New data reveals that spot market Bitcoin (BTC) exchange-traded fund (ETF) inflows have reached a new all-time high as the crypto king pushes near the $64,000 price tag for the first time in years.

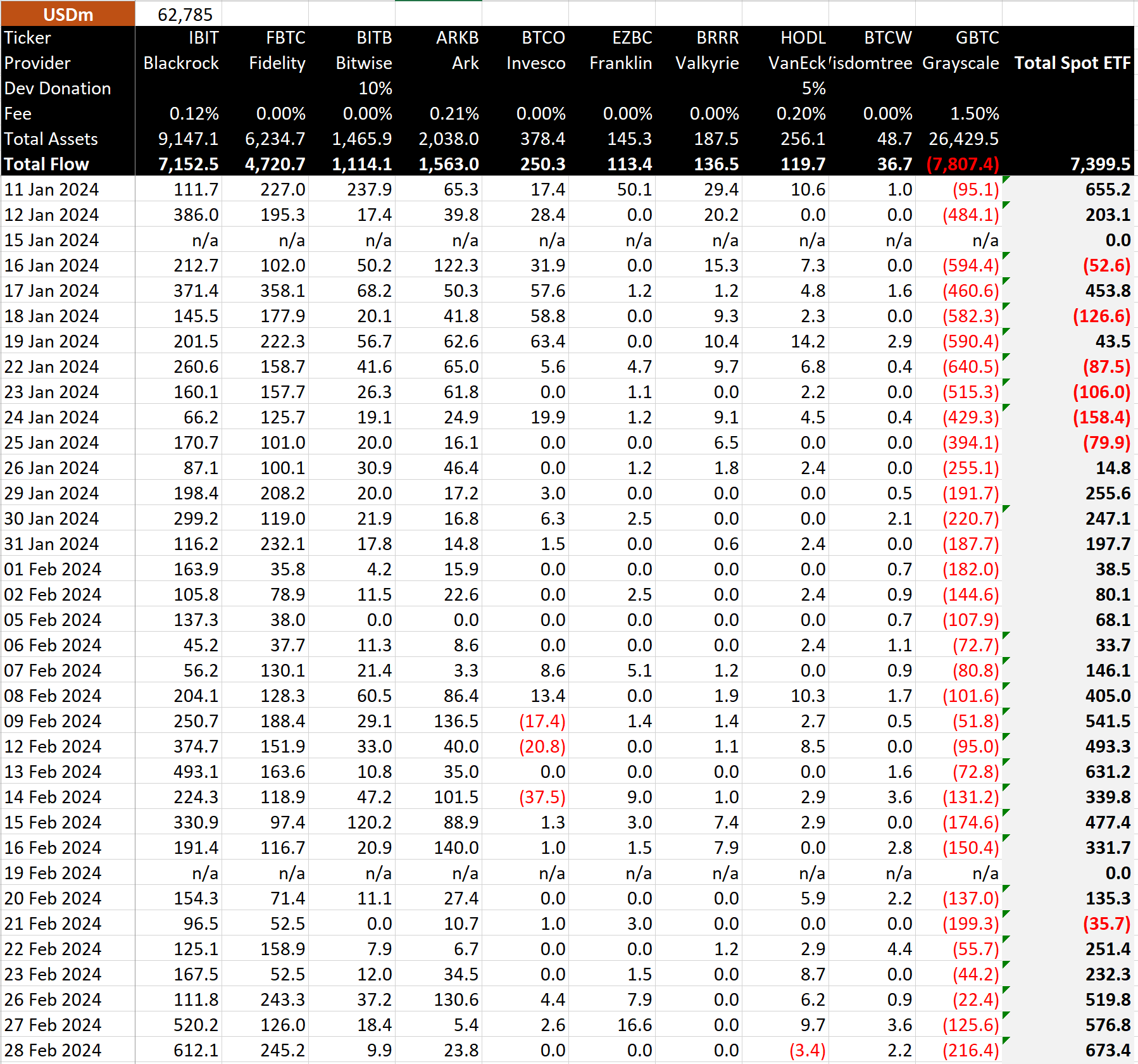

According to the analytics arm of crypto exchange BitMEX, driven by asset management titan BlackRock, Bitcoin ETFs saw over $673 million worth of net inflow in just a single day – setting a new record.

“Bitcoin ETF Flow – 28th Feb 2024. All data in. Today was a record inflow day, with $673.4 million of net inflow. This was driven by Blackrock, which also had a record day, with $612.1 million of inflow.”

Other spot market Bitcoin ETFs that saw significant inflows include Fidelity, BitWise, and Cathie Wood’s ARK Invest, according to the data. However, the data shows that Grayscale’s BTC ETF (GBTC) is seeing significant outflows – to the tune of hundreds of millions of dollars.

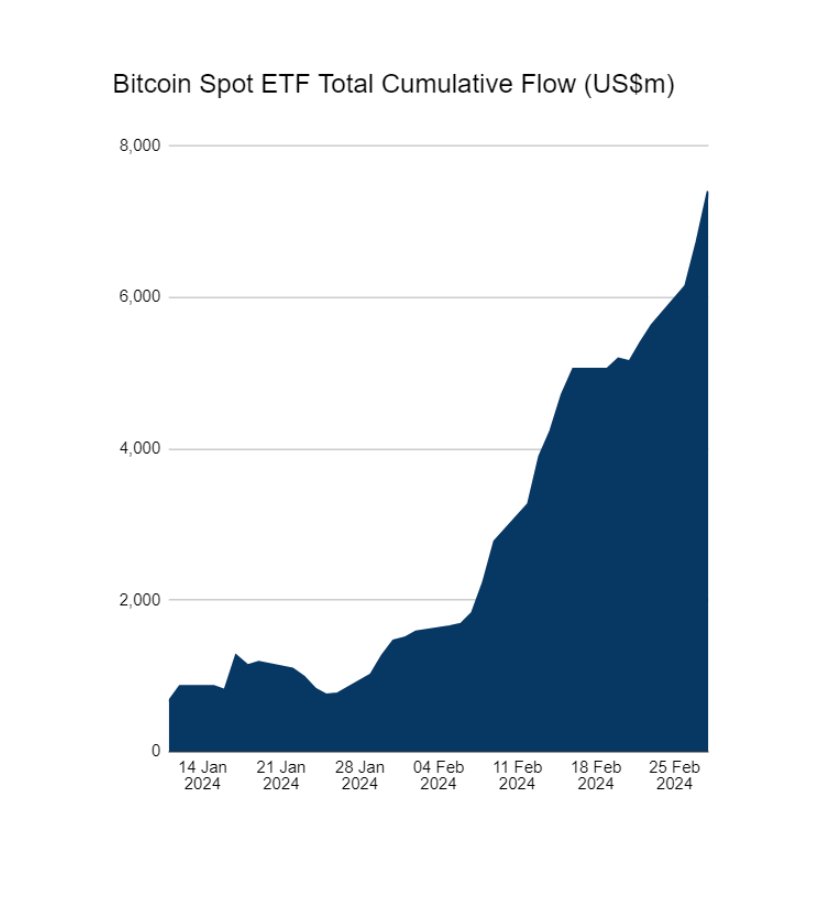

BitMEX Research also finds that the total net inflow of funds into Bitcoin ETFs since they were approved by the U.S. Securities and Exchange Commission (SEC) in mid-January has reached $7.4 billion.

Bitcoin is trading for $62,143 at time of writing, a 1.84% gain during the last 24 hours. However, the flagship digital asset briefly hit $63,600 this morning, a level it hasn’t seen since 2022.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney