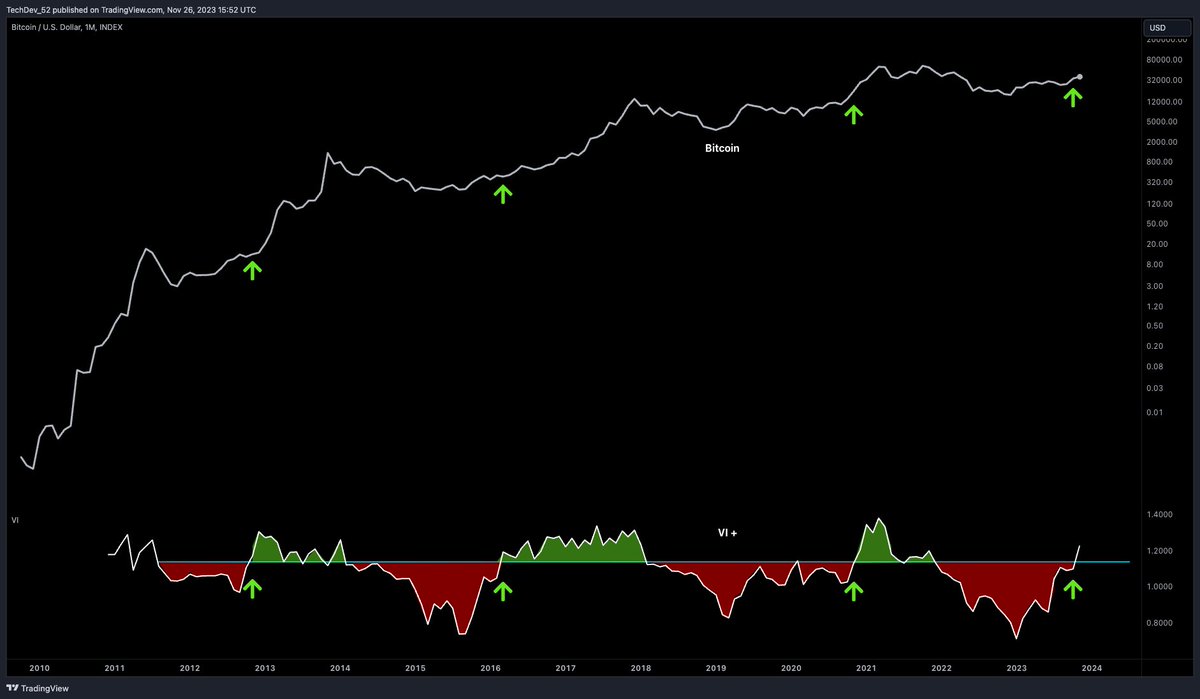

Pseudonymous crypto strategist TechDev tells his 424,500 followers on the social media platform X that the Vortex Indicator (VI) is once again signaling the start of a Bitcoin bull market.

The VI is used in technical analysis to spot trend reversals and confirm current trends. Based on the analyst’s monthly chart of BTC, the VI indicator has accurately nailed the start of bull market runs in three previous instances and it is flashing bullish now for the fourth time.

“A rare Bitcoin buy signal which has never missed.”

The analyst also believes that another metric signaling bullishness for Bitcoin is the recent strong performance of the Dow Jones Industrial Average (DJI).

“New all-time-high on the Dow Jones today. Wonder what’s next.”

The chart he shares includes the measure of the Chinese 10-year yield on its bond against the US dollar index (CN10Y/DXY) to illustrate the cyclical patterns of global liquidity, which appears to coincide with Bitcoin’s market cycles.

The analyst’s chart shows that global liquidity is already on the up and up, suggesting that Bitcoin may follow suit as it did in 2011, 2013, 2017 and 2020.

Bitcoin is trading for $42,540 at time of writing, up 2.6% in the last 24 hours.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3