New data reveals that asset management titan BlackRock has brought in over $10 billion into its spot market Bitcoin (BTC) exchange-traded fund (ETF) since it launched in January.

According to the research team of crypto exchange BitMEX, on March 11th, BlackRock hauled over $500 million into its spot market BTC ETF.

Spot market ETFs give investors exposure to an asset without them having to directly purchase it. ETFs centered around the top digital asset by market cap were approved by the U.S. Securities and Exchange Commission (SEC) on January 11th.

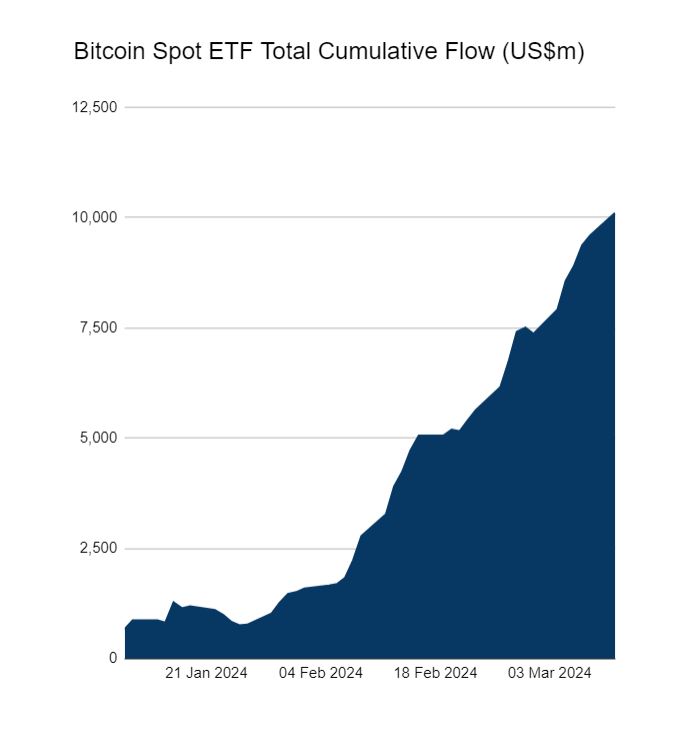

BitMEX’s data shows that the amount of money flowing into Bitcoin ETFs has consistently risen since the SEC’s approval, reaching over $10 billion.

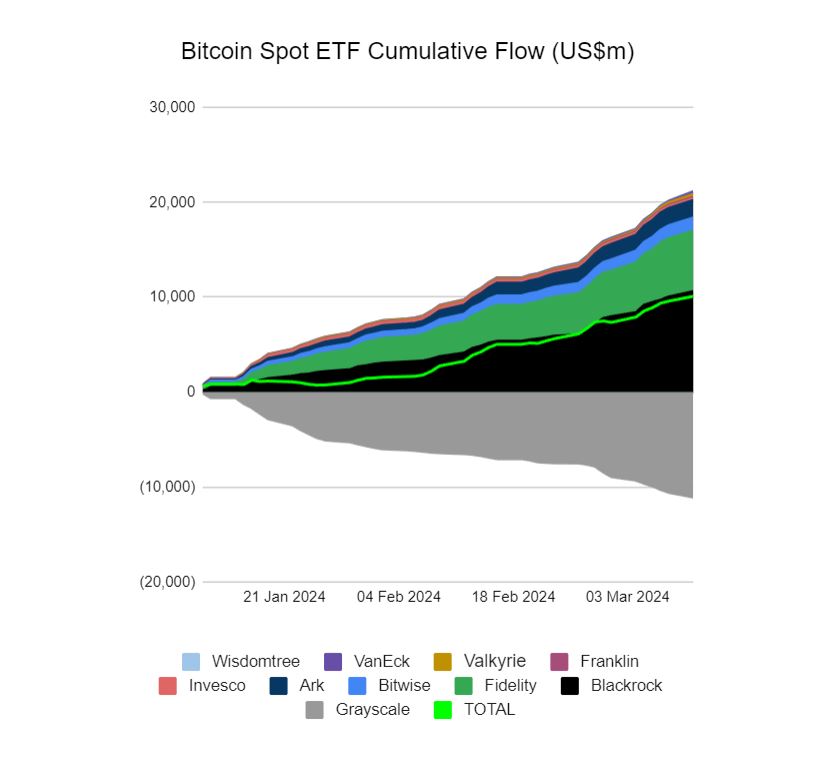

Lastly, the crypto exchange lays out data showing the cumulative flow of funds into BTC ETFs since they went live, which shows that BlackRock leads the pack by far, followed by Fidelity, Wisdomtree and ARK.

On February 28th, BlackRock’s ETF saw a record $612 million worth of inflows.

“Bitcoin ETF Flow – 28th Feb 2024. All data in. Today was a record inflow day, with $673.4 million of net inflow. This was driven by BlackRock, which also had a record day, with $612.1 million of inflow.”

Bitcoin is trading for $72,654 at time of writing.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney