More than $1.2 billion flowed into spot Bitcoin (BTC) exchange-traded funds (ETFs) in the days after they launched last week, according to the research arm of the cryptocurrency exchange BitMEX.

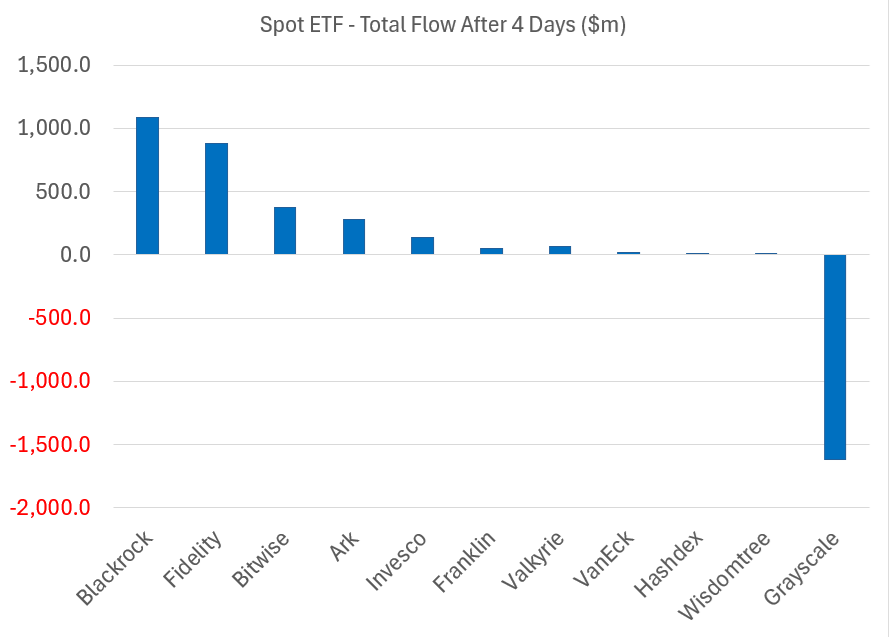

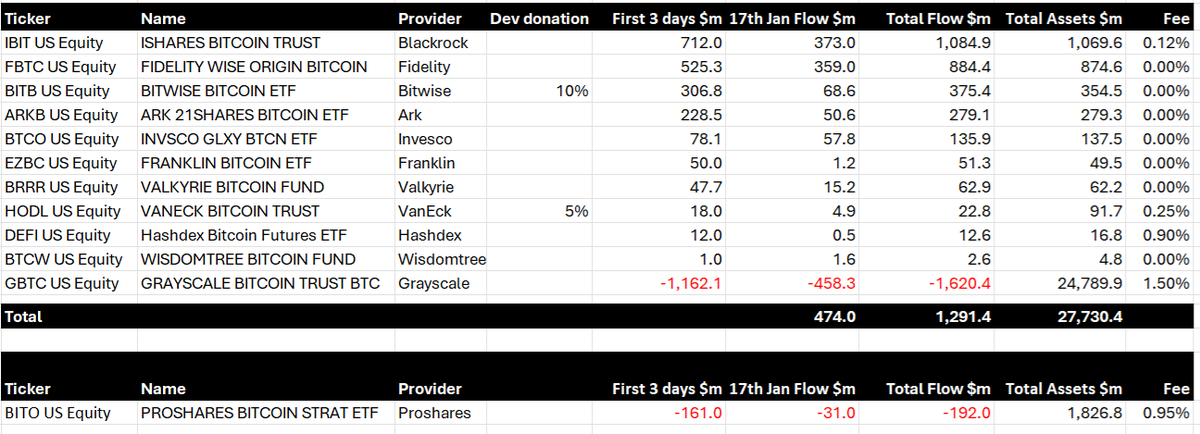

BitMEX says $1.29 billion flowed into the various new ETF products after four trading days, with BlackRock’s offering receiving most of the funding.

DeFiance Capital founder and CEO Arthur Cheong calls BlackRock’s ETF debut a success based on the funding data.

“BlackRock’s spot Bitcoin ETF achieved $1 billion AUM (assets under management) in less than five trading days. $932 million inflow alone on day four. Grayscale probably sees $500 million outflow, so around $400 million net. A very successful launch by any metrics.”

To spread the word, BlackRock dropped a commercial for its ETF following approval.

According to BitMEX, Grayscale’s outflows total $1.6 billion after Grayscale Bitcoin Trust (GBTC) shares were converted from a trust into an exchange-traded fund.

“Bitcoin spot ETFs day four update: GBTC flow number for day four now out. $458 million of outflow on day four and total GBTC outflow of $1.6 billion. All data for day four now available.”

Some analysts believe that GBTC holders booked losses on their shares in order to hold ETFs with lower fees.

The U.S. Securities and Exchange Commission (SEC) approved 11 spot Bitcoin ETFs on January 10th, creating a monetary pipeline between Wall Street and Bitcoin.

Bitcoin is trading for $41,223 at time of writing, down more than 3% in the last 24 hours.

Follow us on X, Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3