A closely followed analyst says billions of dollars in capital are returning to the crypto markets after last week’s correction.

Earlier this month, digital assets witnessed a deep corrective move as the total market cap of crypto plunged from $1.70 trillion to $1.50 trillion in a single day.

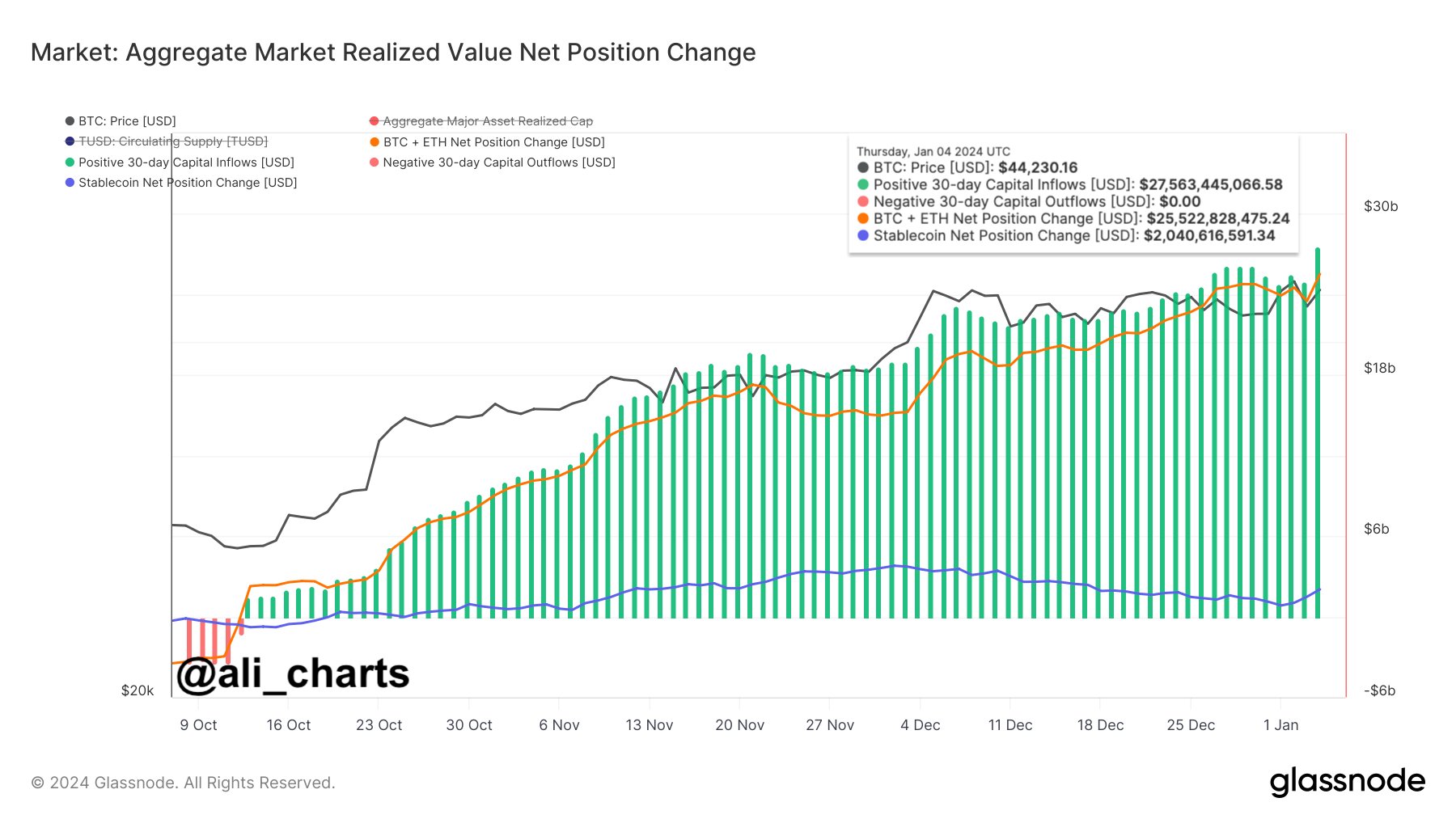

Analyst Ali Martinez tells his 39,700 followers on the social media platform X that the crypto markets are in a position to bounce back as investors spend billions of dollars to take advantage of the dip.

“Following the recent shakeout, there’s been a notable resurgence, with over $2.5 billion flowing back into the crypto market. This influx could signify renewed investor confidence and an upturn in the market!”

At time of writing, the total crypto market cap is hovering at $1.60 trillion.

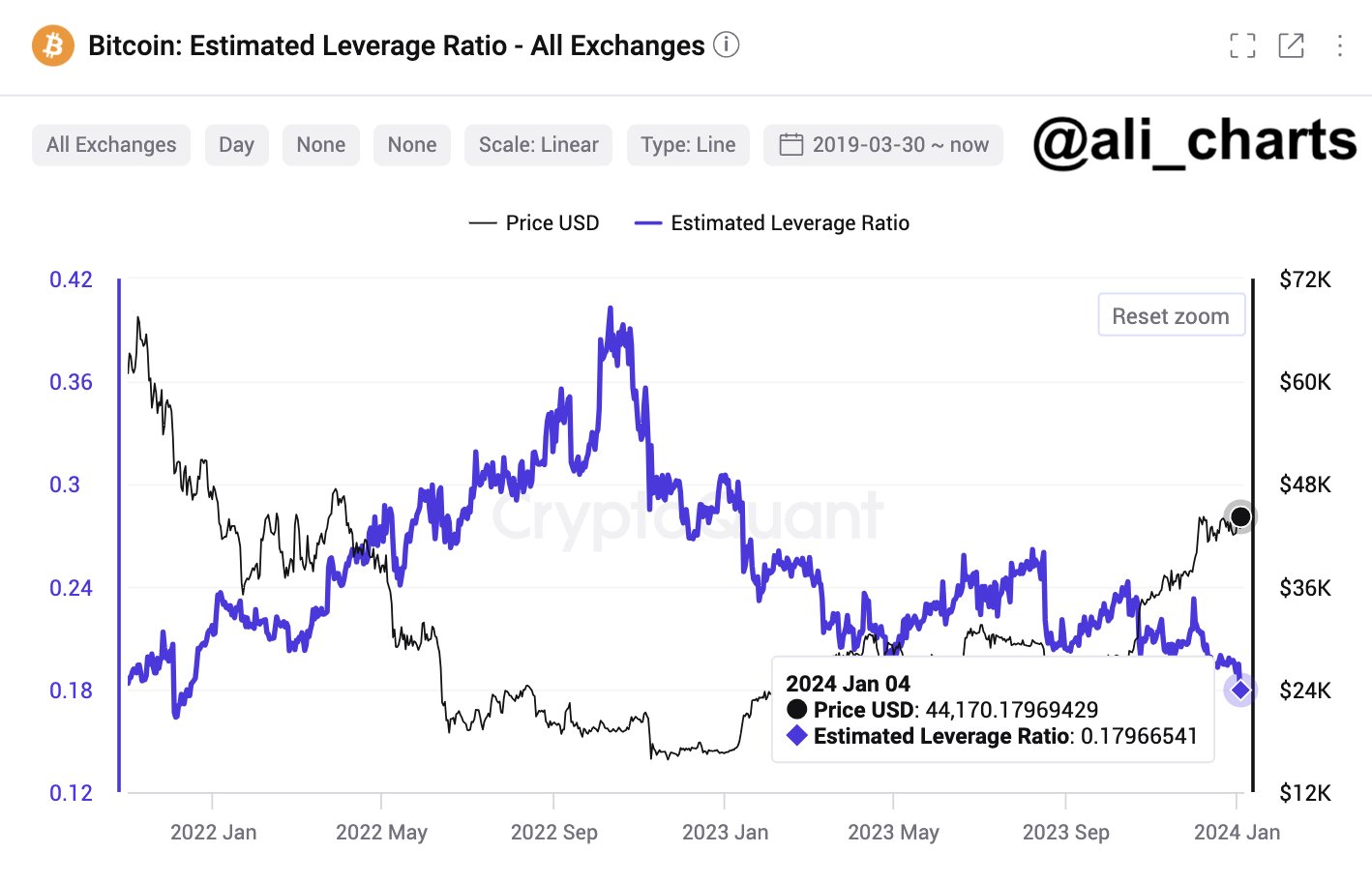

Looking closer at Bitcoin, Martinez says that the possible approval of spot-based BTC exchange-traded funds (ETF) is likely not yet fully priced in. According to the analyst, the crypto markets are far from overheated which means that traders are not going all-in ahead of the highly anticipated event.

“The estimated leverage ratio across all exchanges has fallen to a two-year low. This indicates BTC traders are adopting a more cautious approach, reducing the use of borrowed funds as they await regulatory clarity.”

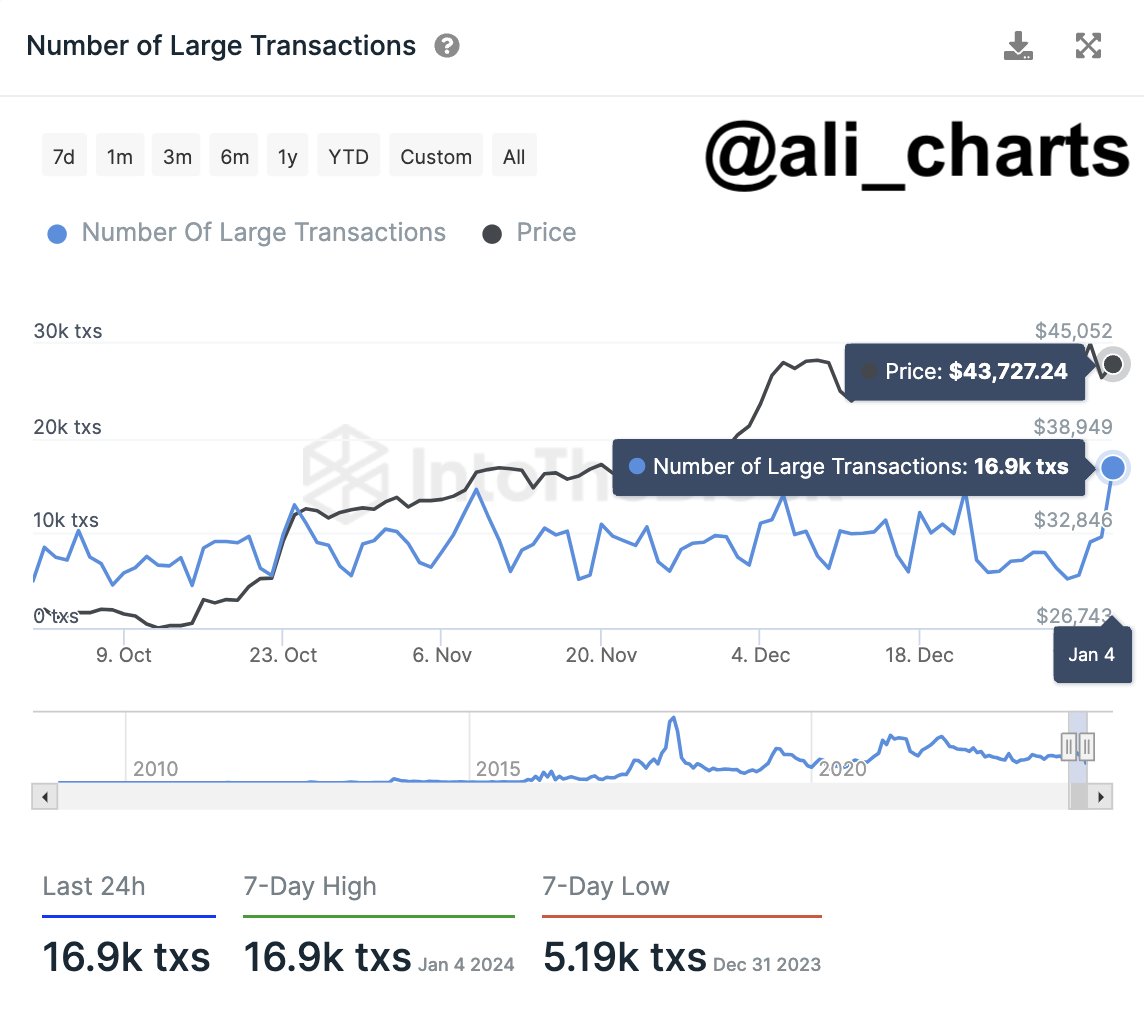

While traders are shying away from using excessive leverage, Martinez says that crypto whales may be in the midst of rapidly accumulating BTC in anticipation of the U.S. Securities and Exchange Commission (SEC) potentially approving a slew of Bitcoin ETF applications this week.

“In the past 24 hours, Bitcoin experienced its largest spike in transactions over $100,000 in nearly two years. The 16,900 large transactions serve as a proxy for BTC whale activity, offering insights into how these major players might be positioned in the crypto market.”

At time of writing, Bitcoin is worth $44,091.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney