Crypto analyst Jamie Coutts says that gold will vastly underperform digital assets in the current market cycle.

Coutts says on the social media platform X that while he’s bullish on gold, he expects crypto to dramatically outshine the precious metal as markets make way for a “birth of the new asset class.”

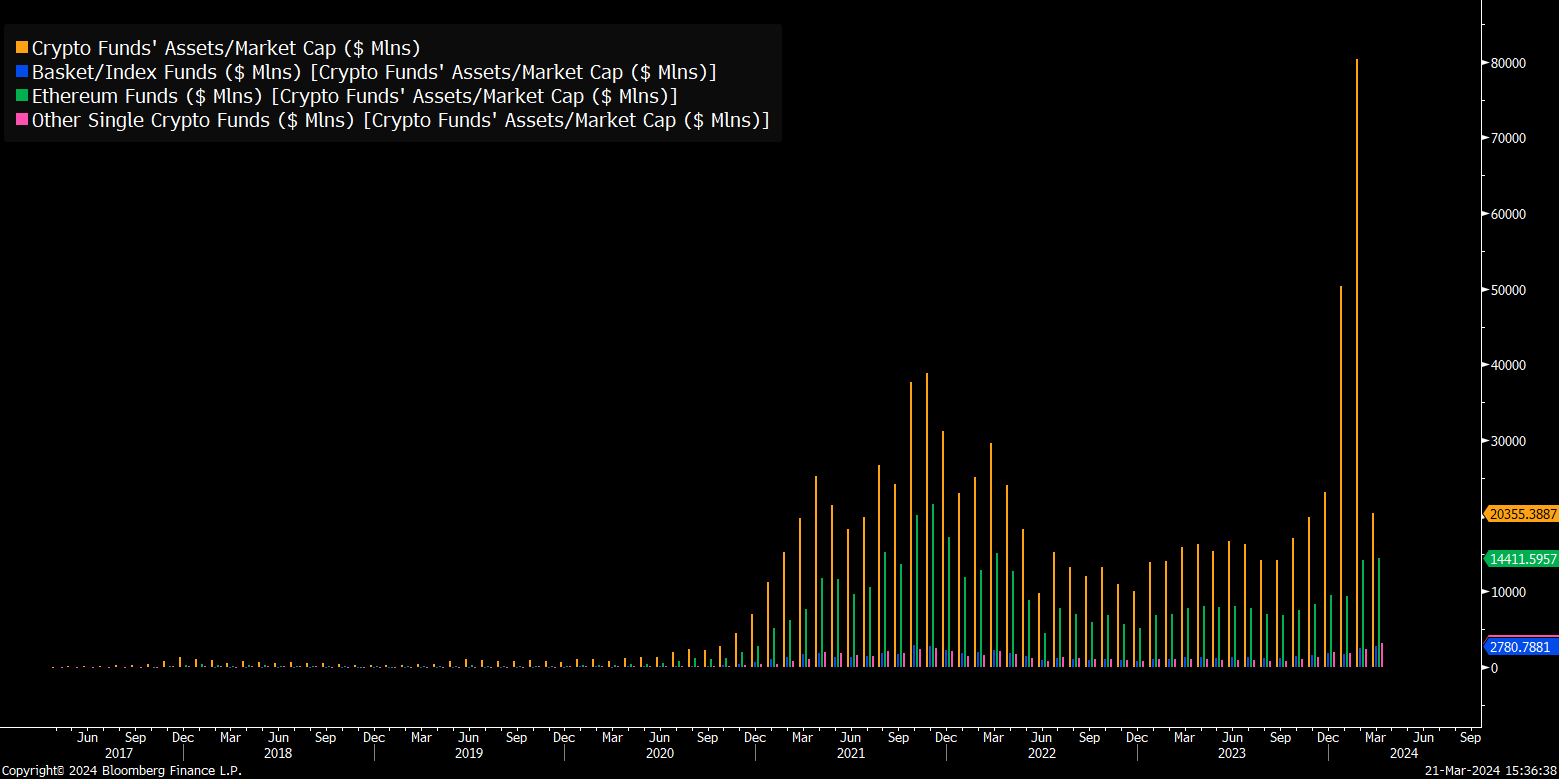

“AUM (assets under management) for crypto exchange-traded products (ETPs) approximately $100 billion (80% Bitcoin).

AUM for Gold ETPs approximately $190 billion.

I am bullish on gold, but it won’t match the expected 2-3x that crypto should do this cycle.

This is the birth of the new asset class.”

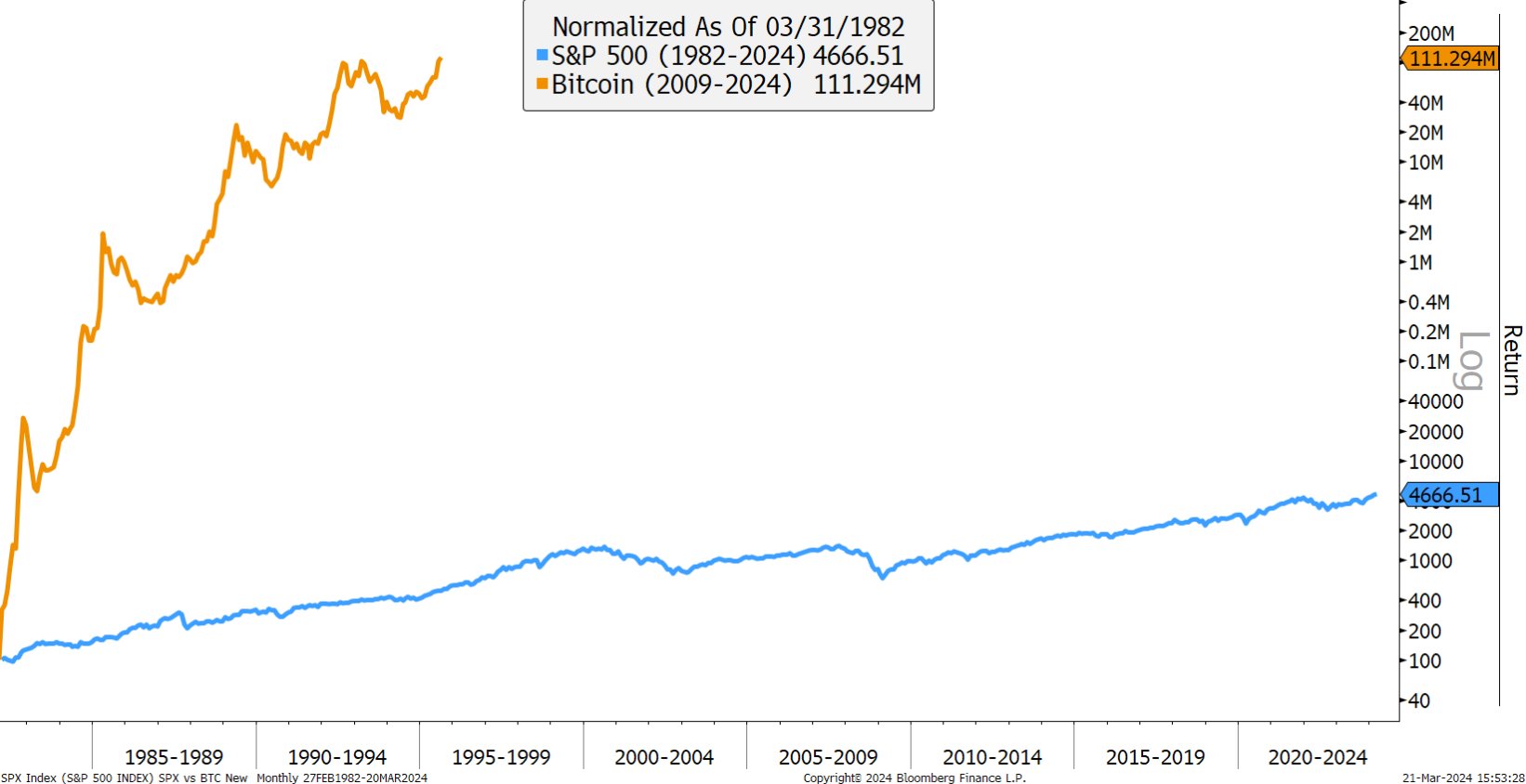

Coutts compares Bitcoin (BTC) and crypto now to the stock market boom of the early 1980s. According to the analyst, millennials will likely be able to outperform inflation with crypto the same way that the baby boomers did with their equities investments over the last 40 years.

“2009 is to Millennials what 1982 is to Boomers.

The great secular bull market in equities started as boomers fully entered the workforce.

The great secular bull market in Bitcoin (and blockchain assets in general) launched as millennials entered the workforce at a time when governments and the boomer generation they represented decided to punish all subsequent generations for their own sins.

No one was punished for the GFC (Great Financial Crisis) – bonuses were honored – and the regulatory capture by industry (too big to fail banks, big food, big pharma, and big tech) only worsened. The government has decided that the path forward is more debt and debasement than curtailment and honesty.

Bitcoin is the antidote, custom-built for the era of debasement and debt – a new form of hard money synthesized with technology, a financial network that was finally fair and transparent. Furthermore, it is an asset that one can self-custody away from the banks and governments that will confiscate as and when the need arises – as they have done throughout history and are doing today via inflation.”

At time of writing, BTC is trading at $64,342.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3